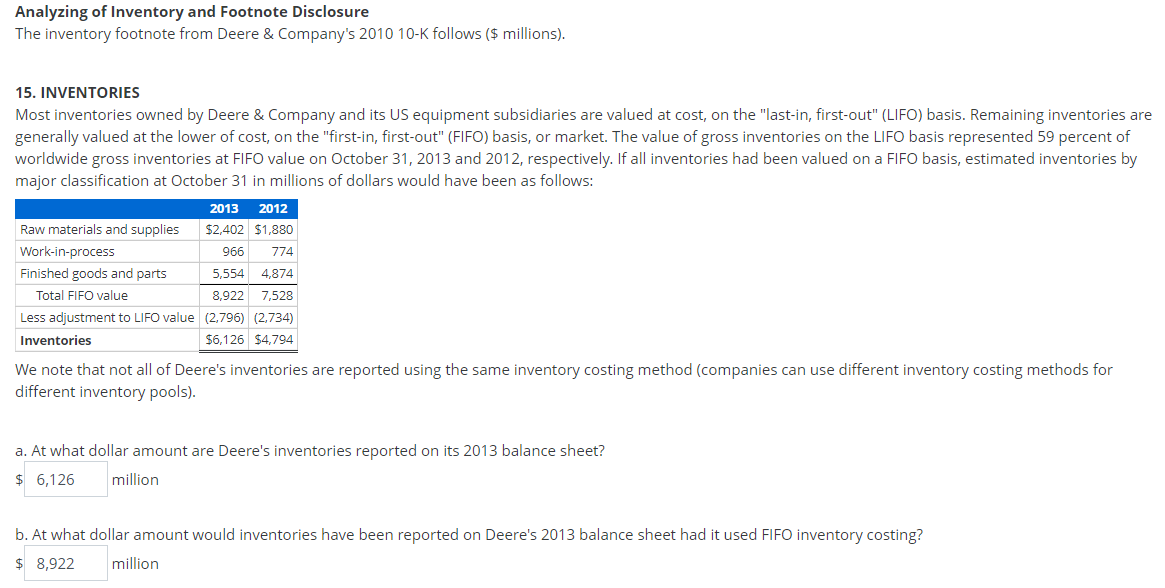

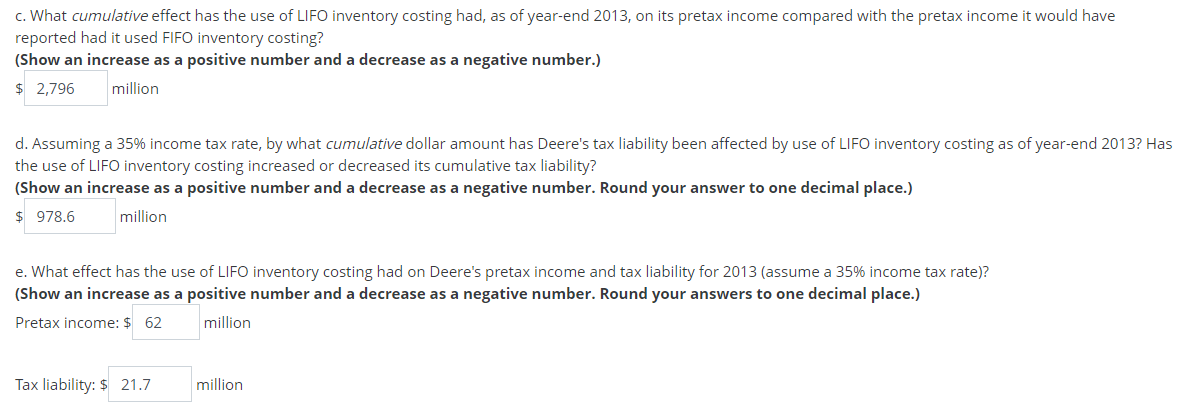

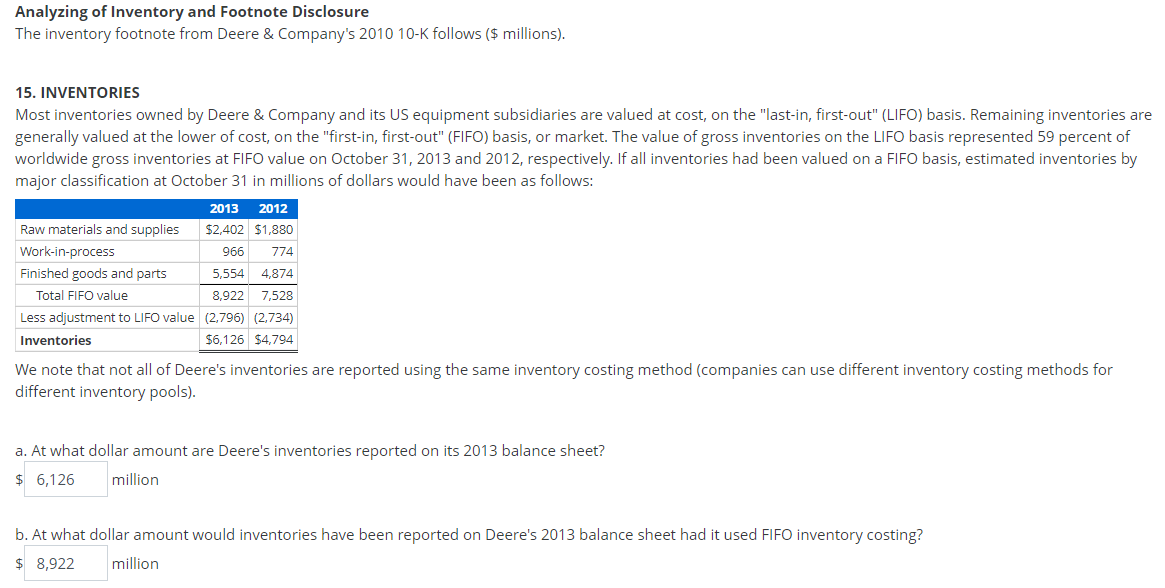

Analyzing of Inventory and Footnote Disclosure The inventory footnote from Deere & Company's 2010 10-K follows ($ millions). 15. INVENTORIES Most inventories owned by Deere & Company and its US equipment subsidiaries are valued at cost, on the "last-in, first-out" (LIFO) basis. Remaining inventories are generally valued at the lower of cost, on the "first-in, first-out" (FIFO) basis, or market. The value of gross inventories on the LIFO basis represented 59 percent of worldwide gross inventories at FIFO value on October 31, 2013 and 2012, respectively. If all inventories had been valued on a FIFO basis, estimated inventories by major classification at October 31 in millions of dollars would have been as follows: 2013 2012 Raw materials and supplies $2,402 $1,880 Work-in-process 966 774 Finished goods and parts 5,554 4,874 Total FIFO value 8,922 7,528 Less adjustment to LIFO value (2,796) (2,734) Inventories $6,126 $4,794 We note that not all of Deere's inventories are reported using the same inventory costing method (companies can use different inventory costing methods for different inventory pools). a. At what dollar amount are Deere's inventories reported on its 2013 balance sheet? $ 6,126 million b. At what dollar amount would inventories have been reported on Deere's 2013 balance sheet had it used FIFO inventory costing? $ 8,922 million c. What cumulative effect has the use of LIFO inventory costing had, as of year-end 2013, on its pretax income compared with the pretax income it would have reported had it used FIFO inventory costing? (Show an increase as a positive number and a decrease as a negative number.) $ 2,796 million d. Assuming a 35% income tax rate, by what cumulative dollar amount has Deere's tax liability been affected by use of LIFO inventory costing as of year-end 2013? Has the use of LIFO inventory costing increased or decreased its cumulative tax liability? (Show an increase as a positive number and a decrease as a negative number. Round your answer to one decimal place.) $ 978.6 million e. What effect has the use of LIFO inventory costing had on Deere's pretax income and tax liability for 2013 (assume a 35% income tax rate)? (Show an increase as a positive number and a decrease as a negative number. Round your answers to one decimal place.) Pretax income: $ 62 million Tax liability: $ 21.7 million Analyzing of Inventory and Footnote Disclosure The inventory footnote from Deere & Company's 2010 10-K follows ($ millions). 