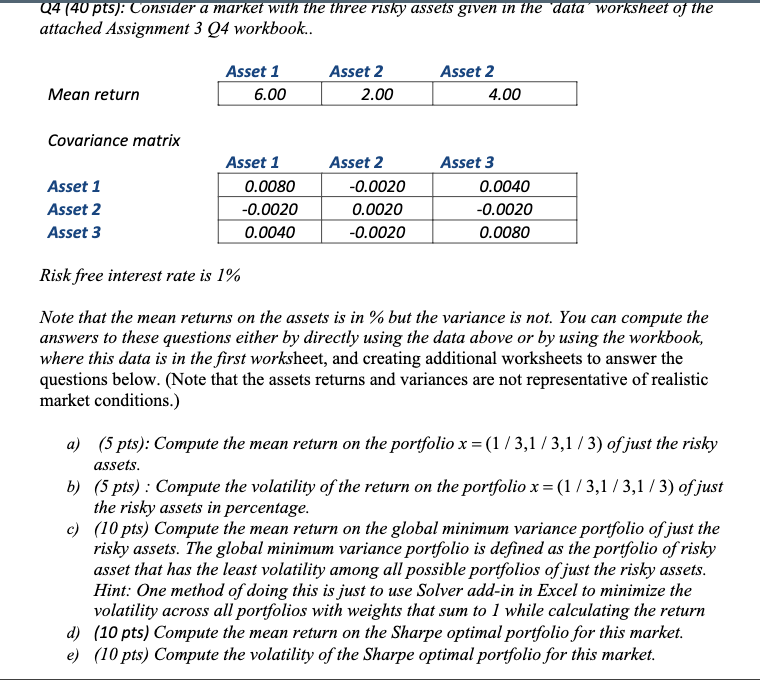

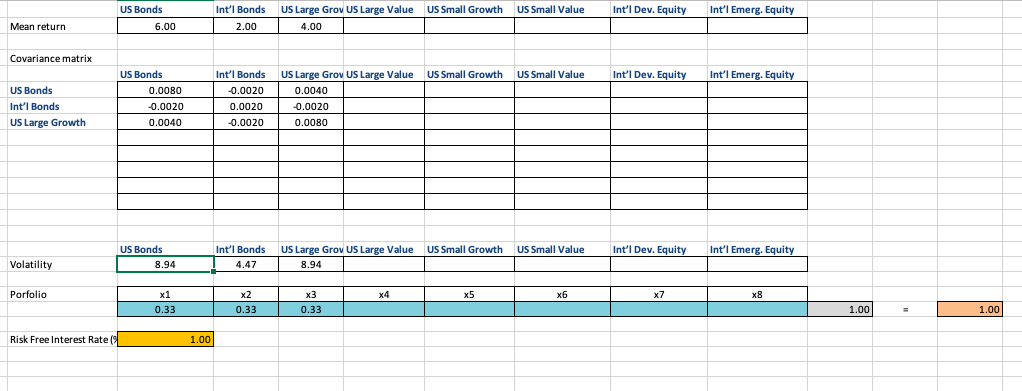

Q4 (40 pts): Consider a market with the three risky assets given in the data worksheet of the attached Assignment 3 04 workbook.. Asset 1 Asset 2 Asset 2 Mean return 6.00 2.00 4.00 Covariance matrix Asset 1 Asset 2 Asset 3 Asset 1 0.0080 -0.0020 0.0040 Asset 2 -0.0020 0.0020 -0.0020 Asset 3 0.0040 -0.0020 0.0080 Risk free interest rate is 1% Note that the mean returns on the assets is in % but the variance is not. You can compute the answers to these questions either by directly using the data above or by using the workbook, where this data is in the first worksheet, and creating additional worksheets to answer the questions below. (Note that the assets returns and variances are not representative of realistic market conditions.) a) (5 pts): Compute the mean return on the portfolio x = (1 / 3,1 / 3,1 / 3) of just the risky assets. b) (5 pts) : Compute the volatility of the return on the portfolio x = (1 / 3,1 / 3,1 / 3) of just the risky assets in percentage. c) (10 pts) Compute the mean return on the global minimum variance portfolio of just the risky assets. The global minimum variance portfolio is defined as the portfolio of risky asset that has the least volatility among all possible portfolios of just the risky assets. Hint: One method of doing this is just to use Solver add-in in Excel to minimize the volatility across all portfolios with weights that sum to I while calculating the return d) (10 pts) Compute the mean return on the Sharpe optimal portfolio for this market. e) (10 pts) Compute the volatility of the Sharpe optimal portfolio for this market.US Bonds Int'l Bonds US Large Grov US Large Value US Small Growth US Small Value Int'l Dev. Equity Int'l Emerg. Equity Mean return 6.00 2.00 4.00 Covariance matrix US Bonds Int'l Bonds US Large Grov US Large Value US Small Growth US Small Value Int'l Dev. Equity Int'l Emerg. Equity US Bonds 0.0080 -0.0020 D.0040 Int'l Bonds 0.0020 D.0020 0.0020 US Large Growth D.0040 0.0020 D.0080 US Bonds Int'l Bonds US Large Grov US Large Value US Small Growth US Small Value Int'l Dev. Equity Int'l Emerg. Equity Volatility 8.94 4.47 8.94 Porfolio x1 x2 x3 x4 x5 X6 x7 X8 0.33 D.33 0.33 1.00 1.00 Risk Free Interest Rate ( 1.00