Question

Q.4 A vehicle was purchased for Rs, 100,000 on 1st January 2019. During 2019 (the current year) depreciation of Rs. 10,000 was debited to

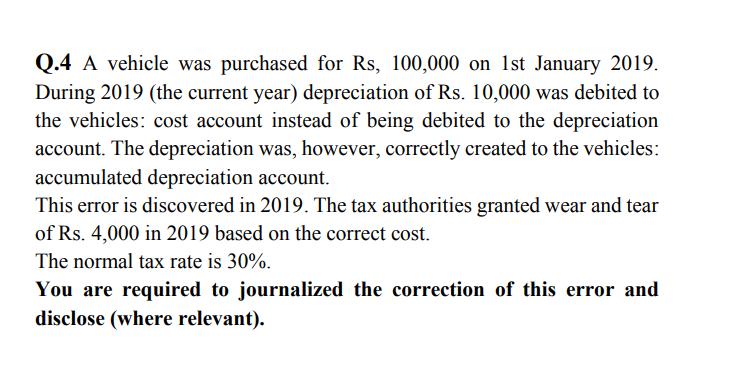

Q.4 A vehicle was purchased for Rs, 100,000 on 1st January 2019. During 2019 (the current year) depreciation of Rs. 10,000 was debited to the vehicles: cost account instead of being debited to the depreciation account. The depreciation was, however, correctly created to the vehicles: accumulated depreciation account. This error is discovered in 2019. The tax authorities granted wear and tear of Rs. 4,000 in 2019 based on the correct cost. The normal tax rate is 30%. You are required to journalized the correction of this error and disclose (where relevant).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To correct the error and journalize the necessary entries we need to adjust the depreciation expense ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App