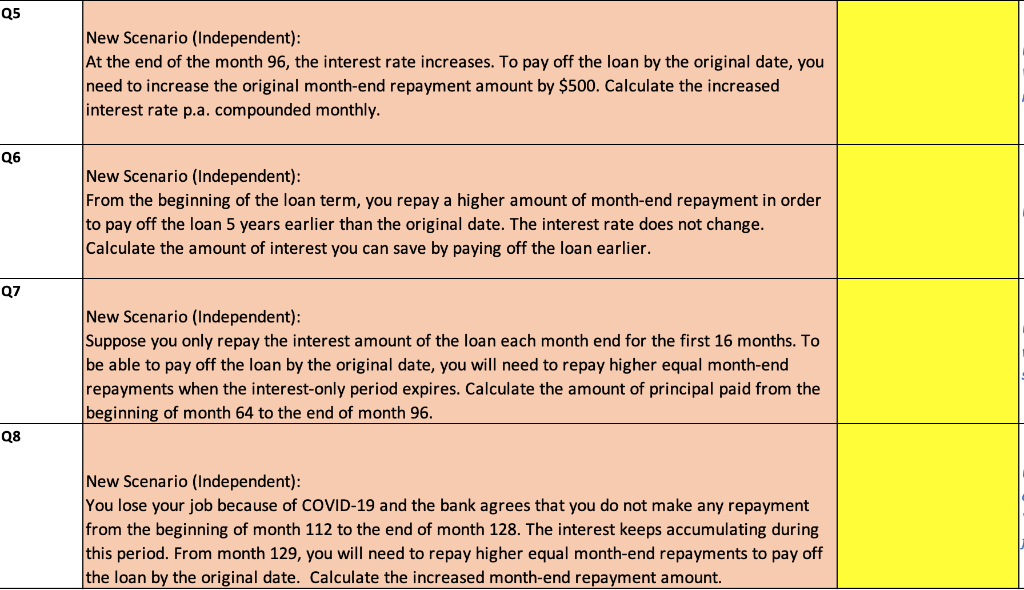

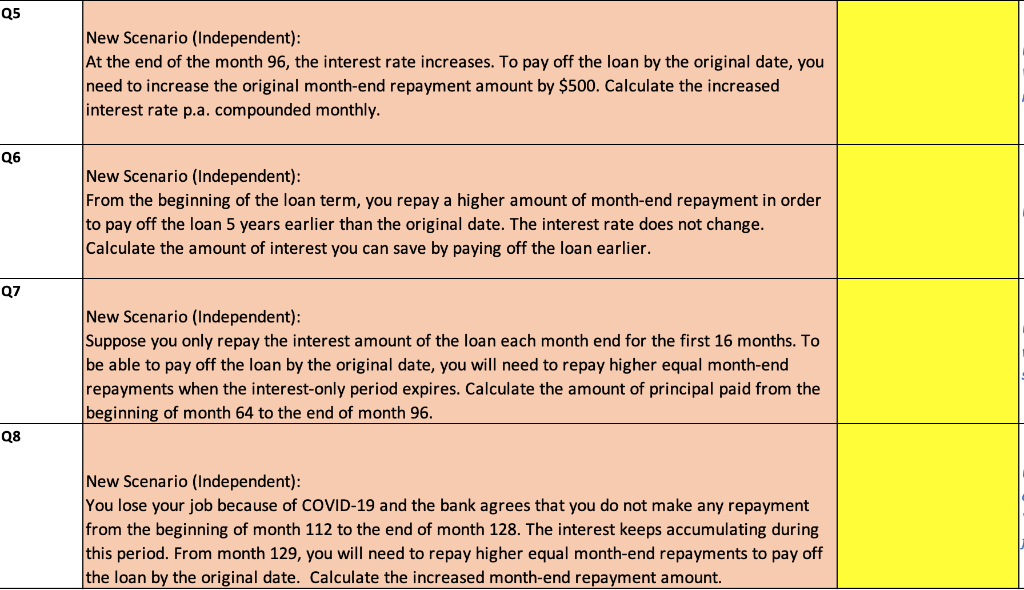

Q5 New Scenario (Independent): At the end of the month 96, the interest rate increases. To pay off the loan by the original date, you need to increase the original month-end repayment amount by $500. Calculate the increased interest rate p.a. compounded monthly. Q6 New Scenario (Independent): From the beginning of the loan term, you repay a higher amount of month-end repayment in order to pay off the loan 5 years earlier than the original date. The interest rate does not change. Calculate the amount of interest you can save by paying off the loan earlier. 07 New Scenario (Independent): Suppose you only repay the interest amount of the loan each month end for the first 16 months. To be able to pay off the loan by the original date, you will need to repay higher equal month-end repayments when the interest-only period expires. Calculate the amount of principal paid from the beginning of month 64 to the end of month 96. Q8 New Scenario (Independent): You lose your job because of COVID-19 and the bank agrees that you do not make any repayment from the beginning of month 112 to the end of month 128. The interest keeps accumulating during this period. From month 129, you will need to repay higher equal month-end repayments to pay off the loan by the original date. Calculate the increased month-end repayment amount. Q5 New Scenario (Independent): At the end of the month 96, the interest rate increases. To pay off the loan by the original date, you need to increase the original month-end repayment amount by $500. Calculate the increased interest rate p.a. compounded monthly. Q6 New Scenario (Independent): From the beginning of the loan term, you repay a higher amount of month-end repayment in order to pay off the loan 5 years earlier than the original date. The interest rate does not change. Calculate the amount of interest you can save by paying off the loan earlier. 07 New Scenario (Independent): Suppose you only repay the interest amount of the loan each month end for the first 16 months. To be able to pay off the loan by the original date, you will need to repay higher equal month-end repayments when the interest-only period expires. Calculate the amount of principal paid from the beginning of month 64 to the end of month 96. Q8 New Scenario (Independent): You lose your job because of COVID-19 and the bank agrees that you do not make any repayment from the beginning of month 112 to the end of month 128. The interest keeps accumulating during this period. From month 129, you will need to repay higher equal month-end repayments to pay off the loan by the original date. Calculate the increased month-end repayment amount