Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q4. What is Contribution Margin Ratio (write the definition)? Apply CMR to present how EBIT depends on Sales. Draw a graph that shows this relationship.

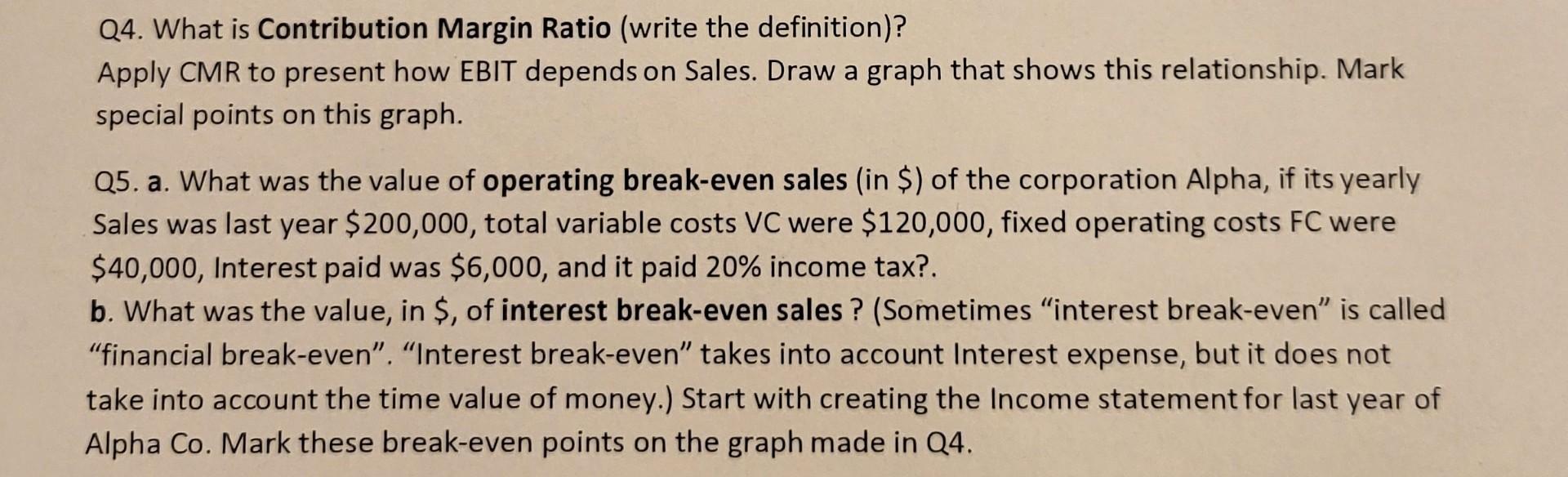

Q4. What is Contribution Margin Ratio (write the definition)? Apply CMR to present how EBIT depends on Sales. Draw a graph that shows this relationship. Mark special points on this graph. Q5. a. What was the value of operating break-even sales (in $) of the corporation Alpha, if its yearly Sales was last year $200,000, total variable costs VC were $120,000, fixed operating costs FC were $40,000, Interest paid was $6,000, and it paid 20% income tax?. b. What was the value, in $, of interest break-even sales? (Sometimes "interest break-even" is called "financial break-even". "Interest break-even" takes into account Interest expense, but it does not take into account the time value of money.) Start with creating the Income statement for last year of Alpha Co. Mark these break-even points on the graph made in Q4. Q4. What is Contribution Margin Ratio (write the definition)? Apply CMR to present how EBIT depends on Sales. Draw a graph that shows this relationship. Mark special points on this graph. Q5. a. What was the value of operating break-even sales (in $) of the corporation Alpha, if its yearly Sales was last year $200,000, total variable costs VC were $120,000, fixed operating costs FC were $40,000, Interest paid was $6,000, and it paid 20% income tax?. b. What was the value, in $, of interest break-even sales? (Sometimes "interest break-even" is called "financial break-even". "Interest break-even" takes into account Interest expense, but it does not take into account the time value of money.) Start with creating the Income statement for last year of Alpha Co. Mark these break-even points on the graph made in Q4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started