Answered step by step

Verified Expert Solution

Question

1 Approved Answer

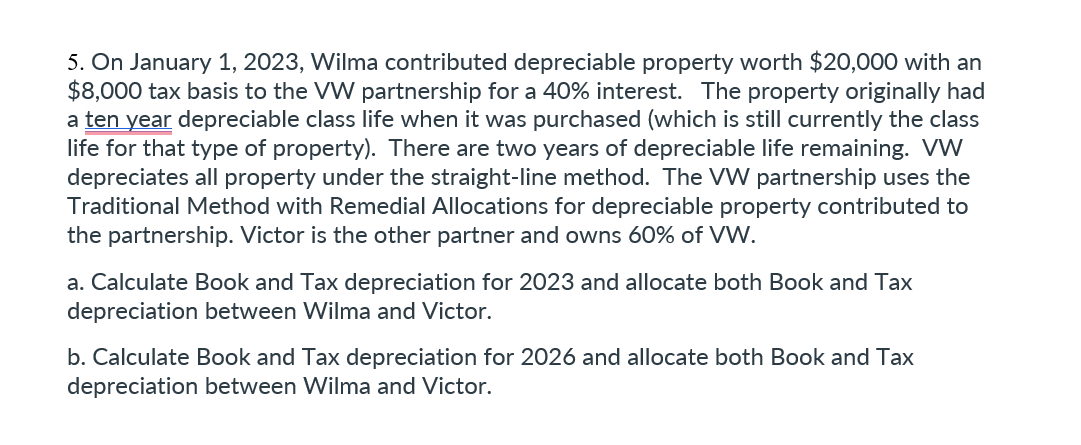

Q5 Please show the details of the answers 5. On January 1,2023 , Wilma contributed depreciable property worth $20,000 with an $8,000 tax basis to

Q5 Please show the details of the answers

5. On January 1,2023 , Wilma contributed depreciable property worth $20,000 with an $8,000 tax basis to the VW partnership for a 40% interest. The property originally had a ten year depreciable class life when it was purchased (which is still currently the class life for that type of property). There are two years of depreciable life remaining. VW depreciates all property under the straight-line method. The VW partnership uses the Traditional Method with Remedial Allocations for depreciable property contributed to the partnership. Victor is the other partner and owns 60% of VW. a. Calculate Book and Tax depreciation for 2023 and allocate both Book and Tax depreciation between Wilma and Victor. b. Calculate Book and Tax depreciation for 2026 and allocate both Book and Tax depreciation between Wilma and VictorStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started