Answered step by step

Verified Expert Solution

Question

1 Approved Answer

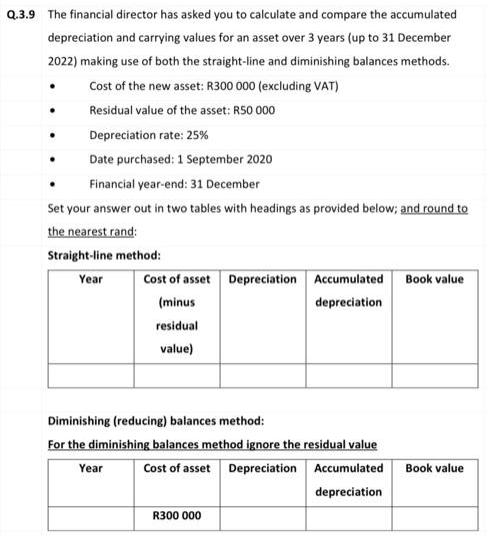

Q.3.9 The financial director has asked you to calculate and compare the accumulated depreciation and carrying values for an asset over 3 years (up

Q.3.9 The financial director has asked you to calculate and compare the accumulated depreciation and carrying values for an asset over 3 years (up to 31 December 2022) making use of both the straight-line and diminishing balances methods. Cost of the new asset: R300 000 (excluding VAT) Residual value of the asset: R50 000 Depreciation rate: 25% Date purchased: 1 September 2020 Financial year-end: 31 December Set your answer out in two tables with headings as provided below; and round to the nearest rand: Straight-line method: Year . . Cost of asset Depreciation Accumulated (minus depreciation residual value) Diminishing (reducing) balances method: For the diminishing balances method ignore the residual value Cost of asset Depreciation Accumulated depreciation Year R300 000 Book value Book value

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate and compare the accumulated depreciation and carrying values for the asset using both t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started