Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q4 1 Point Divine is a company with no debt in the capital structure. Its overall cost of capital is 9%. The firm is considering

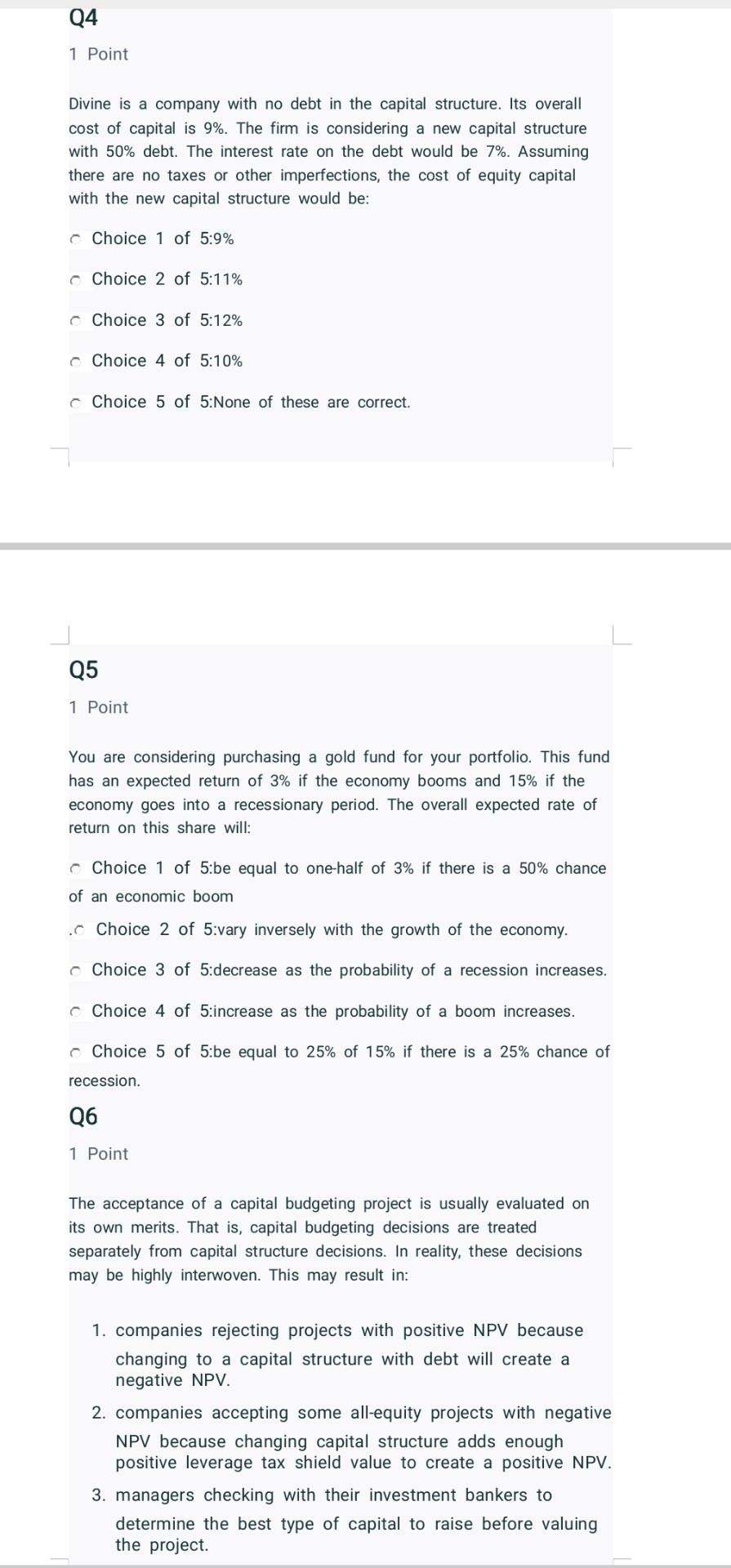

Q4 1 Point Divine is a company with no debt in the capital structure. Its overall cost of capital is 9%. The firm is considering a new capital structure with 50% debt. The interest rate on the debt would be 7%. Assuming there are no taxes or other imperfections, the cost of equity capital with the new capital structure would be: Choice 1 of 5:9% Choice 2 of 5:11% Choice 3 of 5:12% Choice 4 of 5:10% Choice 5 of 5:None of these are correct. Q5 1 Point You are considering purchasing a gold fund for your portfolio. This fund has an expected return of 3% if the economy booms and 15% if the economy goes into a recessionary period. The overall expected rate of return on this share will: Choice 1 of 5:be equal to one-half of 3% if there is a 50% chance of an economic boom . Choice 2 of 5:vary inversely with the growth of the economy. Choice 3 of 5:decrease as the probability of a recession increases. Choice 4 of 5:increase as the probability of a boom increases. 5:be equal to 25% of 15% if there is a 25% chance of ice recession. Q6 1 Point The acceptance of a capital budgeting project is usually evaluated on its own merits. That is, capital budgeting decisions are treated separately from capital structure decisions. In reality, these decisions may be highly interwoven. This may result in: 1. companies rejecting projects with positive NPV because changing to a capital structure with debt will create a negative NPV. 2. companies accepting some all-equity projects with negative NPV because changing capital structure adds enough positive leverage tax shield value to create a positive NPV. 3. managers checking with their investment bankers to determine the best type of capital to raise before valuing the project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started