Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q4. The Delhi Manufacturers Ltd sells goods on credit. Its current annual credit sales amount to Rs 900 lakh. The varialo cual ratio is cu

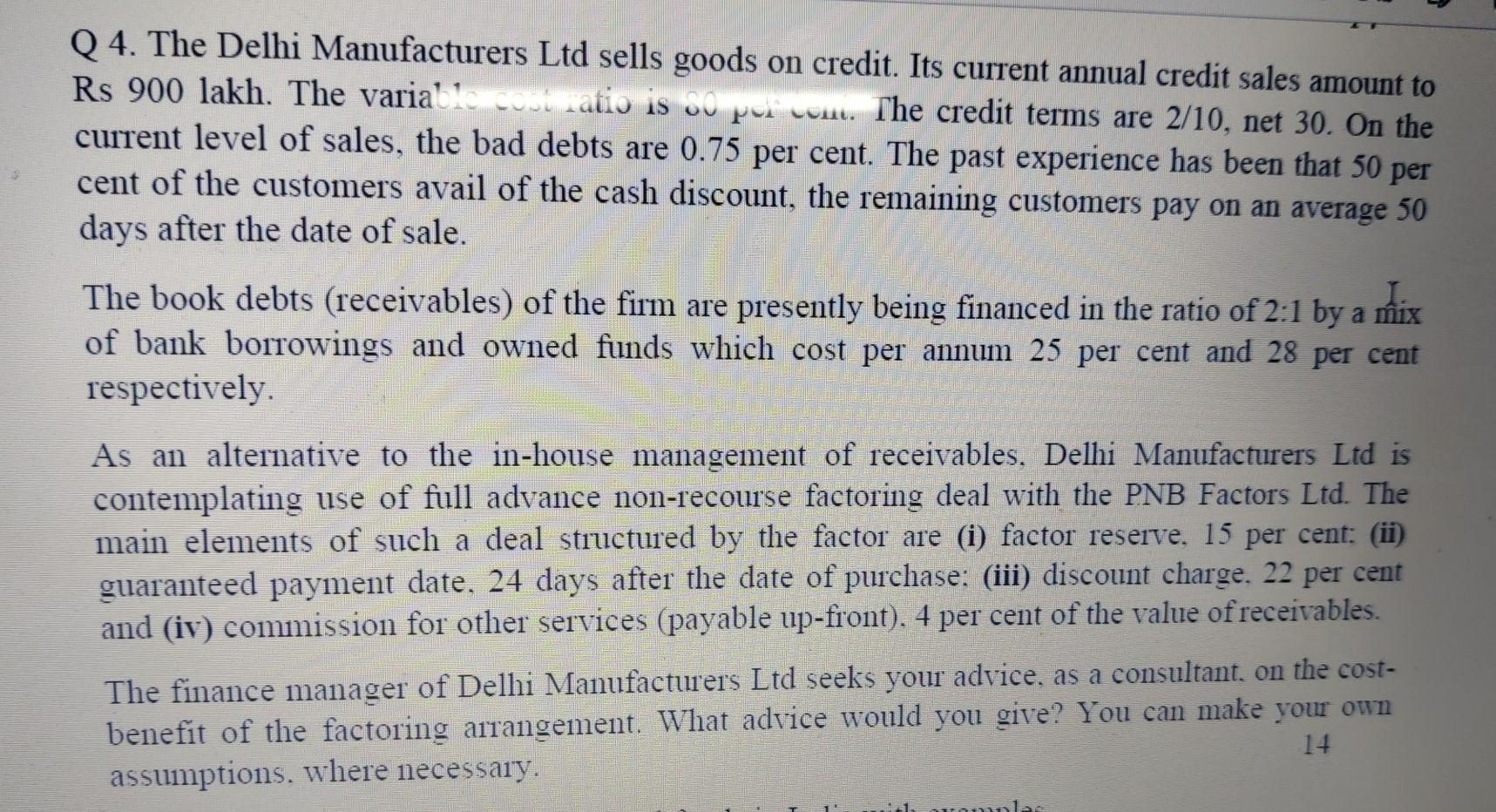

Q4. The Delhi Manufacturers Ltd sells goods on credit. Its current annual credit sales amount to Rs 900 lakh. The varialo cual ratio is cu pui com. The credit terms are 2/10, net 30. On the current level of sales, the bad debts are 0.75 per cent. The past experience has been that 50 per cent of the customers avail of the cash discount, the remaining customers pay on an average 50 days after the date of sale. The book debts (receivables) of the firm are presently being financed in the ratio of 2:1 by a mix of bank borrowings and owned funds which cost per annum 25 per cent and 28 per cent respectively. As an alternative to the in-house management of receivables. Delhi Manufacturers Ltd is contemplating use of full advance non-recourse factoring deal with the PNB Factors Ltd. The main elements of such a deal structured by the factor are (i) factor reserve. 15 per cent: (i) guaranteed payment date, 24 days after the date of purchase: (iii) discount charge. 22 per cent and (iv) commission for other services (payable up-front). 4 per cent of the value of receivables. The finance manager of Delhi Manufacturers Ltd seeks your advice. as a consultant, on the cost- benefit of the factoring arrangement. What advice would you give? You can make your own 14 assumptions, where necessary. 1 lae Q4. The Delhi Manufacturers Ltd sells goods on credit. Its current annual credit sales amount to Rs 900 lakh. The varialo cual ratio is cu pui com. The credit terms are 2/10, net 30. On the current level of sales, the bad debts are 0.75 per cent. The past experience has been that 50 per cent of the customers avail of the cash discount, the remaining customers pay on an average 50 days after the date of sale. The book debts (receivables) of the firm are presently being financed in the ratio of 2:1 by a mix of bank borrowings and owned funds which cost per annum 25 per cent and 28 per cent respectively. As an alternative to the in-house management of receivables. Delhi Manufacturers Ltd is contemplating use of full advance non-recourse factoring deal with the PNB Factors Ltd. The main elements of such a deal structured by the factor are (i) factor reserve. 15 per cent: (i) guaranteed payment date, 24 days after the date of purchase: (iii) discount charge. 22 per cent and (iv) commission for other services (payable up-front). 4 per cent of the value of receivables. The finance manager of Delhi Manufacturers Ltd seeks your advice. as a consultant, on the cost- benefit of the factoring arrangement. What advice would you give? You can make your own 14 assumptions, where necessary. 1 lae

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started