Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q5. Use the following information to answer Q5a, Q5b, Q5c & Q5d. During 2019 Alf Co. constructed a warehouse for its own use. Construction began

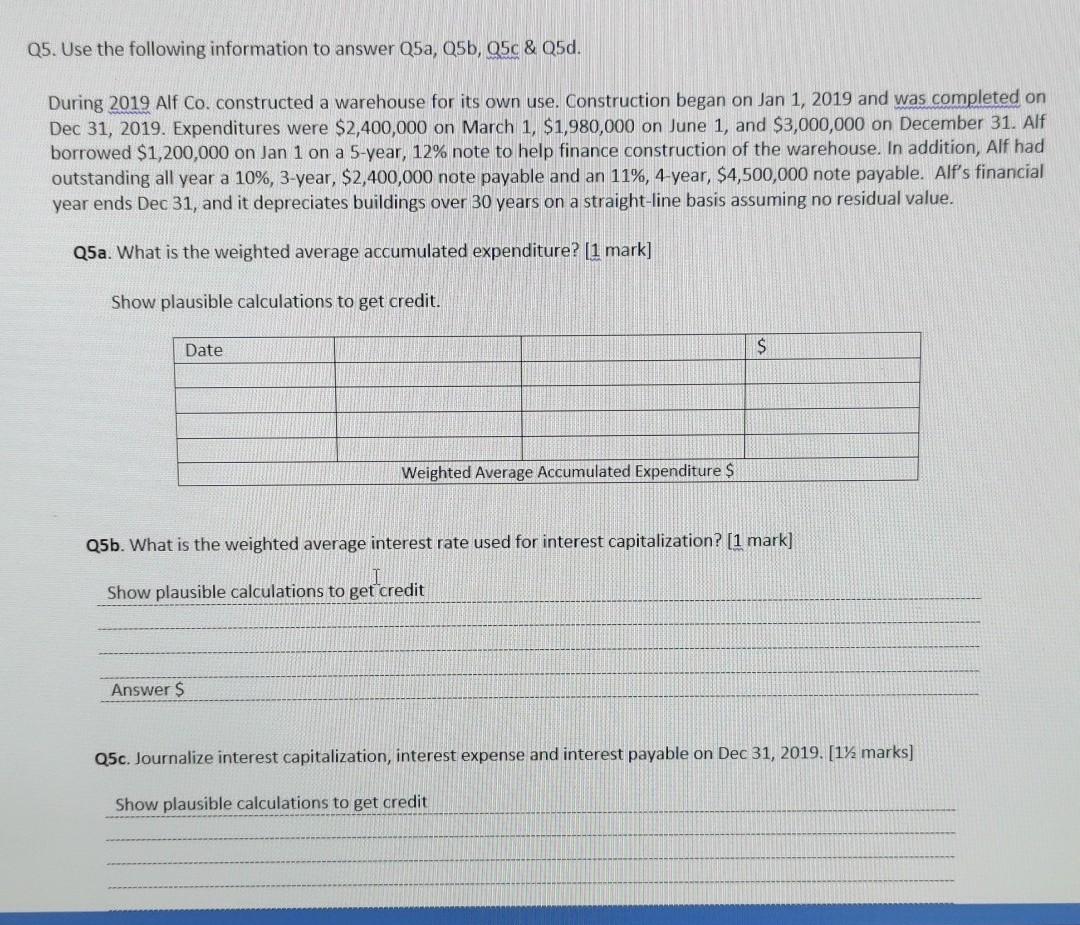

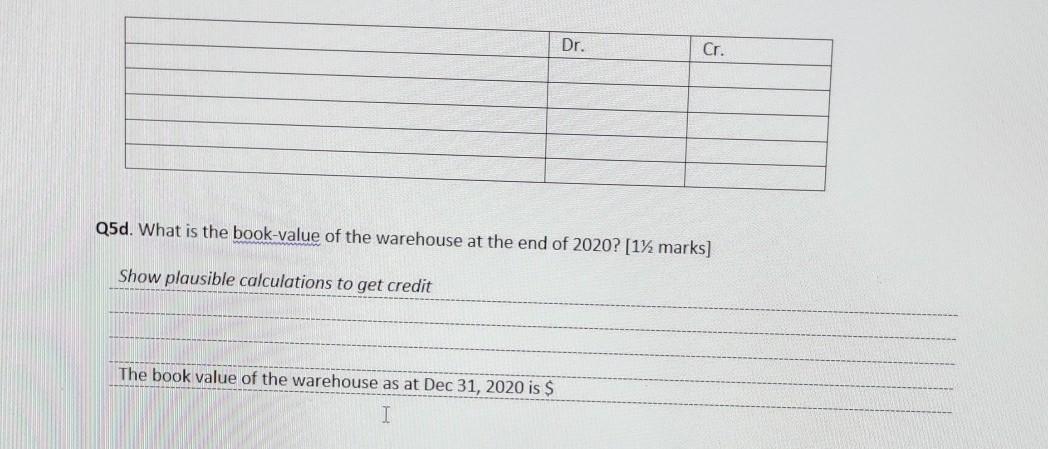

Q5. Use the following information to answer Q5a, Q5b, Q5c & Q5d. During 2019 Alf Co. constructed a warehouse for its own use. Construction began on Jan 1, 2019 and was completed on Dec 31, 2019. Expenditures were $2,400,000 on March 1, $1,980,000 on June 1, and $3,000,000 on December 31. Alf borrowed $1,200,000 on Jan 1 on a 5-year, 12% note to help finance construction of the warehouse. In addition, Alf had outstanding all year a 10%, 3-year, $2,400,000 note payable and an 11%, 4-year, $4,500,000 note payable. Alf's financial year ends Dec 31, and it depreciates buildings over 30 years on a straight-line basis assuming no residual value. Q5a. What is the weighted average accumulated expenditure? [1 mark] Show plausible calculations to get credit. Date $ Weighted Average Accumulated Expenditure $ Q5b. What is the weighted average interest rate used for interest capitalization? [1 mark] Show plausible calculations to get credit Answers Q5c. Journalize interest capitalization, interest expense and interest payable on Dec 31, 2019. [1% marks] Show plausible calculations to get credit Dr. Cr. Q5d. What is the book-value of the warehouse at the end of 2020? [1% marks] Show plausible calculations to get credit The book value of the warehouse as at Dec 31, 2020 is $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started