Question

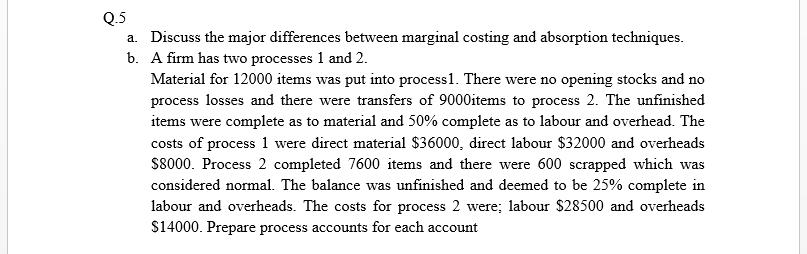

Q.5 a. Discuss the major differences between marginal costing and absorption techniques. b. A firm has two processes 1 and 2. Material for 12000

Q.5 a. Discuss the major differences between marginal costing and absorption techniques. b. A firm has two processes 1 and 2. Material for 12000 items was put into process1. There were no opening stocks and no process losses and there were transfers of 9000items to process 2. The unfinished items were complete as to material and 50% complete as to labour and overhead. The costs of process 1 were direct material $36000, direct labour $32000 and overheads S8000. Process 2 completed 7600 items and there were 600 scrapped which was considered normal. The balance was unfinished and deemed to be 25% complete in labour and overheads. The costs for process 2 were; labour $28500 and overheads $14000. Prepare process accounts for each account

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials of Business Law

Authors: Anthony Liuzzo

9th edition

007802319X, 978-0078023194

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App