Answered step by step

Verified Expert Solution

Question

1 Approved Answer

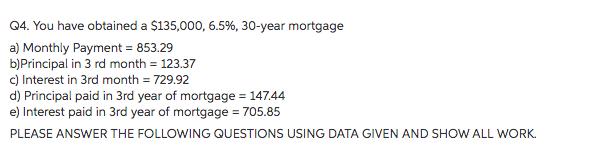

Q4. You have obtained a $135,000, 6.5%, 30-year mortgage a) Monthly Payment = 853.29 b)Principal in 3 rd month= 123.37 c) Interest in 3rd

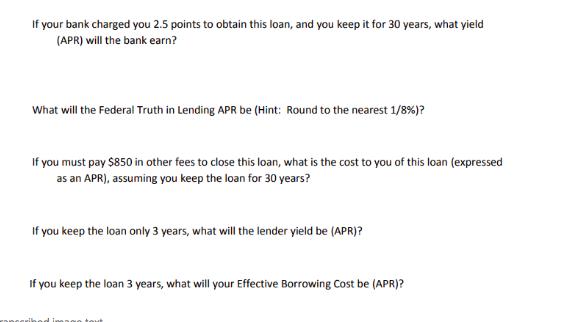

Q4. You have obtained a $135,000, 6.5%, 30-year mortgage a) Monthly Payment = 853.29 b)Principal in 3 rd month= 123.37 c) Interest in 3rd month = 729.92 d) Principal paid in 3rd year of mortgage = 147.44 e) Interest paid in 3rd year of mortgage = 705.85 PLEASE ANSWER THE FOLLOWING QUESTIONS USING DATA GIVEN AND SHOW ALL WORK. If your bank charged you 2.5 points to obtain this loan, and you keep it for 30 years, what yield (APR) will the bank earn? What will the Federal Truth in Lending APR be (Hint: Round to the nearest 1/8%)? If you must pay $850 in other fees to close this loan, what is the cost to you of this loan (expressed as an APR), assuming you keep the loan for 30 years? If you keep the loan only 3 years, what will the lender yield be (APR)? If you keep the loan 3 years, what will your Effective Borrowing Cost be (APR)? tout

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Monthly Payment Youve provided the correct monthly payment of 85329 b Principal in 3rd Month Youve provided the correct principal payment in the 3rd month which is 12337 c Interest in 3rd Month Youv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started