Answered step by step

Verified Expert Solution

Question

1 Approved Answer

q37-47 A disadvantage of bond financing is: Multiple Choice Bonds do not affect owners' control. Interest on bonds is tax deductible. All of the choices

q37-47

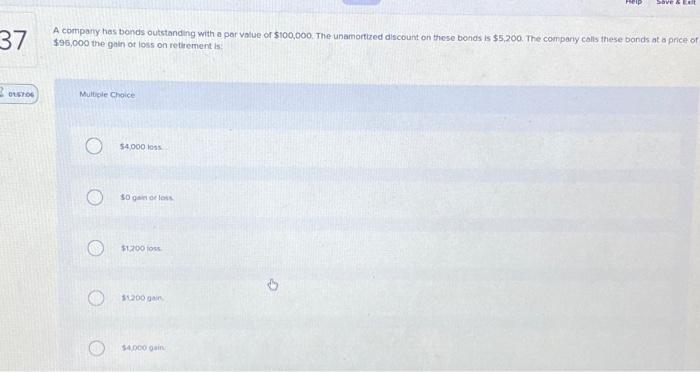

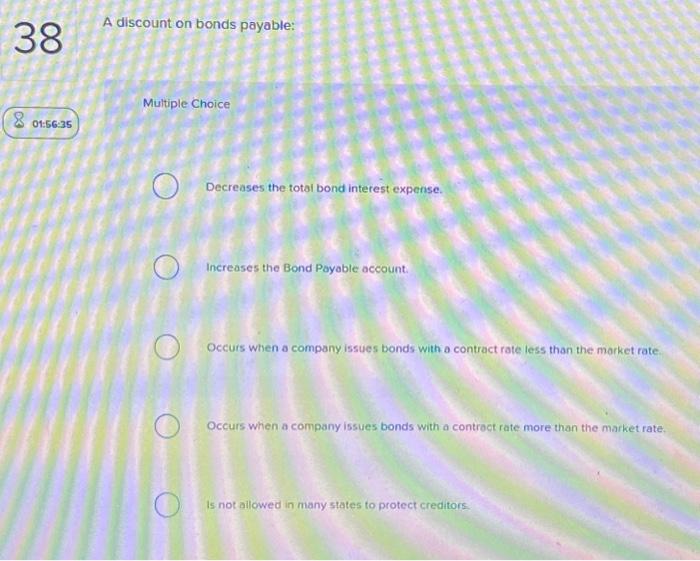

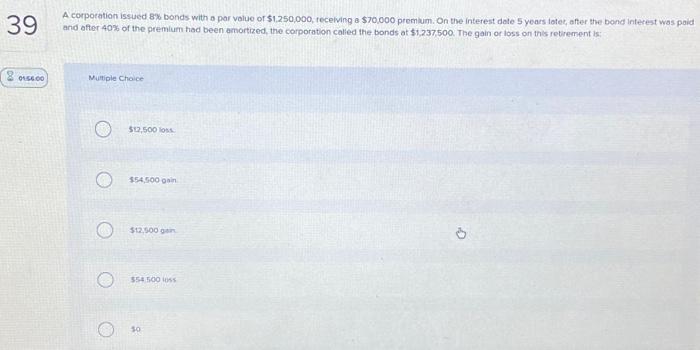

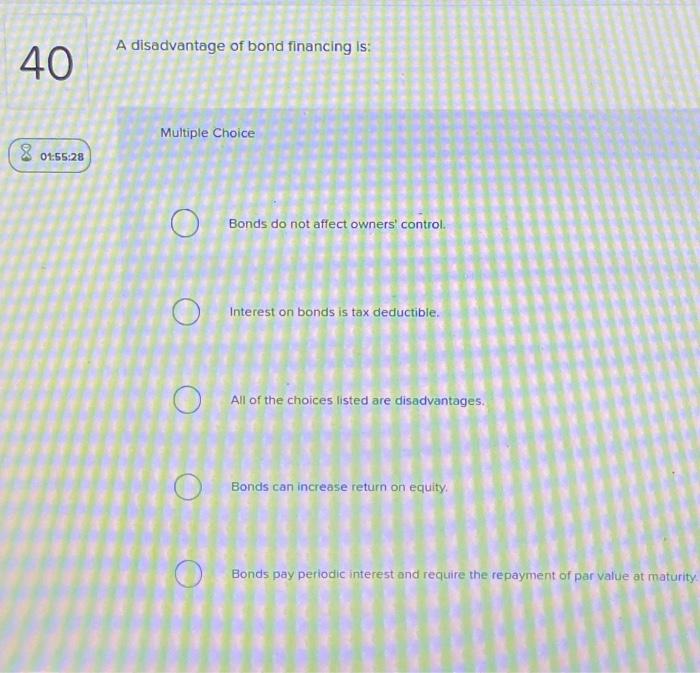

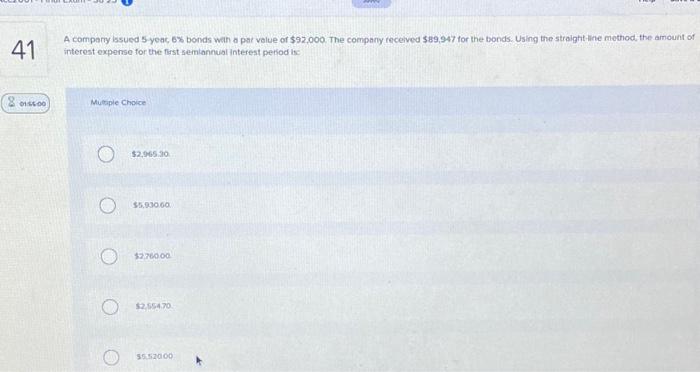

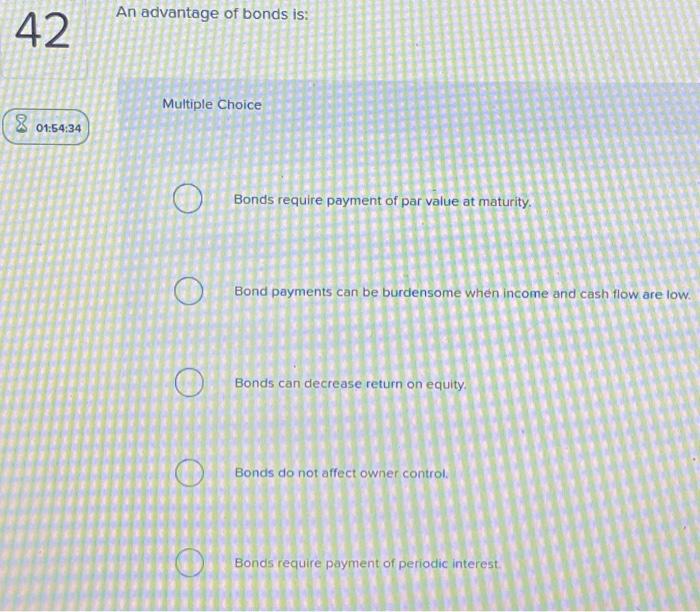

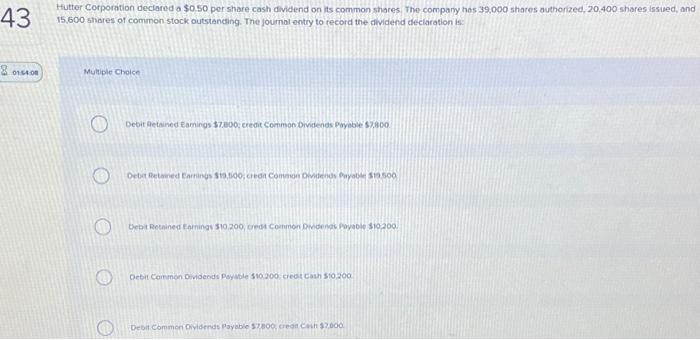

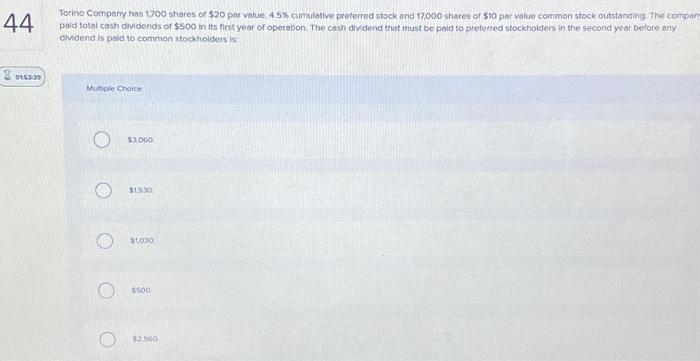

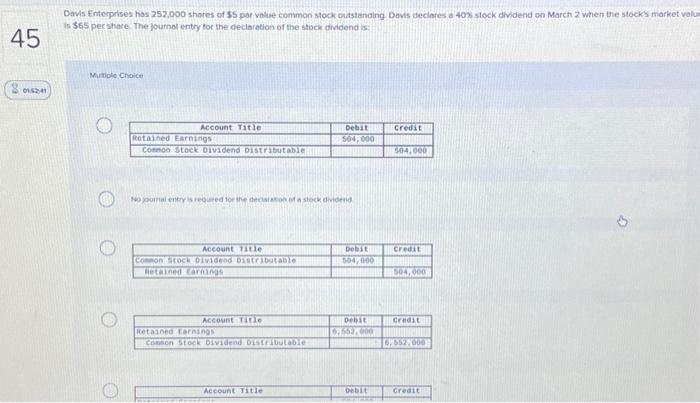

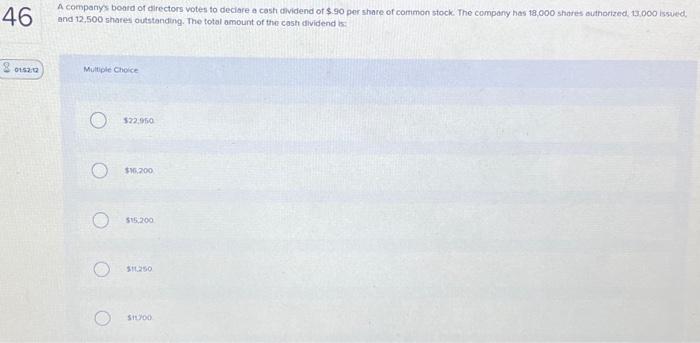

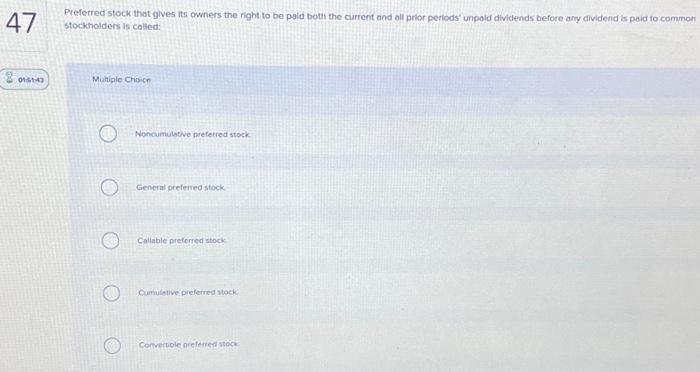

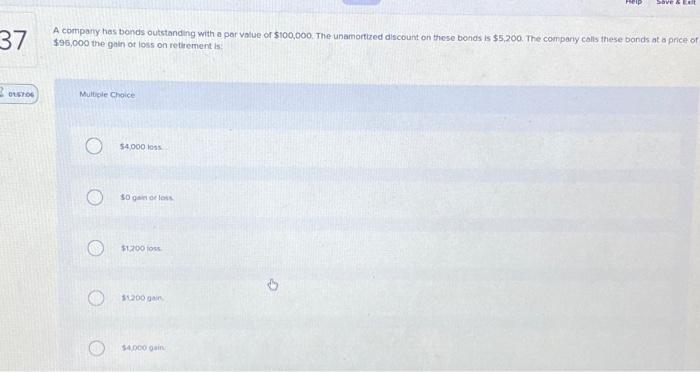

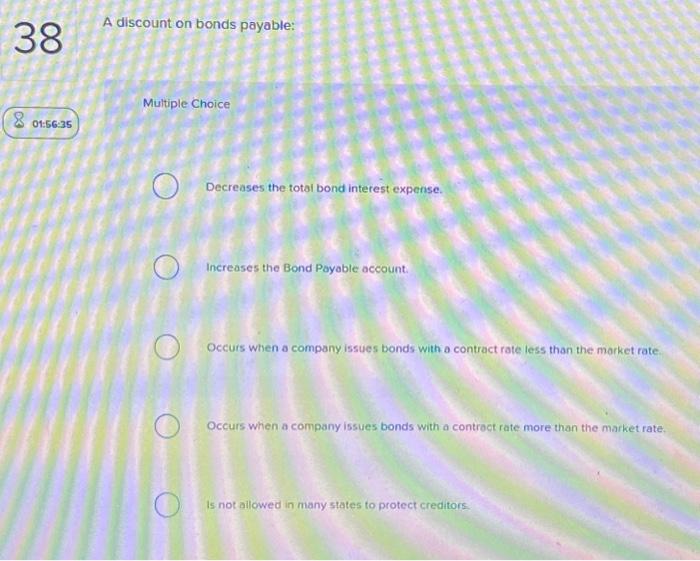

