Answered step by step

Verified Expert Solution

Question

1 Approved Answer

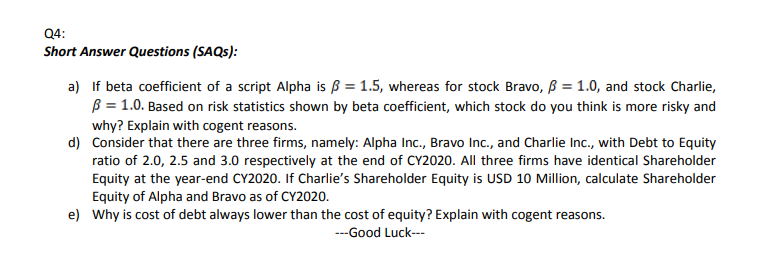

Q4: Short Answer Questions (SAQs): If you are not sure about the cogent reasons no problem about that, just answer what you can. Please Answer

Q4: Short Answer Questions (SAQs):

If you are not sure about the cogent reasons no problem about that, just answer what you can.

Please Answer FAST! Thank you

Q4: Short Answer Questions (SAQs): a) If beta coefficient of a script Alpha is B = 1.5, whereas for stock Bravo, = 1.0, and stock Charlie, B = 1.0. Based on risk statistics shown by beta coefficient, which stock do you think is more risky and why? Explain with cogent reasons. d) Consider that there are three firms, namely: Alpha Inc., Bravo Inc., and Charlie Inc., with Debt to Equity ratio of 2.0, 2.5 and 3.0 respectively at the end of CY2020. All three firms have identical Shareholder Equity at the year-end CY2020. If Charlie's Shareholder Equity is USD 10 Million, calculate Shareholder Equity of Alpha and Bravo as of CY2020. e) Why is cost of debt always lower than the cost of equity? Explain with cogent reasons. ---Good LuckStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started