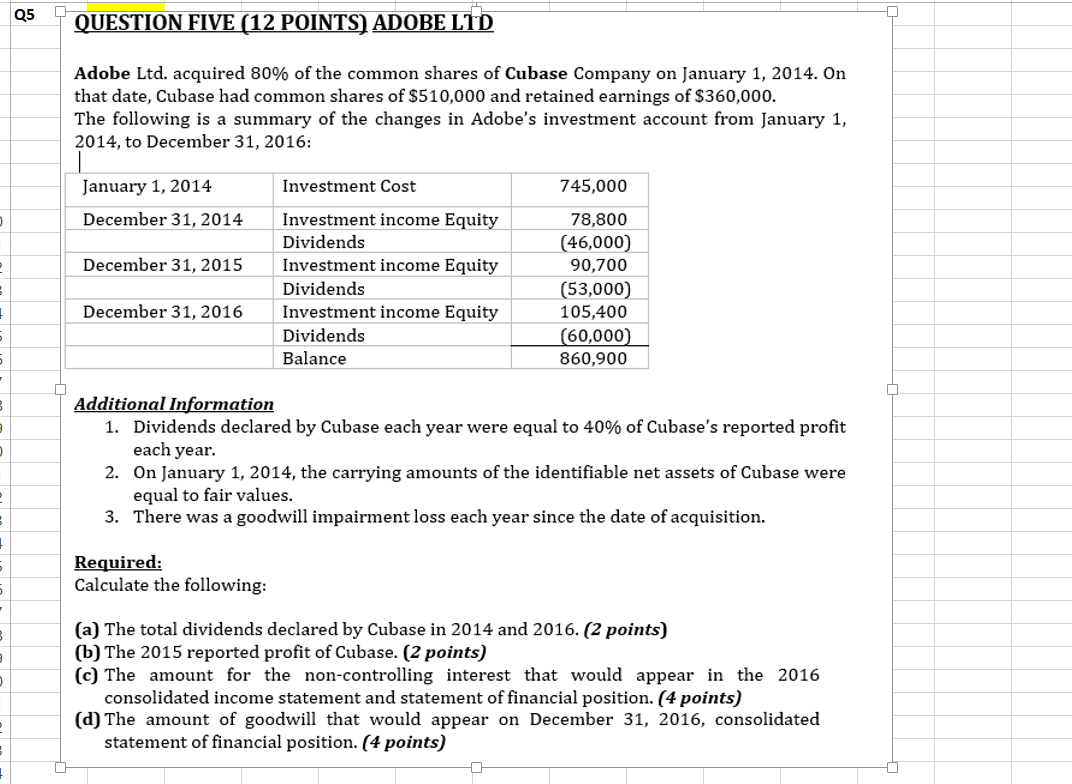

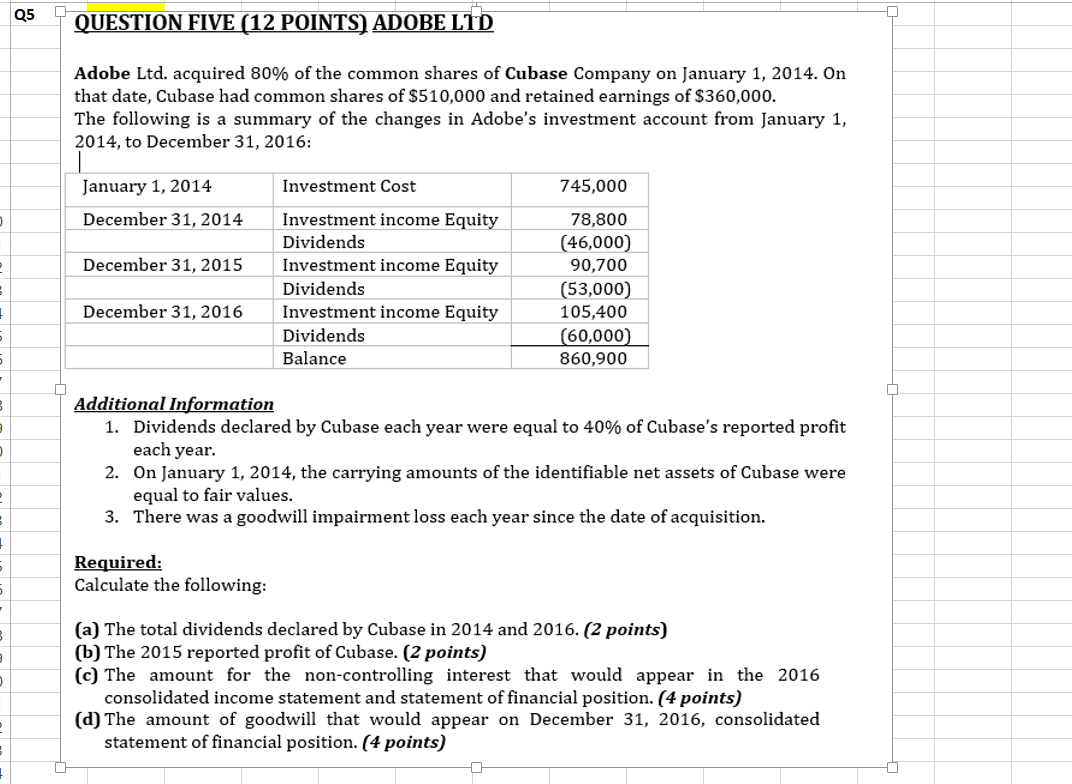

Q5 QUESTION FIVE (12 POINTS) ADOBE LTD Adobe Ltd. acquired 80% of the common shares of Cubase Company on January 1, 2014. On that date, Cubase had common shares of $510,000 and retained earnings of $360,000. The following is a summary of the changes in Adobe's investment account from January 1, 2014, to December 31, 2016: January 1, 2014 Investment Cost 745,000 December 31, 2014 December 31, 2015 Investment income Equity Dividends Investment income Equity Dividends Investment income Equity Dividends Balance 78,800 (46,000) 90,700 (53,000) 105,400 (60,000) 860,900 December 31, 2016 6 n 00 8 Additional Information 1. Dividends declared by Cubase each year were equal to 40% of Cubase's reported profit each year. 2. On January 1, 2014, the carrying amounts of the identifiable net assets of Cubase were equal to fair values. 3. There was a goodwill impairment loss each year since the date of acquisition. Required: Calculate the following: on (a) The total dividends declared by Cubase in 2014 and 2016. (2 points) (b) The 2015 reported profit of Cubase. (2 points) (c) The amount for the non-controlling interest that would appear in the 2016 consolidated income statement and statement of financial position. (4 points) (d) The amount of goodwill that would appear on December 31, 2016, consolidated