Answered step by step

Verified Expert Solution

Question

1 Approved Answer

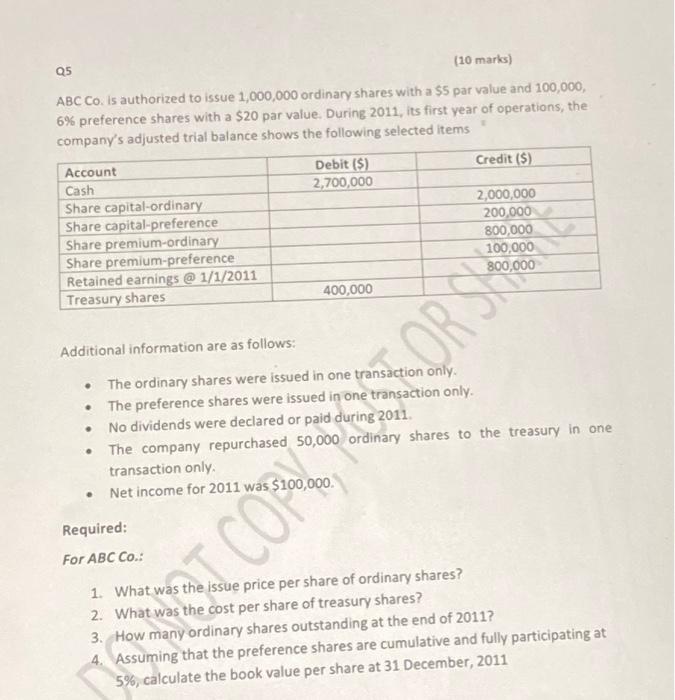

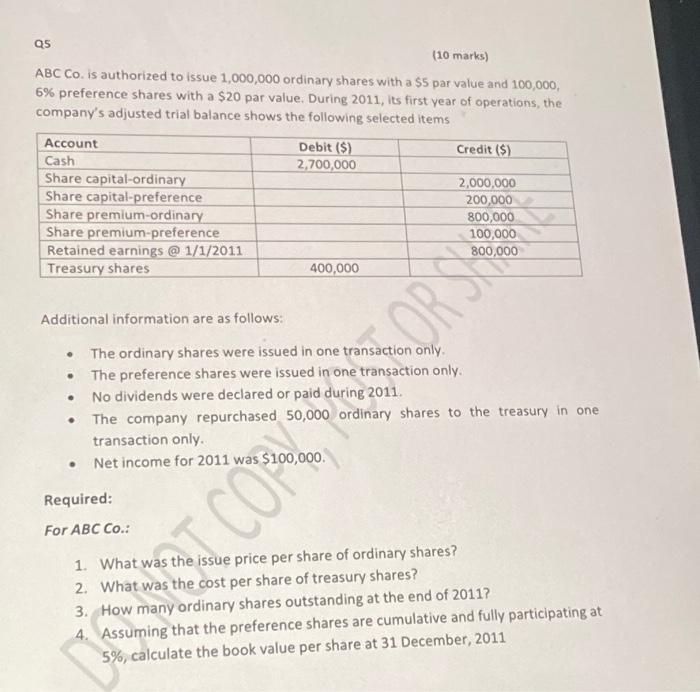

Q5 (10 marks) ABC Co. is authorized to issue 1,000,000 ordinary shares with a $5 par value and 100,000, 6% preference shares with a $20

Q5 (10 marks) ABC Co. is authorized to issue 1,000,000 ordinary shares with a $5 par value and 100,000, 6% preference shares with a $20 par value. During 2011, its first year of operations, the company's adjusted trial balance shows the following selected items Account Cash Share capital-ordinary Share capital-preference Share premium-ordinary Share premium-preference Retained earnings @ 1/1/2011 Treasury shares Additional information are as follows: Debit ($) 2,700,000 Required: For ABC Co.: 400,000 Credit ($) SI COP 2,000,000 200,000 800,000 100,000 800,000 The ordinary shares were issued in one transaction only. The preference shares were issued in one transaction only. No dividends were declared or paid during 2011. The company repurchased 50,000 ordinary shares to the treasury in one transaction only. Net income for 2011 was $100,000. OR SE 1. What was the issue price per share of ordinary shares? 2. What was the cost per share of treasury shares? 3. How many ordinary shares outstanding at the end of 2011? 4. Assuming that the preference shares are cumulative and fully participating at 5%, calculate the book value per share at 31 December, 2011

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started