Question

Q4) What is the meaning of balance sheet, how many times in a year companies issued their balance sheets to the public and write periods.

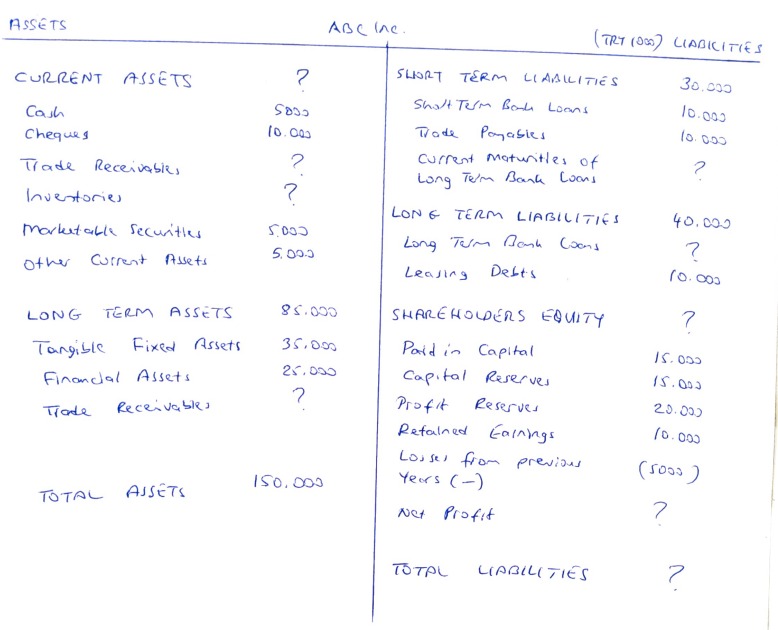

Q4) What is the meaning of balance sheet, how many times in a year companies issued their balance sheets to the public and write periods. Please answer the following questions by looking at the balance sheet which is on other page. 1. Find the missing numbers in question marks. 2. Inventories are triple more then trade receivables. 3. Calculate the asset profitability 4. Calculate the current ratio and write your comment about it. 5. calculate the shareholder equity ratO. 6. Calculate the price to book value. 7. If the compnays share price is TRY 8, Calculate its market value and price/earning ratio.

ASSETS ABClnC. (TRT NODO) CIABICITIES CURRENT ASSETS Cash Cheques Trade Receivabies Inventories morketable securities other current Alsets LONG TERM ASSETS 85.000 Tangible Fixed Assets Financlal Assets Trade Receivables total assets ? Soso 10.002 ? 2.000 2. 00.5 35.000 25.000 SLORT TERM LAALITIS Sholt Term Bond Loans Trode Pajabies current maturitles of long Te/m Bank Coons LONG TERM LIABILITIES Long Term Mowk Coons Leasing Debts SHAREWOLERS EQUITY Pard in Capital Capital Reserves Profit Reserves Retalned Eainings losses from previous Yeors (-) Net Profit TOTAL LIABILGTES 30.000 10.000 10.000 ? 40.000 ? 10.03 ? 15.000 12.002 20.003 10.000 (5000)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started