15. INVENTORIES Most inventories owned by Deere & Company and its US equipment subsidiaries are valued at cost, on the "last-in, first-out" (LIFO) basis. Remaining inventories are generally valued at the lower of cost, on the "first-in, first-out" (FIFO) basis, or market. The value of gross inventories on the LIFO basis represented 59 percent of worldwide gross inventories at FIFO value on October 31, 2013 and 2012, respectively. If all inventories had been valued on a FIFO basis, estimated inventories by major classification at October 31 in millions of dollars would have been as follows: 2013 2012 Raw materials and supplies $2,402 $1,880 Work-in-process 966 774 Finished goods and parts 5,554 4,874 Total FIFO value 8,922 7,528 Less adjustment to LIFO value (2,796) (2,734) Inventories $6,126 $4,794 We note that not all of Deere's inventories are reported using the same inventory costing method (companies can use different inventory costing methods for different inventory pools). a. At what dollar amount are Deere's inventories reported on its 2013 balance sheet? $ 6,126 million b. At what dollar amount would inventories have been reported on Deere's 2013 balance sheet had it used FIFO inventory costing? $ 8,922 million c. What cumulative effect has the use of LIFO inventory costing had, as of year-end 2013, on its pretax income compared with the pretax income it would have reported had it used FIFO inventory costing? (Show an increase as a positive number and a decrease as a negative number.) $ 2,796 million d. Assuming a 35% income tax rate, by what cumulative dollar amount has Deere's tax liability been affected by use of LIFO inventory costing as of year-end 2013? Has the use of LIFO inventory costing increased or decreased its cumulative tax liability? (Show an increase as a positive number and a decrease as a negative number. Round your answer to one decimal place.) $ 978.6 million e. What effect has the use of LIFO inventory costing had on Deere's pretax income and tax liability for 2013 (assume a 35% income tax rate)? (Show an increase as a positive number and a decrease as a negative number. Round your answers to one decimal place.) Pretax income: $ 62 million Tax liability: $ 21.7 million