Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q5) A $1,000 par value bond was issued 25 years ago at a 12% coupon rate. It currently has 15 years remaining to maturity. Interest

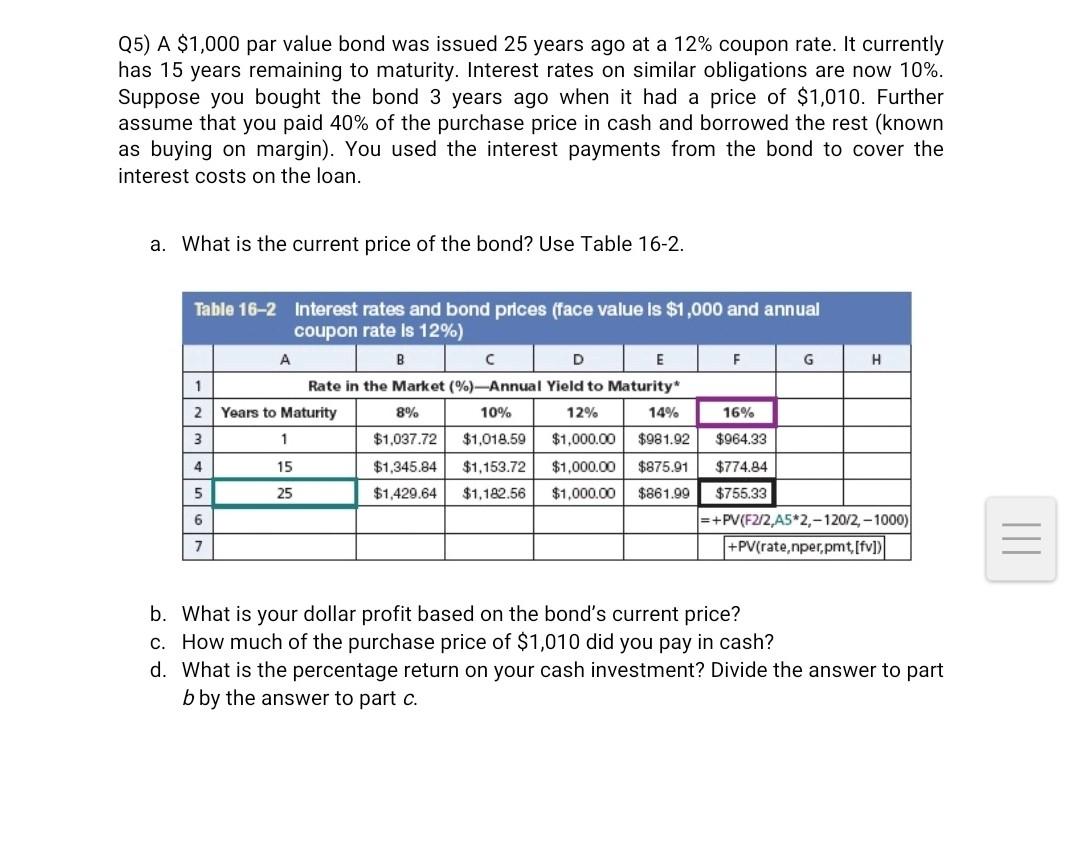

Q5) A $1,000 par value bond was issued 25 years ago at a 12% coupon rate. It currently has 15 years remaining to maturity. Interest rates on similar obligations are now 10%. Suppose you bought the bond 3 years ago when it had a price of $1,010. Further assume that you paid 40% of the purchase price in cash and borrowed the rest (known as buying on margin). You used the interest payments from the bond to cover the interest costs on the loan. a. What is the current price of the bond? Use Table 16-2. Table 16-2 Interest rates and bond prices (face value is $1,000 and annual coupon rate is 12%) A B C D E F G H 1 Rate in the Market (%)-Annual Yield to Maturity* 2 Years to Maturity 16% 3 1 8% 10% 12% 14% $1,037.72 $1,018.59 $1,000.00 $981.92 $964.33 $1,345.84 $1,153.72 $1,000.00 $875.91 $774.84 $1,429.64 $1,182.56 $1,000.00 $861.99 $755.33 4 15 5 25 6 =+PV(F2/2,A5*2,-120/2,-1000) +PV(rate,nper,pmt, [fv]) 7 b. What is your dollar profit based on the bond's current price? c. How much of the purchase price of $1,010 did you pay in cash? d. What is the percentage return on your cash investment? Divide the answer to part b by the answer to part c

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started