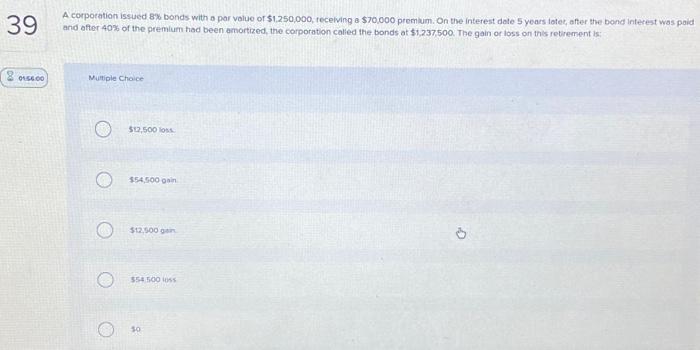

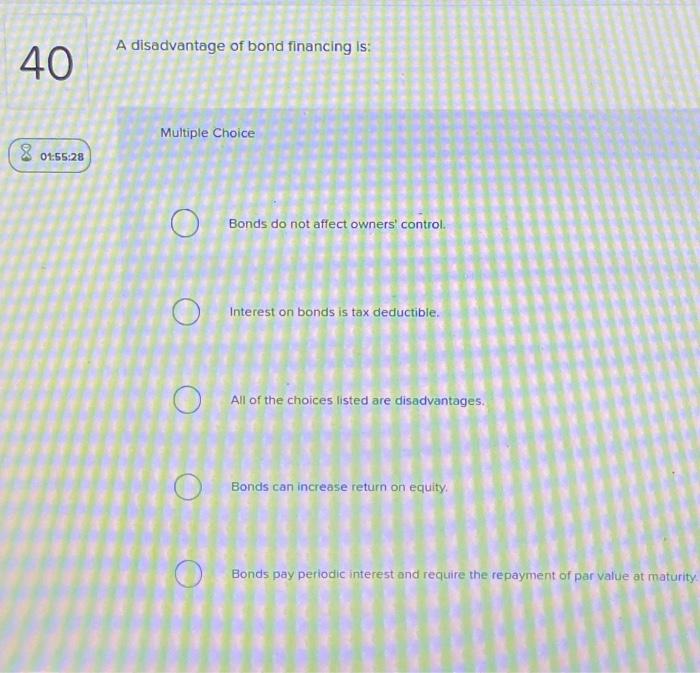

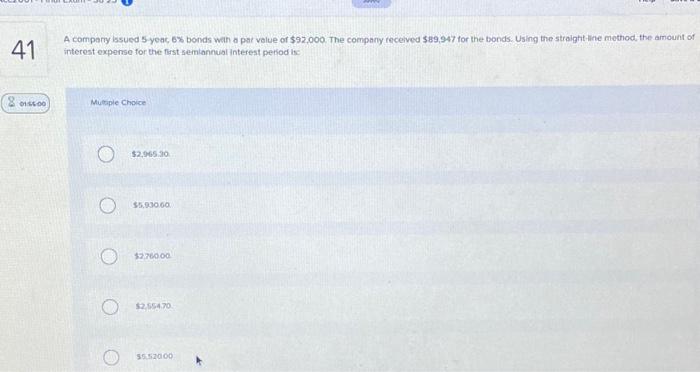

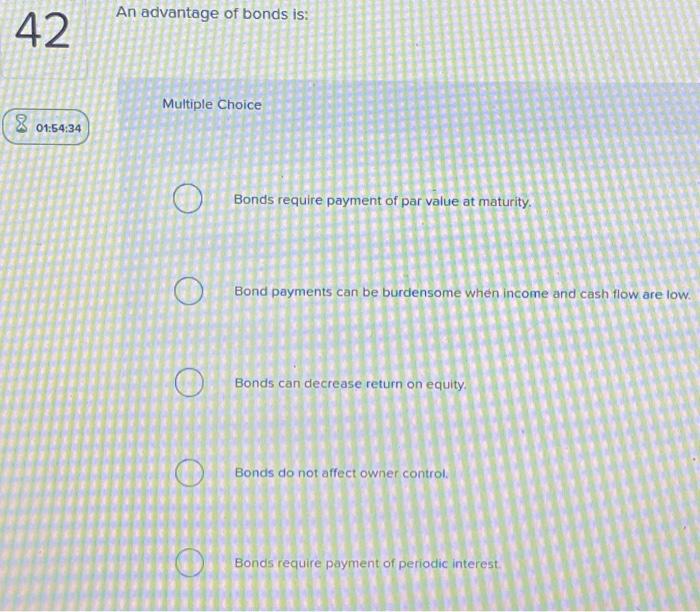

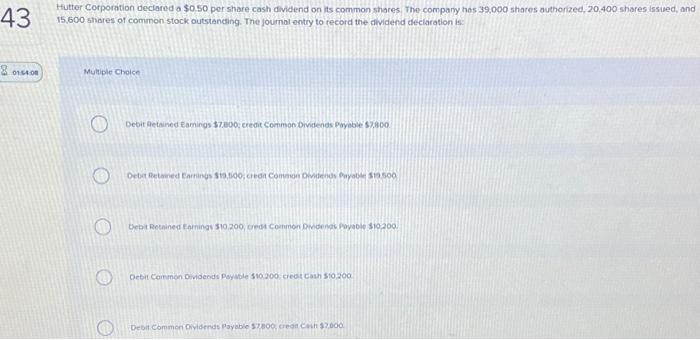

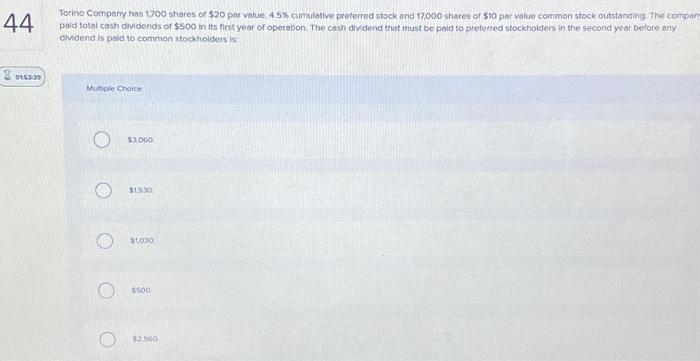

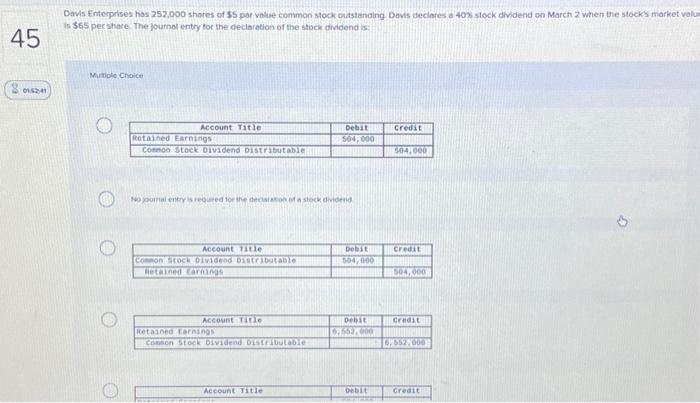

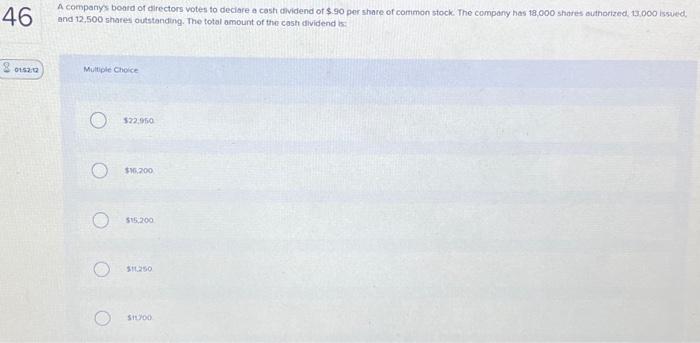

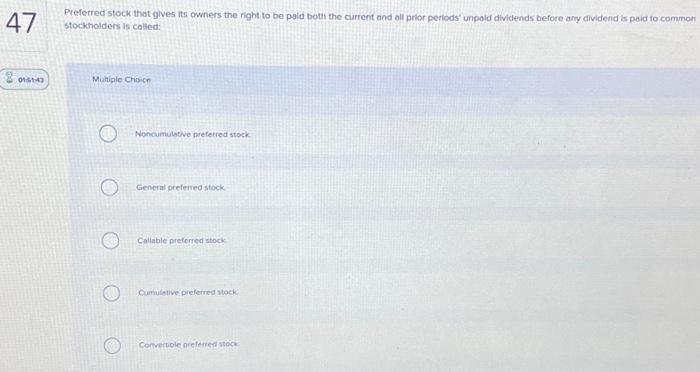

A disadvantage of bond financing is: Multiple Choice Bonds do not affect owners' control. Interest on bonds is tax deductible. All of the choices listed are disadvantages. Bonds can increase return on equity. Bonds pay periodic interest and require the repayment of par value at maturity Torino Compeny has 1700 shares of \\( \\$ 20 \\) par volue, \4.5 cumulative preferred stock and 17000 shares of \\( \\$ 10 \\) par value common