Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q4. (25%) Suppose you have business operation in scenario (A) and (B) as bellow. Please describe yoedging strategy by using (1) future contracts and (2)

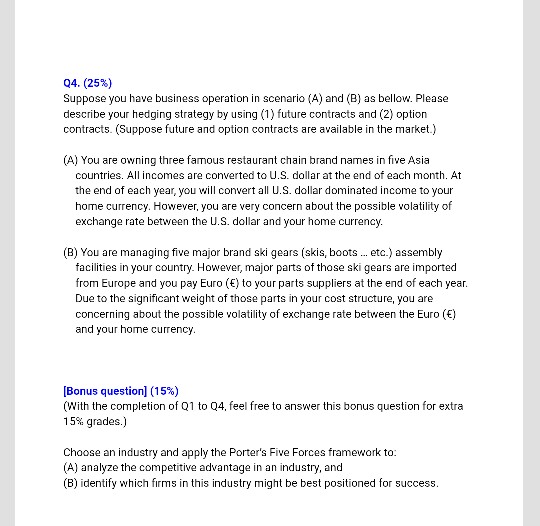

Q4. (25%) Suppose you have business operation in scenario (A) and (B) as bellow. Please describe yoedging strategy by using (1) future contracts and (2) option contracts. (Suppose future and option contracts are available in the market.) (A) You are owning three famous restaurant chain brand names in five Asia countries. All incomes are converted to U.S. dollar at the end of each month. At the end of each year, you will convert all U.S. dollar dominated income to your home currency. However, you are very concern about the possible volatility of exchange rate between the U.S. dollar and your home currency (B) You are managing five major brand ski gears (skis, boots...etc.) assembly facilities in your country. However, major parts of thase ski gears are imported from Europe and you pay Euro () to your parts suppliers at the end of each year. Due to the significant weight of those parts in your cost structure, you are concerning about the possible volatility of exchange rate between the Euro (E) and your home currency Bonus question)(15%) (With the completion of Q1 to Q4, feel free to answer this bonus question for extra 15% grades.) Choose an industry and apply the Porter's Five Forces framework to: (A) analyze the competitive advantage in an industry, and (B) identify which firms in this industry might be best positioned for success

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started