Answered step by step

Verified Expert Solution

Question

1 Approved Answer

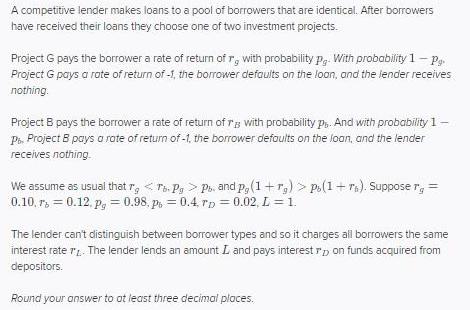

A competitive lender makes loans to a pool of borrowers that are identical. After borrowers have received their loans they choose one of two

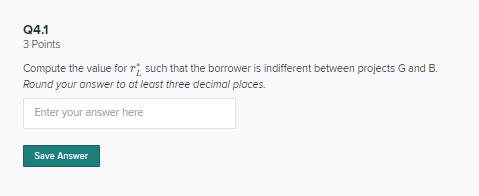

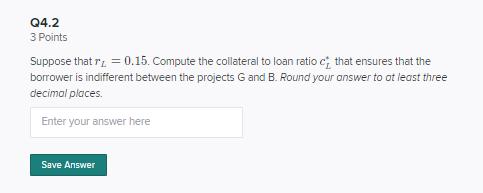

A competitive lender makes loans to a pool of borrowers that are identical. After borrowers have received their loans they choose one of two investment projects. Project G pays the borrower a rate of return of r, with probability Pg. With probability 1 - Pg. Project G pays a rate of return of -1, the borrower defaults on the loon, and the lender receives nothing. Project B pays the borrower a rate of return of r with probability Ps. And with probability 1- Pb. Project B pays a rate of return of -1, the borrower defaults on the loan, and the lender receives nothing. We assume as usual that rg < TbPg > Pb. and P, (1+rg) > po(1+r). Suppose r = 0.10. rs = 0.12. pg = 0.98, p=0.4. Tp=0.02, L = 1. The lender can't distinguish between borrower types and so it charges all borrowers the same interest rater. The lender lends an amount L and pays interest rp on funds acquired from depositors. Round your answer to at least three decimal places. Q4.1 3 Points Compute the value for r such that the borrower is indifferent between projects G and B. Round your answer to at least three decimal places. Enter your answer here Save Answer Q4.2 3 Points Suppose that r = 0.15. Compute the collateral to loan ratio c that ensures that the borrower is indifferent between the projects G and B. Round your answer to at least three decimal places. Enter your answer here Save Answer

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The lender lends to a pool of identical borrowers The borrowers have option to invest in two project...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started