Question

Q.4. Roger Guidry, CIO of a university endowment fund, is reviewing investment data related to the endowment's investment in energy commodities. ( 4 Marks) A.

Q.4. Roger Guidry, CIO of a university endowment fund, is reviewing investment data related to the endowment's investment in energy commodities. (4 Marks)

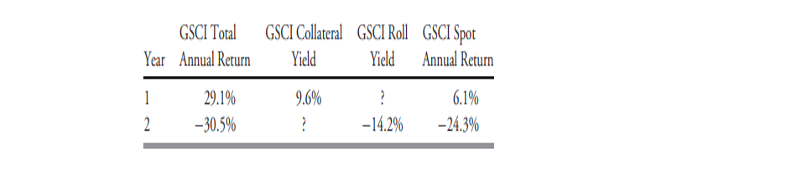

A. Calculate the roll yield for Year 1. B. Calculate the collateral yield for Year 2.

A. Calculate the roll yield for Year 1. B. Calculate the collateral yield for Year 2.

Guidry notes that the collateral yield is positive in both scenarios, although the GSCI total annual return for Year 2 is -30.5 percent. He asks for an explanation with regard to the positive collateral yield.

C. Justify the positive collateral yield by discussing the concepts of margin and implied yield.

A consultant tells Guidry: "Commodities exhibit positive event risk."

D. Justify the consultant's statement by discussing the relationship between commodity prices and event risk.

\begin{tabular}{ccccc} & GSCITotal & GSCICollateral & GSCI Roll & GSCI Spot \\ Year & Annual Return & Yield & Yield & Annual Return \\ \hline 1 & 29.1% & 9.6% & ! & 6.1% \\ 2 & 30.5% & ? & 14.2% & 24.3% \\ \hline \hline \end{tabular} \begin{tabular}{ccccc} & GSCITotal & GSCICollateral & GSCI Roll & GSCI Spot \\ Year & Annual Return & Yield & Yield & Annual Return \\ \hline 1 & 29.1% & 9.6% & ! & 6.1% \\ 2 & 30.5% & ? & 14.2% & 24.3% \\ \hline \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started