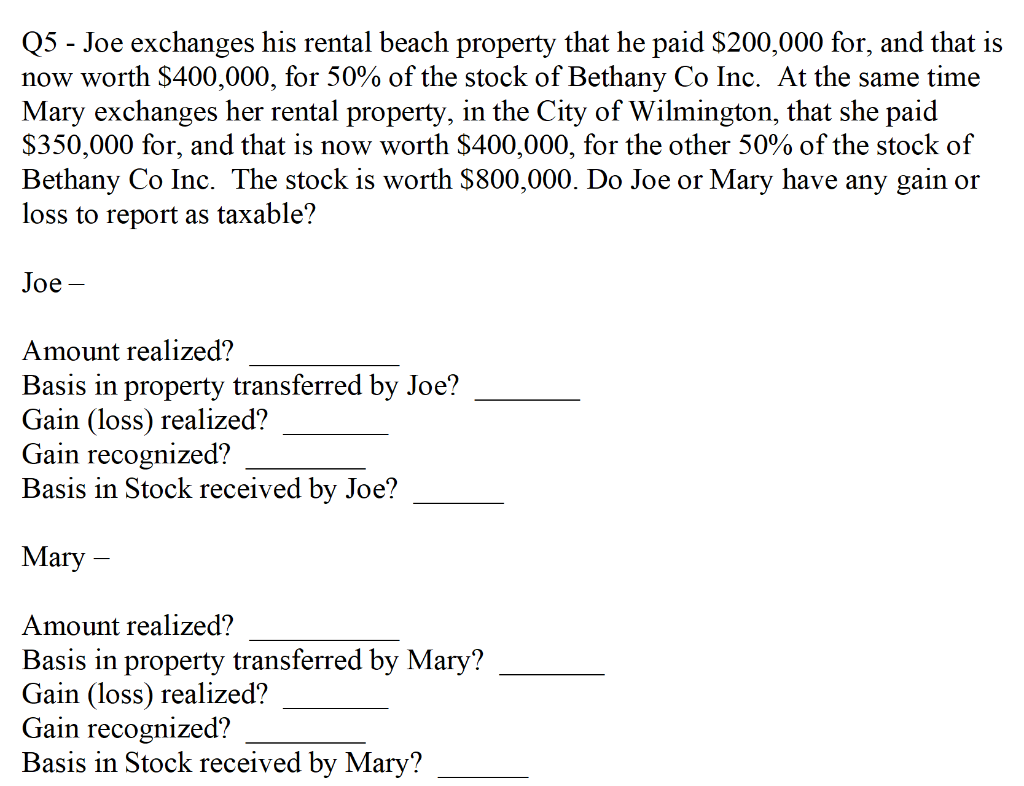

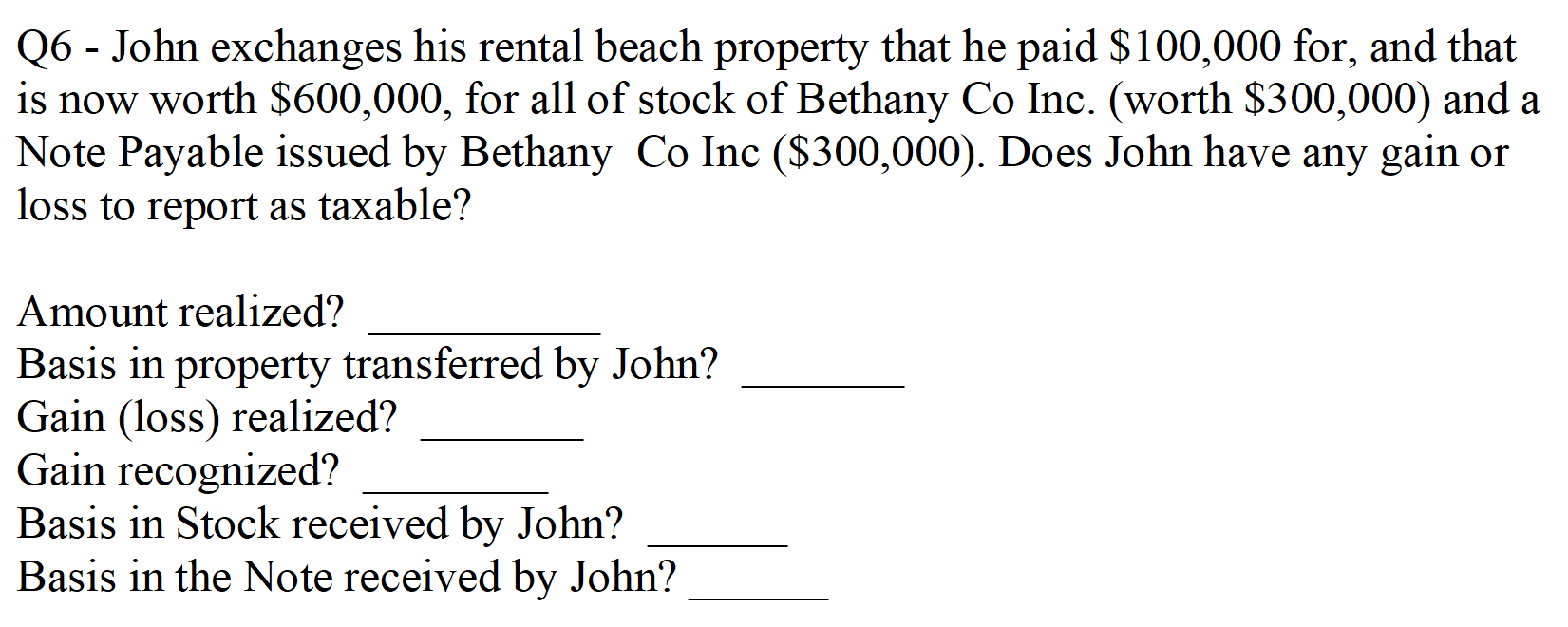

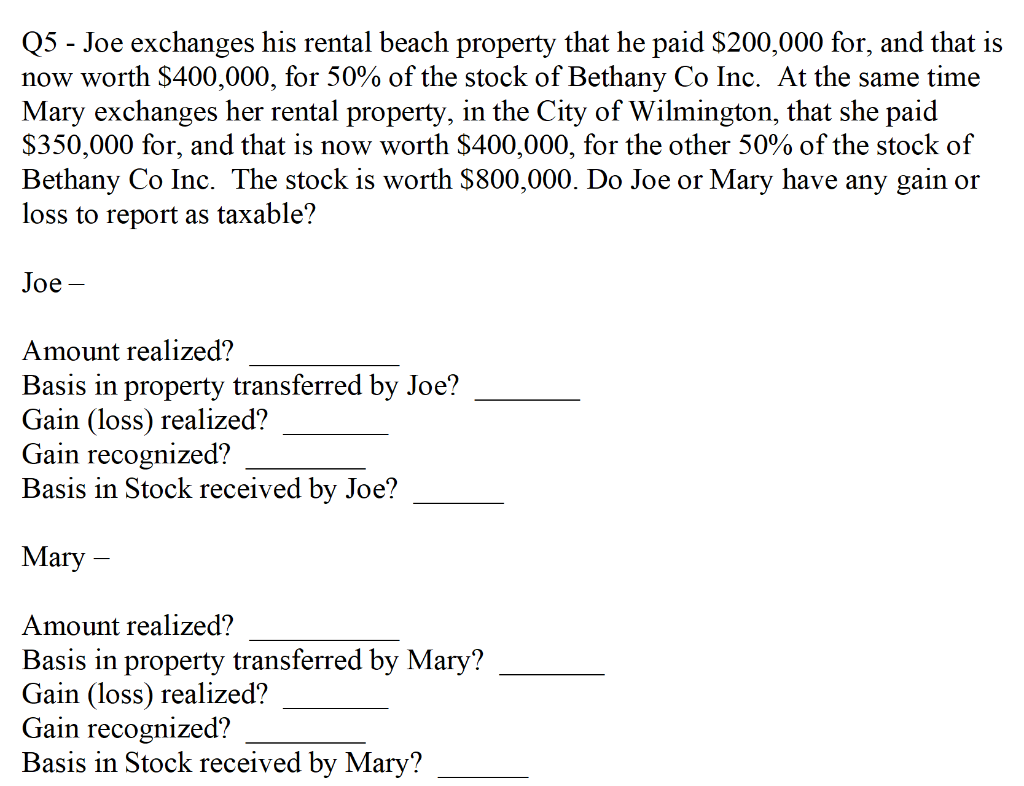

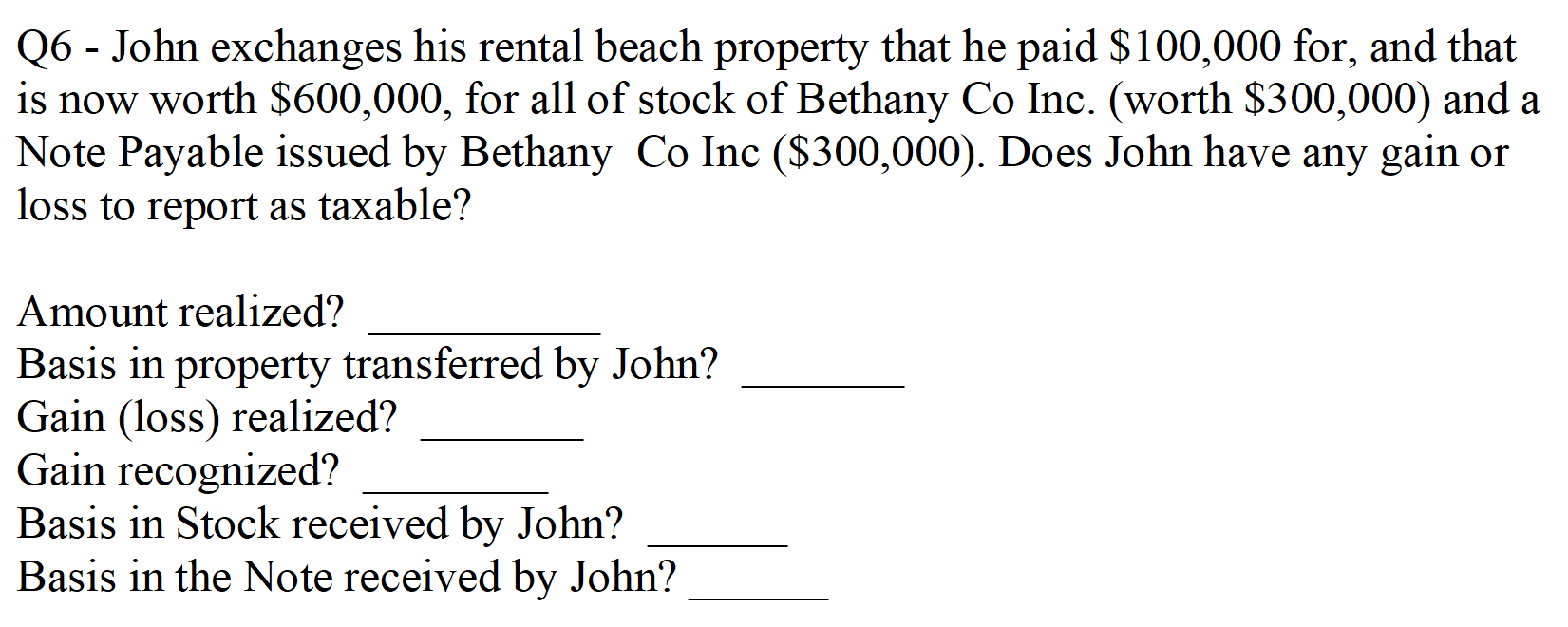

Q5 - Joe exchanges his rental beach property that he paid $200,000 for, and that is now worth $400,000, for 50% of the stock of Bethany Co Inc. At the same time Mary exchanges her rental property, in the City of Wilmington, that she paid $350,000 for, and that is now worth $400,000, for the other 50% of the stock of Bethany Co Inc. The stock is worth $800,000. Do Joe or Mary have any gain or loss to report as taxable? Joe - Amount realized? Basis in property transferred by Joe? Gain (loss) realized? Gain recognized? Basis in Stock received by Joe? Mary - Amount realized? Basis in property transferred by Mary? Gain (loss) realized? Gain