Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q5 Assume an FI has assets of $250 million and liabilities of $190 million on 2 March 2020 and interest rates are 10%. The

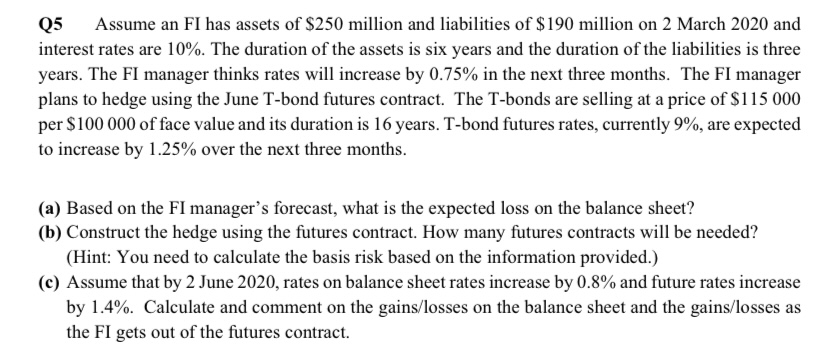

Q5 Assume an FI has assets of $250 million and liabilities of $190 million on 2 March 2020 and interest rates are 10%. The duration of the assets is six years and the duration of the liabilities is three years. The FI manager thinks rates will increase by 0.75% in the next three months. The FI manager plans to hedge using the June T-bond futures contract. The T-bonds are selling at a price of $115 000 per $100 000 of face value and its duration is 16 years. T-bond futures rates, currently 9%, are expected to increase by 1.25% over the next three months. (a) Based on the FI manager's forecast, what is the expected loss on the balance sheet? (b) Construct the hedge using the futures contract. How many futures contracts will be needed? (Hint: You need to calculate the basis risk based on the information provided.) (c) Assume that by 2 June 2020, rates on balance sheet rates increase by 0.8% and future rates increase by 1.4%. Calculate and comment on the gains/losses on the balance sheet and the gains/losses as the FI gets out of the futures contract.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the expected loss on the balance sheet based on the FI managers forecast we can use the duration and interest rate information provided ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started