Answered step by step

Verified Expert Solution

Question

1 Approved Answer

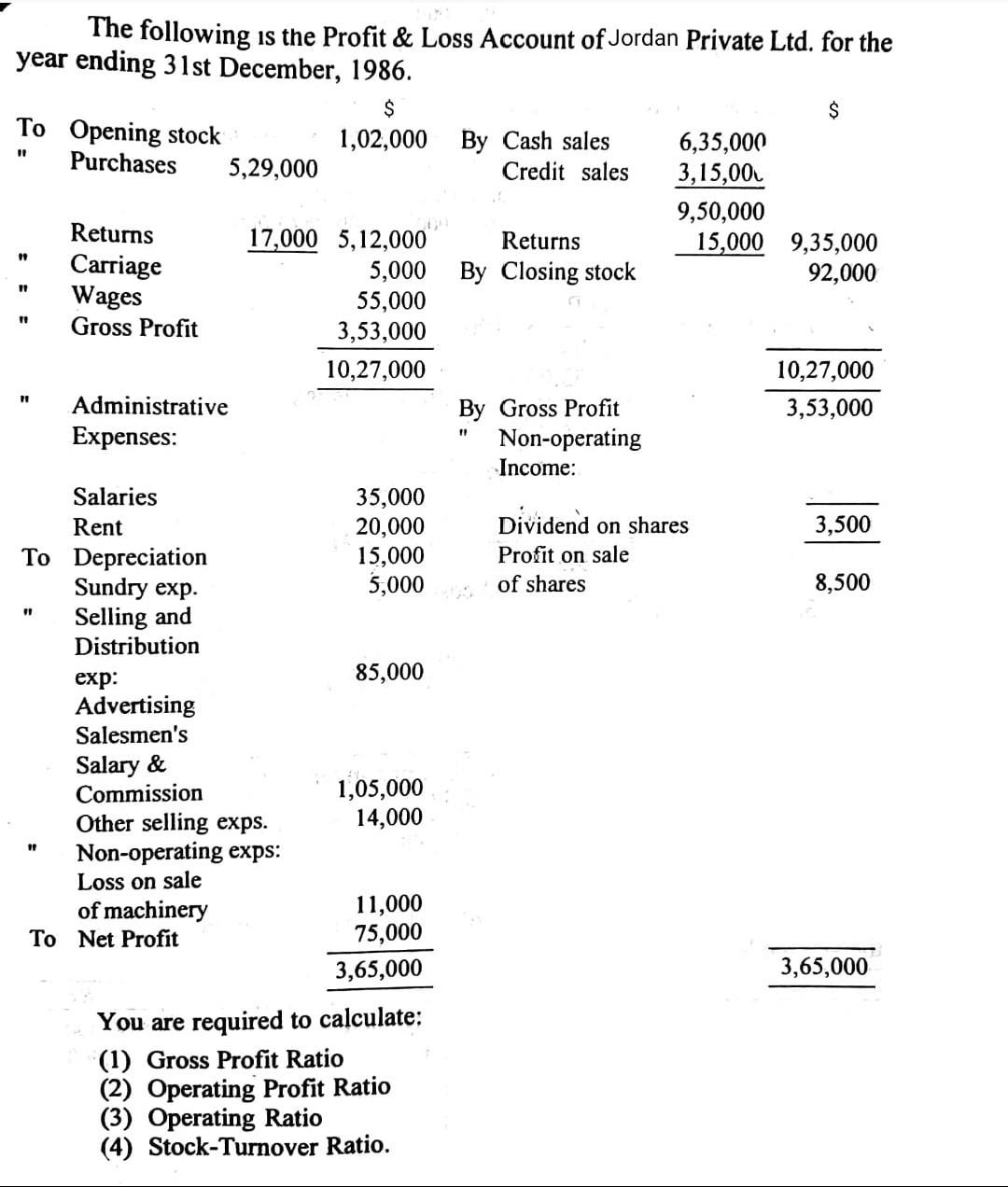

Q44 00 1 11 I! The following is the Profit & Loss Account of Jordan Private Ltd. for the year ending 31st December, 1986. $

Q44

00 1 11 I! The following is the Profit & Loss Account of Jordan Private Ltd. for the year ending 31st December, 1986. $ $ To Opening stock 1,02,000 By Cash sales 6,35,000 Purchases 5,29,000 Credit sales 3,15,00 9,50,000 Returns 17,000 5,12,000 Returns 15,000 9,35,000 Carriage 5,000 By Closing stock 92,000 Wages 55,000 Gross Profit 3,53,000 10,27,000 10,27,000 Administrative By Gross Profit 3,53,000 Expenses: Non-operating Income: Salaries 35,000 Rent 20,000 Dividend on shares 3,500 To Depreciation 15,000 Profit on sale Sundry exp. 5,000 of shares 8,500 Selling and Distribution exp: 85,000 Advertising Salesmen's Salary & Commission 1,05,000 Other selling exps. 14,000 Non-operating exps: Loss on sale of machinery 11,000 To Net Profit 75,000 3,65,000 3,65,000 You are required to calculate: (1) Gross Profit Ratio (2) Operating Profit Ratio (3) Operating Ratio (4) Stock-Turnover Ratio. 01 09Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started