Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Present Worth of equal life alternatives A & D = Present Value/Cost (P) B & E = Annual Cost (AOC) C & F = Annual

Present Worth of equal life alternatives

B & E = Annual Cost (AOC)

C & F = Annual Return/Income (R)

Salvage Cost/Value (S) = RM15,000

MARR (i%) = 12%

n = 5 year

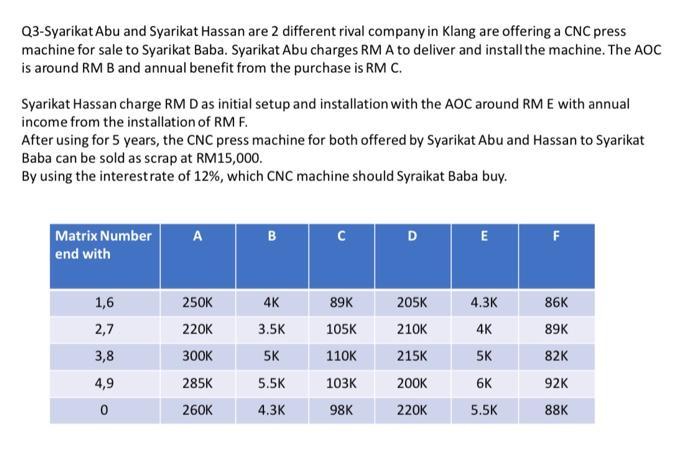

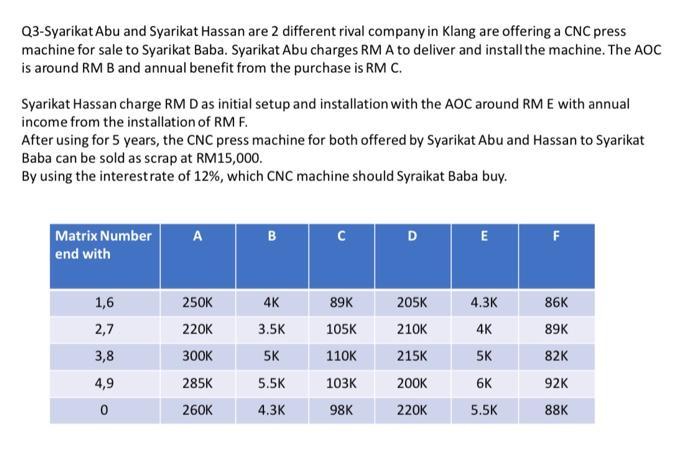

Q3-Syarikat Abu and Syarikat Hassan are 2 different rival company in Klang are offering a CNC press machine for sale to Syarikat Baba. Syarikat Abu charges RM A to deliver and install the machine. The AOC is around RM B and annual benefit from the purchase is RM C. Syarikat Hassan charge RM D as initial setup and installation with the AOC around RM E with annual income from the installation of RM F. After using for 5 years, the CNC press machine for both offered by Syarikat Abu and Hassan to Syarikat Baba can be sold as scrap at RM15,000. By using the interest rate of 12%, which CNC machine should Syraikat Baba buy. Matrix Number end with 1,6 2,7 3,8 4,9 A 250K 220K 300K 285K 260K B 4K 3.5K 5K 5.5K 4.3K 89K 105K 110K 103K 98K D 205K 210K 215K 200K 220K E 4.3K 4K 5K 6K 5.5K F 86K 89K 82K 92K 88K

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

ANS WER A D P A OC 1 i n S 1 i n 12 000 1 0 12 5 15 000 1 0 12 5 RM ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started