stock outstancing The compan paid total cashi dividends of \\( \\$ 500 \\) in its fiest year of operabon. The cash dividend that must be poid to preferted stockholders in the second yeor before any dividend is pald to common stockholders is Multipie Choice \\( \\$ 3.000 \\) \\( \\$ 1530 \\) 51030 5500 52.5io Hutter Corporation declared a \\( \\$ 0,50 \\) per share cash dividend on its common shares. The comparry hos 39,000 shares authorized, 20,400 shares issued, and 15,600 shares of common stock outstanding. The journal entry to fecord the dividend deciaration is: Muliple Choice A compary has bonds outstanding with a par value or \\( \\$ 100,000 \\). The unamortized discount on these bonds is \\( \\$ 5,200 \\). The compary calls these bonds at a price of \\( \\$ 96,000 \\) the gain of loss on retirement is: Multicie Choice \\( \\$ 4,000 \\) ioss 30 gan celois. \\( \\$ 1200 \\) loss: 14200 gain \\$4.000 oain A companys board of directors votes to declare a cash dividend of \\( \\$ 90 \\) per share of common stock. The company has 18,000 shares authorized, 13,000 issied. and 12,500 shares outstanding. The total amount of the cash dividend is: Multiple Choice 322.950 515,200 311.250 sin 100 Preferred stock that glves its owners the right to be paid both the current and all prior periods' unpoid dividends before any dividend is paid to common Stockhoiders is colled: Mutiple choicn Noncumulative preferred stock General preferred stock Caliable preferred stock Cumulative preferned stock Corverpole nreferted stace A discount on bonds payable: Multiple Choice Decreases the total