Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q4. You are given the following information about country A in period 0:r (interest rate paid on debt) = 5%; g (growth rate of

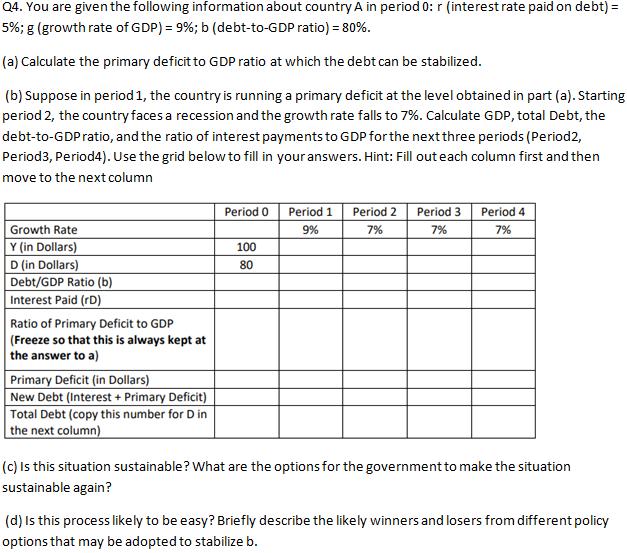

Q4. You are given the following information about country A in period 0:r (interest rate paid on debt) = 5%; g (growth rate of GDP) = 9%; b (debt-to-GDP ratio) = 80%. (a) Calculate the primary deficit to GDP ratio at which the debt can be stabilized. (b) Suppose in period 1, the country is running a primary deficit at the level obtained in part (a). Starting period 2, the country faces a recession and the growth rate falls to 7%. Calculate GDP, total Debt, the debt-to-GDP ratio, and the ratio of interest payments to GDP for the next three periods (Period2, Period3, Period4). Use the grid below to fill in your answers. Hint: Fill out each column first and then move to the next column Growth Rate Y (in Dollars) D (in Dollars) Debt/GDP Ratio (b) Interest Paid (rD) Ratio of Primary Deficit to GDP (Freeze so that this is always kept at the answer to a) Primary Deficit (in Dollars) New Debt (Interest + Primary Deficit) Total Debt (copy this number for D in the next column) Period 0 100 80 Period 1 9% Period 2 Period 3 Period 4 7% 7% 7% (c) Is this situation sustainable? What are the options for the government to make the situation sustainable again? (d) Is this process likely to be easy? Briefly describe the likely winners and losers from different policy options that may be adopted to stabilize b.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the primary deficit to GDP ratio at which the debt can be stabilized we can use the following formula Primary Deficit to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started