Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer all questions and show necessary work. Please be brief. This is an open books, open notes exam. 1. You have been asked to

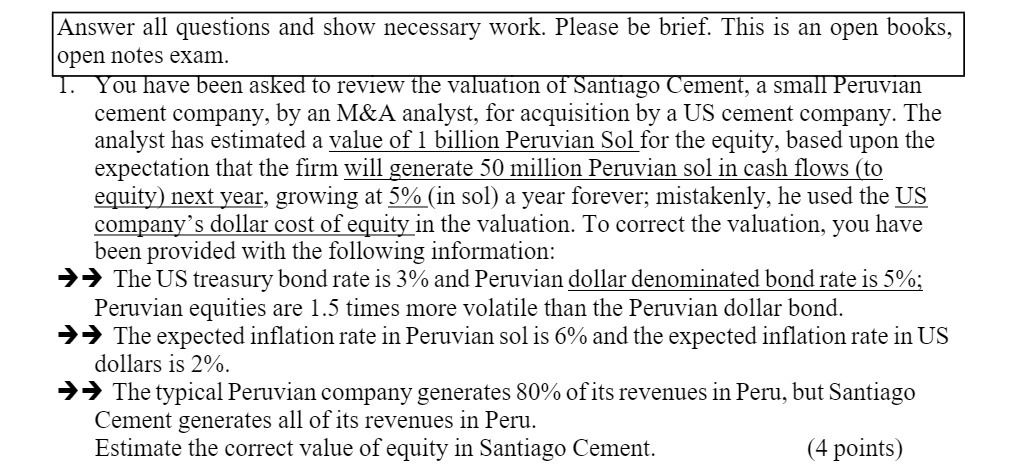

Answer all questions and show necessary work. Please be brief. This is an open books, open notes exam. 1. You have been asked to review the valuation of Santiago Cement, a small Peruvian cement company, by an M&A analyst, for acquisition by a US cement company. The analyst has estimated a value of 1 billion Peruvian Sol for the equity, based upon the expectation that the firm will generate 50 million Peruvian sol in cash flows (to equity) next year, growing at 5% (in sol) a year forever; mistakenly, he used the US company's dollar cost of equity in the valuation. To correct the valuation, you have been provided with the following information: The US treasury bond rate is 3% and Peruvian dollar denominated bond rate is 5%; Peruvian equities are 1.5 times more volatile than the Peruvian dollar bond. The expected inflation rate in Peruvian sol is 6% and the expected inflation rate in US dollars is 2%. The typical Peruvian company generates 80% of its revenues in Peru, but Santiago Cement generates all of its revenues in Peru. Estimate the correct value of equity in Santiago Cement. (4 points)

Step by Step Solution

★★★★★

3.40 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

To correct the valuation of Santiago Cement we need to adjust the discount rate to reflect the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started