bond interest expense. Increases the Bond Poyable account. Occuis when a company issues bonds with a contract rate less than the morket rate. Occurs when a company issues bonds with a controct rate more than the market rate. Is not ailowed in many states to protect creditors. A compory lssued 5 yeac, 68 bonds wah a par value of \\( \\$ 92,000 \\). The company received \\( \\$ 89,947 \\) for the bonds. Using the straight-line mothod, the amount of interest expense for the first semiannual interest period is: Mutaple choice \\$2,945.30 35,93000 . 3776000 \\$2.554.70. 55552000 An advantage of bonds is: Multiple Choice Bonds require payment of par value at maturity. Bond payments can be burdensome when income and cash flow are low. Bonds can decrease return on equity. Bonds do not affect owner control. Bonds require payment of periodic interest. A corporation issued \8 tsonds with o par value or \\( \\$ 1,250,000 \\), recelving a \\( \\$ 70,000 \\) premium. On the interest dote 5 years totec, after the bond interest was paid and after \40 of the premium had been amortized, the corporation calied the bonds at \\( \\$ 1,237,500 \\). The gain or loss on this retirement is: Mutiple Choice Su, 500 loss \\$54,500 oain \\( \\$ 12,900 \\) gain 554500 loss so Davis Enterprises has 252,000 shores of \\( \\$ 5 \\) por volve common stock outstanding Davis declares a \40 stock diviend on March 2 when the stock 3 market valh is \\( \\$ 65 \\) per share. The journol entry for the declaration of the stock dividend is: Muntiple croice

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started