Answered step by step

Verified Expert Solution

Question

1 Approved Answer

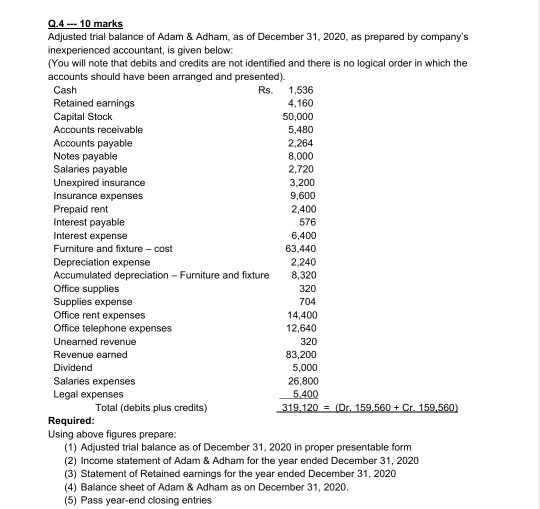

Q.4 --- 10 marks Adjusted trial balance of Adam & Adham, as of December 31, 2020, as prepared by company's inexperienced accountant, is given below:

Q.4 --- 10 marks Adjusted trial balance of Adam & Adham, as of December 31, 2020, as prepared by company's inexperienced accountant, is given below: (You will note that debits and credits are not identified and there is no logical order in which the accounts should have been arranged and presented). Cash Rs. 1,536 Retained earnings 4,160 Capital Stock 50,000 Accounts receivable 5,480 Accounts payable 2,264 Notes payable 8,000 Salaries payable 2,720 Unexpired insurance 3,200 Insurance expenses 9,600 Prepaid rent 2,400 Interest payable 576 Interest expense 6,400 Furniture and fixture - cost 63,440 Depreciation expense 2.240 Accumulated depreciation - Furniture and fixture 8,320 Office supplies 320 Supplies expense 704 Office rent expenses 14,400 Office telephone expenses 12,640 Unearned revenue 320 Revenue earned 83,200 Dividend 5,000 Salaries expenses 26,800 Legal expenses 5.400 Total (debits plus credits) 319.120 = (Dr. 159.560 + Cr. 159,560) Required: Using above figures prepare: (1) Adjusted trial balance as of December 31, 2020 in proper presentable form (2) Income statement of Adam & Adham for the year ended December 31, 2020 (3) Statement of Retained earnings for the year ended December 31, 2020 (4) Balance sheet of Adam & Adham as on December 31, 2020. (5) Pass year-end closing entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started