Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q4 (Eurodollar futures) Suppose we wish to borrow $100 million for 90 days beginning next June, and that today's quoted price of Eurodollar futures maturing

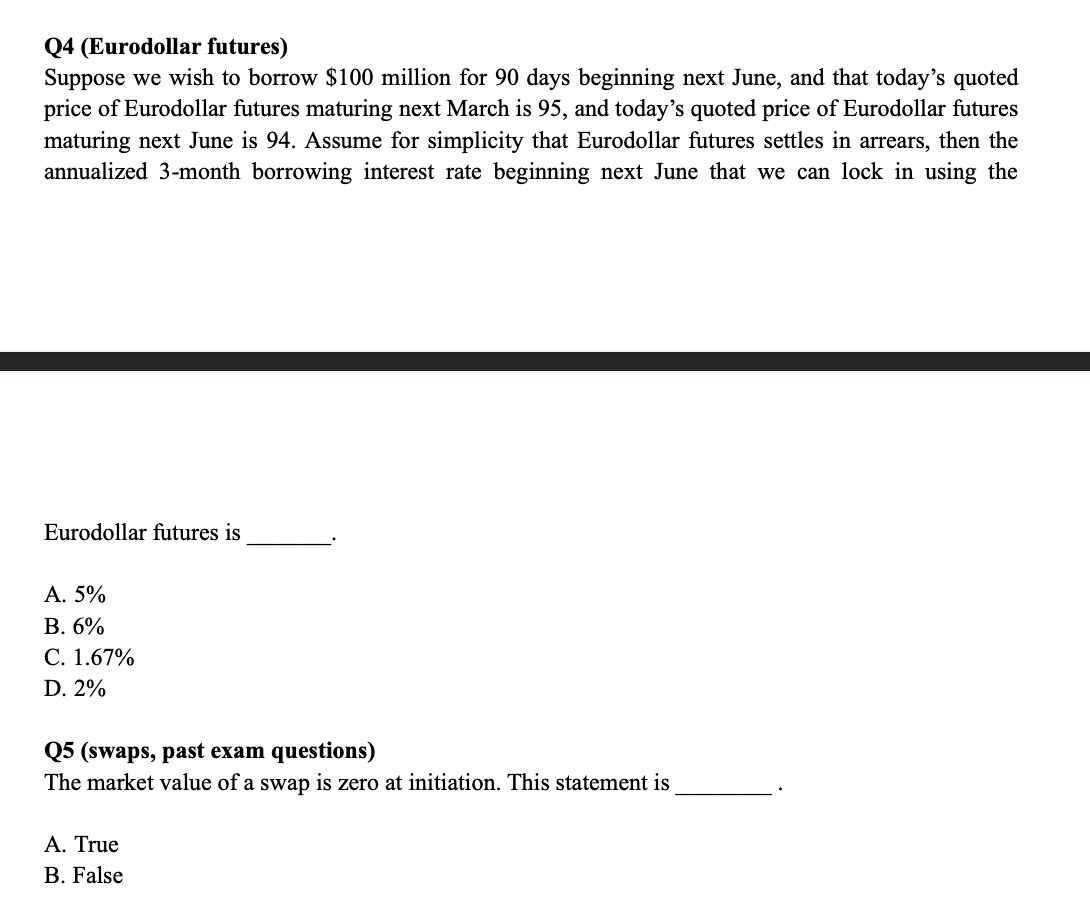

Q4 (Eurodollar futures) Suppose we wish to borrow $100 million for 90 days beginning next June, and that today's quoted price of Eurodollar futures maturing next March is 95, and today's quoted price of Eurodollar futures maturing next June is 94. Assume for simplicity that Eurodollar futures settles in arrears, then the annualized 3-month borrowing interest rate beginning next June that we can lock in using the Eurodollar futures is A. 5% B. 6% C. 1.67% D. 2% Q5 (swaps, past exam questions) The market value of a swap is zero at initiation. This statement is A. True B. False

Q4 (Eurodollar futures) Suppose we wish to borrow $100 million for 90 days beginning next June, and that today's quoted price of Eurodollar futures maturing next March is 95, and today's quoted price of Eurodollar futures maturing next June is 94. Assume for simplicity that Eurodollar futures settles in arrears, then the annualized 3-month borrowing interest rate beginning next June that we can lock in using the Eurodollar futures is A. 5% B. 6% C. 1.67% D. 2% Q5 (swaps, past exam questions) The market value of a swap is zero at initiation. This statement is A. True B. False Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started