statement of financial position. (4 points) Q5 QUESTION FIVE (12 POINTS) ADOBE LTD Adobe Ltd. acquired 80% of the common shares of Cubase Company on January 1, 2014. On that date, Cubase had common shares of $510,000 and retained earnings of $360,000. The following is a summary of the changes in Adobe's investment account from January 1, 2014, to December 31, 2016: January 1, 2014 Investment Cost 745,000 December 31, 2014 December 31, 2015 Investment income Equity Dividends Investment income Equity Dividends Investment income Equity Dividends Balance 78,800 (46,000) 90,700 (53,000) 105,400 (60,000) 860,900 December 31, 2016 6 n 00 8 Additional Information 1. Dividends declared by Cubase each year were equal to 40% of Cubase's reported profit each year. 2. On January 1, 2014, the carrying amounts of the identifiable net assets of Cubase were equal to fair values. 3. There was a goodwill impairment loss each year since the date of acquisition. Required: Calculate the following: on (a) The total dividends declared by Cubase in 2014 and 2016. (2 points) (b) The 2015 reported profit of Cubase. (2 points) (c) The amount for the non-controlling interest that would appear in the 2016 consolidated income statement and statement of financial position. (4 points) (d) The amount of goodwill that would appear on December 31, 2016, consolidated statement of financial position. (4 points)