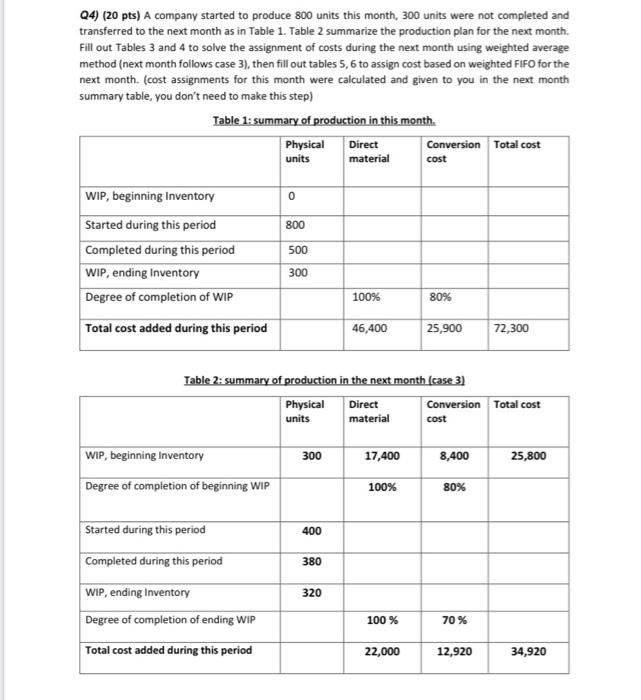

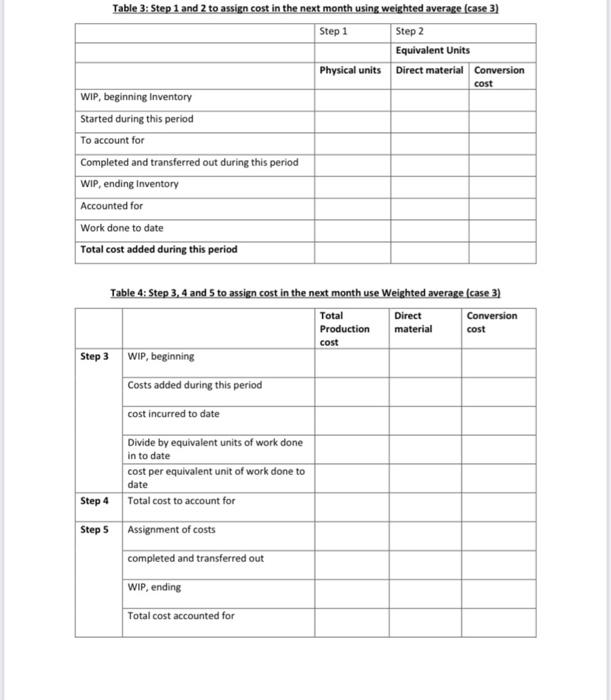

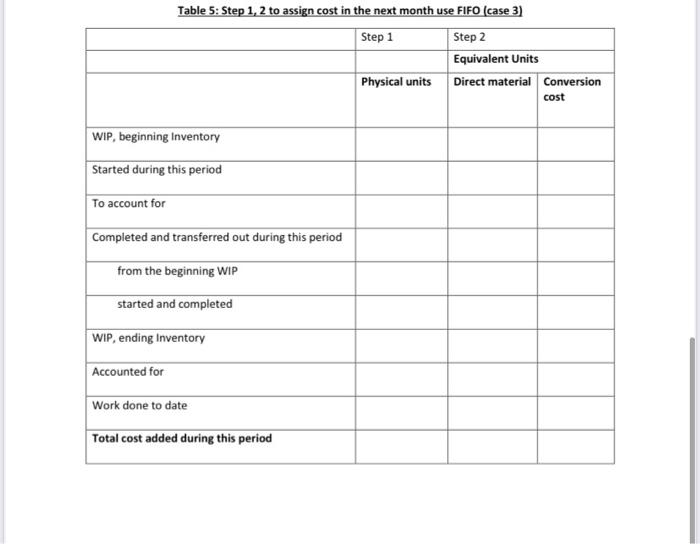

Q4) (20 pts) A company started to produce 800 units this month, 300 units were not completed and transferred to the next month as in Table 1. Table 2 summarize the production plan for the next month. Fill out Tables 3 and 4 to solve the assignment of costs during the next month using weighted average method (next month follows case 3), then fill out tables 5,6 to assign cost based on weighted FIFO for the next month. (cost assignments for this month were calculated and given to you in the next month summary table, you don't need to make this step) Table 1: summary of production in this month. Physical Direct Conversion Total cost units material cost 0 800 500 WIP, beginning Inventory Started during this period Completed during this period WIP, ending Inventory Degree of completion of WIP Total cost added during this period 300 100% 80% 46,400 25,900 72,300 Table 2: summary of production in the next month (case 3) Physical Direct Conversion units material cost Total cost WIP, beginning Inventory 300 17,400 8,400 25,800 Degree of completion of beginning WIP 100% 80% Started during this period 400 Completed during this period 380 320 WIP, ending Inventory Degree of completion of ending WIP 100 % 70% Total cost added during this period 22,000 12,920 34,920 Table 3: Step 1 and 2 to assign cost in the next month using weighted average (case 3) Step 1 Step 2 Equivalent Units Physical units Direct material Conversion cost WIP, beginning Inventory Started during this period To account for Completed and transferred out during this period WIP, ending Inventory Accounted for Work done to date Total cost added during this period Table 4: Step 3, 4 and 5 to assign cost in the next month use Weighted average (case 3) Total Direct Conversion Production material cost Step 3 WIP, beginning cost Costs added during this period cost incurred to date Divide by equivalent units of work done in to date cost per equivalent unit of work done to date Total cost to account for Step 4 Step 5 Assignment of costs completed and transferred out WIP, ending Total cost accounted for Table 5: Step 1, 2 to assign cost in the next month use FIFO (case 3) Step 1 Step 2 Equivalent Units Physical units Direct material Conversion cost WIP, beginning Inventory Started during this period To account for Completed and transferred out during this period from the beginning WIP started and completed WIP, ending Inventory Accounted for Work done to date Total cost added during this period Table 6: Step 3, 4, and 5 to assign cost in the next month use FIFO (case 3) Total Direct Conversion Production material cost cost Step 3 WIP, beginning Costs added during this period Divide by equivalent units of work done in to date cost per equivalent unit of work done to date Step 4 Total cost to account for Step 5 Assignment of costs completed and transferred out WIP, beginning Cost added to the Beginning WIP During this period Total cost from beginning WIP Started and completed Total cost of units completed and transferred out WIP, ending Total cost accounted for