Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q-5) Define and explain in detail following terms: Marked to Market Elimination Consolidation Fair Value Enron Crisis Please make required journalising in accordance with TFRS

Q-5) Define and explain in detail following terms:

Marked to Market

Elimination

Consolidation

Fair Value

Enron Crisis

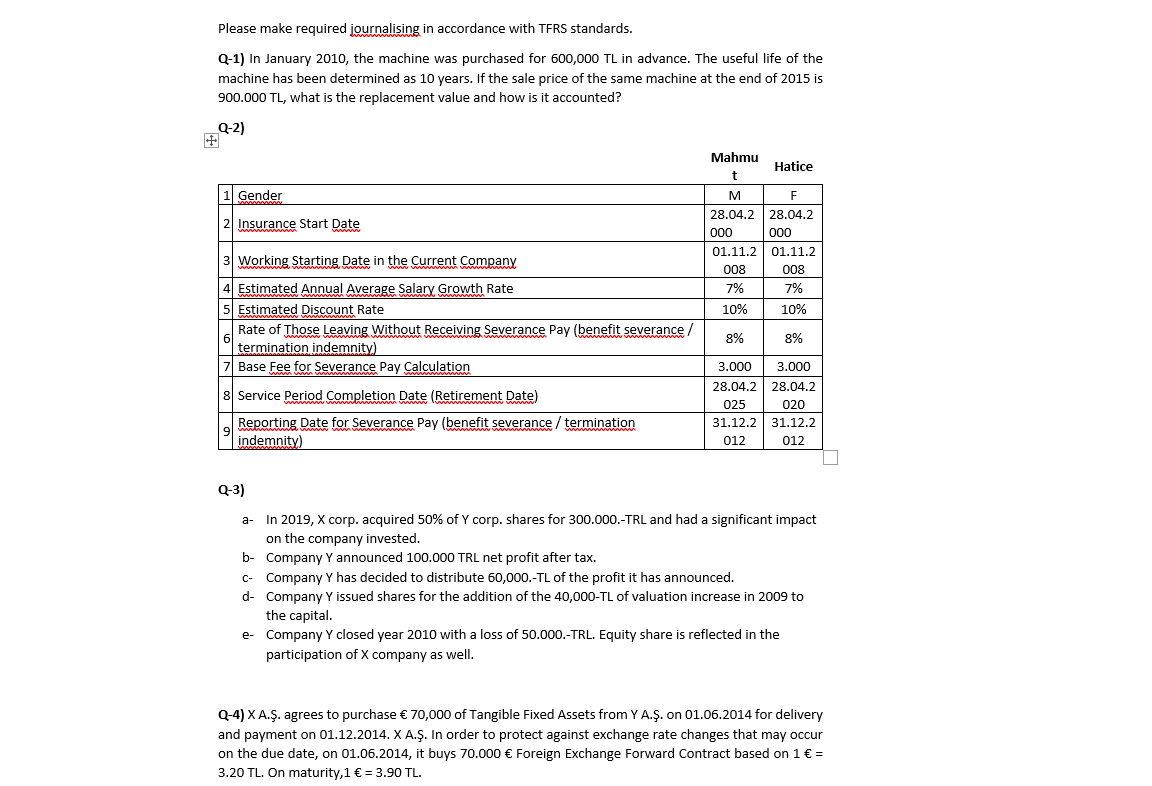

Please make required journalising in accordance with TFRS standards. Q-1) In January 2010, the machine was purchased for 600,000 TL in advance. The useful life of the machine has been determined as 10 years. If the sale price of the same machine at the end of 2015 is 900.000 TL, what is the replacement value and how is it accounted? Q-2) Mahmu t Hatice Gender 2 Insurance Start Date M 28.04.2 000 01.11.2 008 7% 10% F 28.04.2 000 01.11.2 008 7% 10% 8% 8% 3) Working Starting Date in the Current Company 4 Estimated Annual Average Salary Growth Rate 5 Estimated Discount Rate Rate of Those Leaving Without Receiving Severance Pay (benefit severance / termination indemnity) 7 Base Fee for Severance Pay Calculation 8 Service Period Completion Date (Retirement Date) Reporting Date for Severance Pay (benefit severance / termination indemnity) 3.000 28.04.2 025 31.12.2 012 3.000 28.04.2 020 31.12.2 012 Q-3) a- In 2019, X corp. acquired 50% of Y corp. shares for 300.000.-TRL and had a significant impact on the company invested. b- Company Y announced 100.000 TRL net profit after tax. Company Y has decided to distribute 60,000.-TL of the profit it has announced. d- Company Y issued shares for the addition of the 40,000-TL of valuation increase in 2009 to the capital. e- Company Y closed year 2010 with a loss of 50.000.-TRL. Equity share is reflected in the participation of X company as well. Q-4) X A.. agrees to purchase 70,000 of Tangible Fixed Assets from Y A.. on 01.06.2014 for delivery and payment on 01.12.2014. X A.. In order to protect against exchange rate changes that may occur on the due date, on 01.06.2014, it buys 70.000 Foreign Exchange Forward Contract based on 1 = 3.20 TL. On maturity,1 = 3.90 TLStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started