Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q3. You recently learned that a rumor is spreading in the market, in which an unidentified buyer wants to takeover EMVX Ltd., an electric

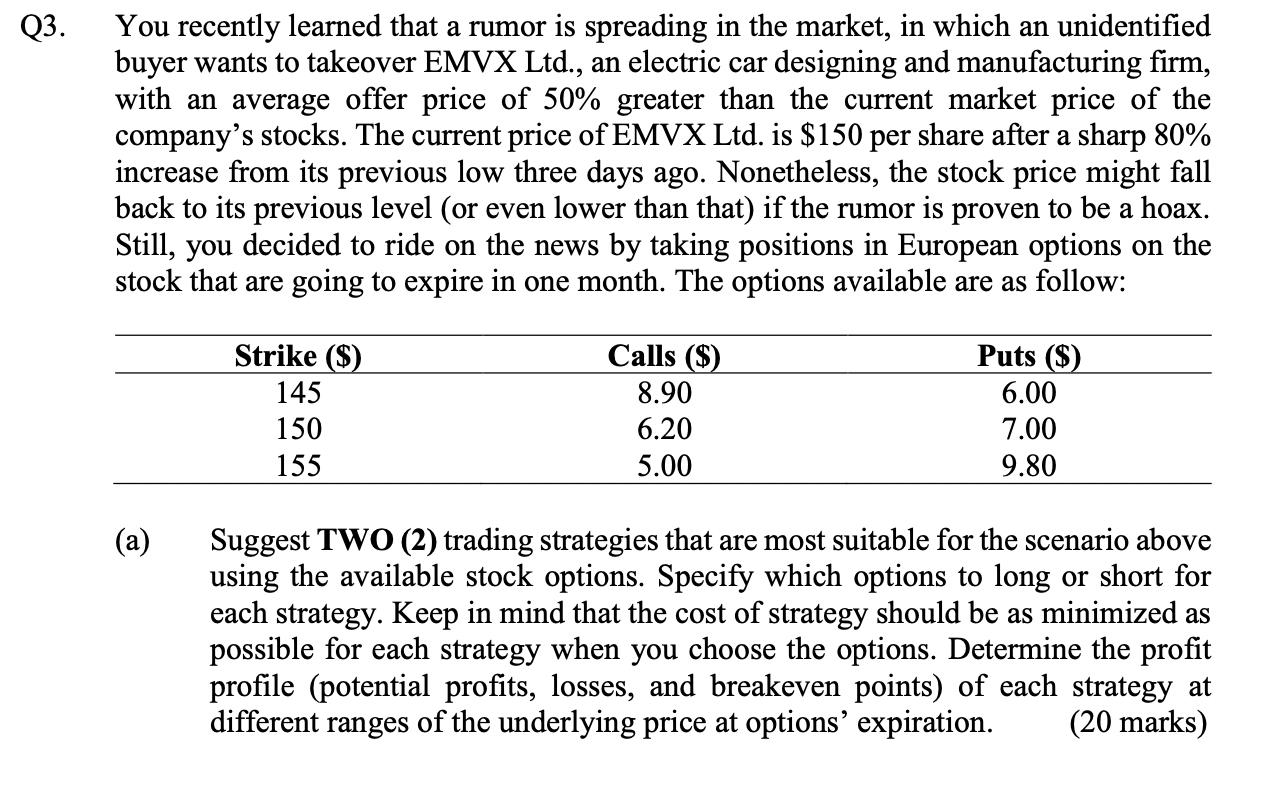

Q3. You recently learned that a rumor is spreading in the market, in which an unidentified buyer wants to takeover EMVX Ltd., an electric car designing and manufacturing firm, with an average offer price of 50% greater than the current market price of the company's stocks. The current price of EMVX Ltd. is $150 per share after a sharp 80% increase from its previous low three days ago. Nonetheless, the stock price might fall back to its previous level (or even lower than that) if the rumor is proven to be a hoax. Still, you decided to ride on the news by taking positions in European options on the stock that are going to expire in one month. The options available are as follow: (a) Strike ($) 145 150 155 Calls ($) 8.90 6.20 5.00 Puts ($) 6.00 7.00 9.80 Suggest TWO (2) trading strategies that are most suitable for the scenario above using the available stock options. Specify which options to long or short for each strategy. Keep in mind that the cost of strategy should be as minimized as possible for each strategy when you choose the options. Determine the profit profile (potential profits, losses, and breakeven points) of each strategy at different ranges of the underlying price at options' expiration. (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

In the given scenario where there is a rumor of a potential takeover of EMVX Ltd with a higher offer price we can consider two trading strategies using the available stock options The strategies will ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started