Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q4,Q5, Q6,Q7 Part B: Bond Valuation Q4: Bond Value: Mills Company, a large defense contractor, on January 1, 2016, issued a 10% coupon interest rate,

Q4,Q5, Q6,Q7

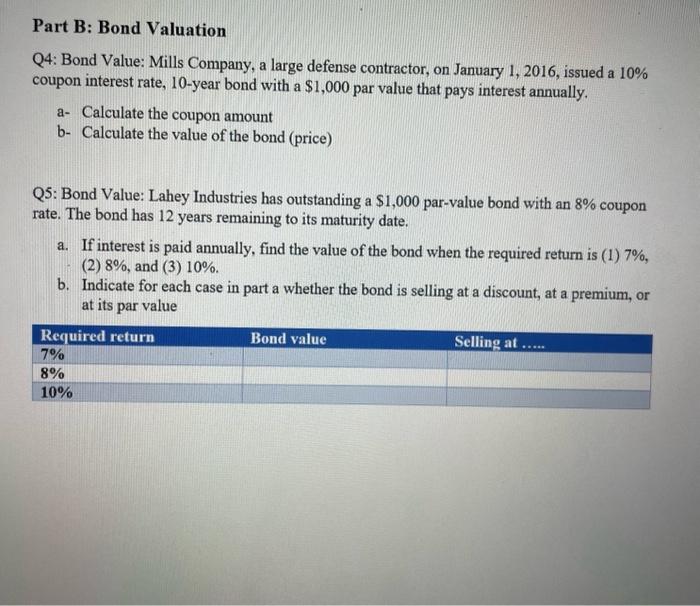

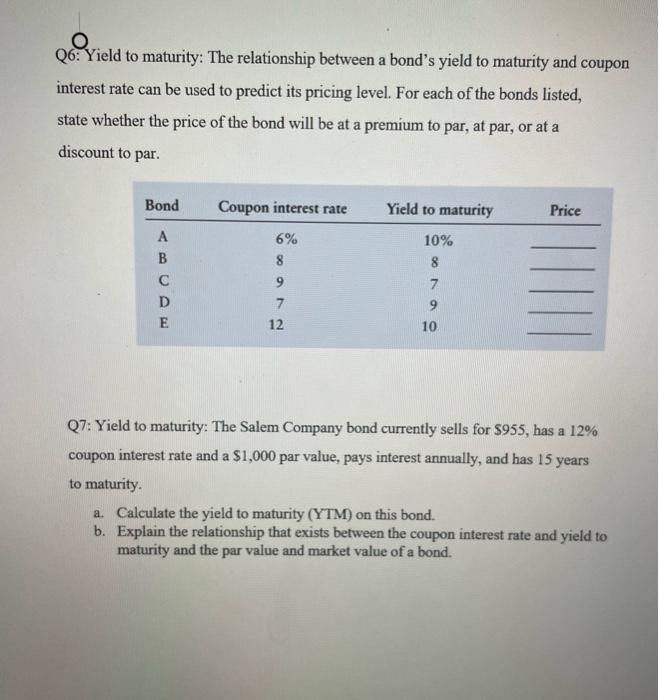

Part B: Bond Valuation Q4: Bond Value: Mills Company, a large defense contractor, on January 1, 2016, issued a 10\% coupon interest rate, 10-year bond with a $1,000 par value that pays interest annually. a- Calculate the coupon amount b- Calculate the value of the bond (price) Q5: Bond Value: Lahey Industries has outstanding a $1,000 par-value bond with an 8% coupon rate. The bond has 12 years remaining to its maturity date. a. If interest is paid annually, find the value of the bond when the required return is (1) 7%, (2) 8%, and (3) 10%. b. Indicate for each case in part a whether the bond is selling at a discount, at a premium, or at its par value Q6: Yield to maturity: The relationship between a bond's yield to maturity and coupon interest rate can be used to predict its pricing level. For each of the bonds listed, state whether the price of the bond will be at a premium to par, at par, or at a discount to par. Q7: Yield to maturity: The Salem Company bond currently sells for $955, has a 12% coupon interest rate and a $1,000 par value, pays interest annually, and has 15 years to maturity. a. Calculate the yield to maturity (YTM) on this bond. b. Explain the relationship that exists between the coupon interest rate and yield to maturity and the par value and market value of a bond

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started