recognized? Basis in Stock received by Mary? Q6 - John exchanges his rental beach property that he paid $100,000 for, and that is now worth $600,000, for all of stock of Bethany Co Inc. (worth $300,000 ) and a Note Payable issued by Bethany Co Inc ($300,000). Does John have any gain or loss to report as taxable? Amount realized? Basis in property transferred by John? Gain (loss) realized? Gain recognized? Basis in Stock received by John? Basis in the Note received by John? Q5 - Joe exchanges his rental beach property that he paid $200,000 for, and that is now worth $400,000, for 50% of the stock of Bethany Co Inc. At the same time Mary exchanges her rental property, in the City of Wilmington, that she paid $350,000 for, and that is now worth $400,000, for the other 50% of the stock of Bethany Co Inc. The stock is worth $800,000. Do Joe or Mary have any gain or loss to report as taxable? Joe - Amount realized? Basis in property transferred by Joe? Gain (loss) realized? Gain recognized? Basis in Stock received by Joe? Mary - Amount realized? Basis in property transferred by Mary? Gain (loss) realized? Gain recognized? Basis in Stock received by Mary? Q6 - John exchanges his rental beach property that he paid $100,000 for, and that is now worth $600,000, for all of stock of Bethany Co Inc. (worth $300,000 ) and a Note Payable issued by Bethany Co Inc ($300,000). Does John have any gain or loss to report as taxable? Amount realized? Basis in property transferred by John? Gain (loss) realized? Gain recognized? Basis in Stock received by John? Basis in the Note received by John