Answered step by step

Verified Expert Solution

Question

1 Approved Answer

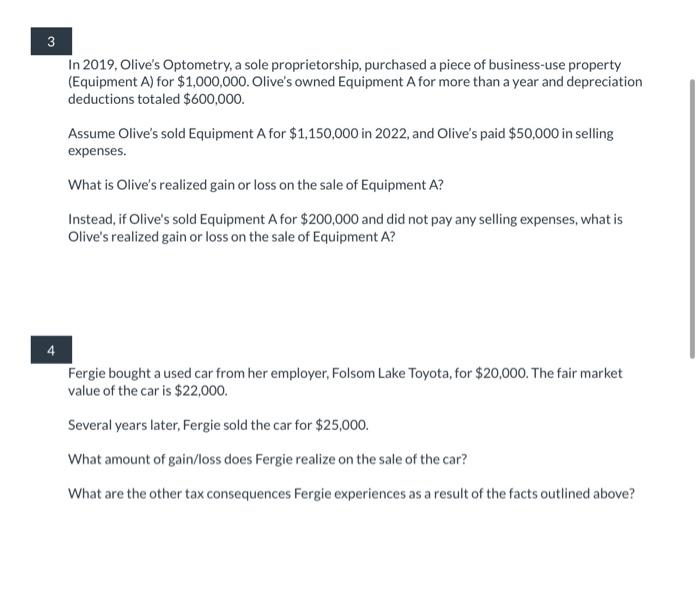

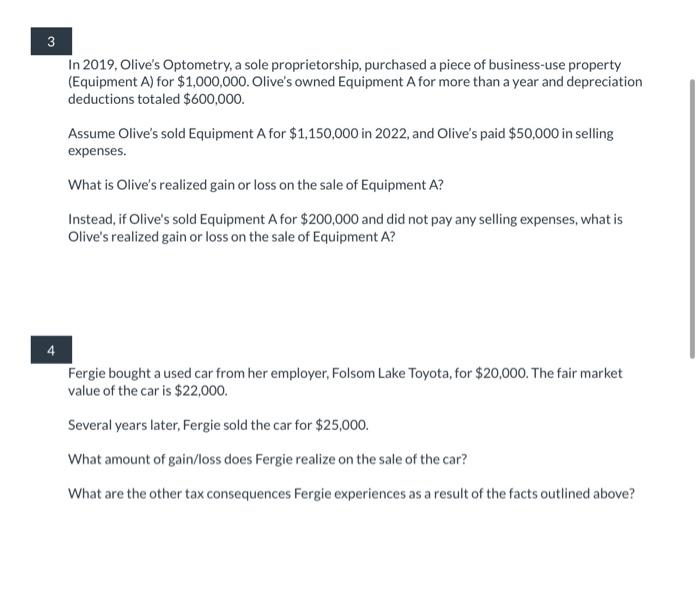

Q3-4 In 2019, Olive's Optometry, a sole proprietorship, purchased a piece of business-use property (Equipment A) for $1,000,000. Olive's owned Equipment A for more than

Q3-4

In 2019, Olive's Optometry, a sole proprietorship, purchased a piece of business-use property (Equipment A) for $1,000,000. Olive's owned Equipment A for more than a year and depreciation deductions totaled $600,000. Assume Olive's sold Equipment A for $1,150,000 in 2022, and Olive's paid $50,000 in selling expenses. What is Olive's realized gain or loss on the sale of Equipment A? Instead, if Olive's sold Equipment A for $200,000 and did not pay any selling expenses, what is Olive's realized gain or loss on the sale of Equipment A ? Fergie bought a used car from her employer, Folsom Lake Toyota, for $20,000. The fair market value of the car is $22,000. Several years later, Fergie sold the car for $25,000. What amount of gain/loss does Fergie realize on the sale of the car? What are the other tax consequences Fergie experiences as a result of the facts outlined above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started