Q5(b)

Q5(b)

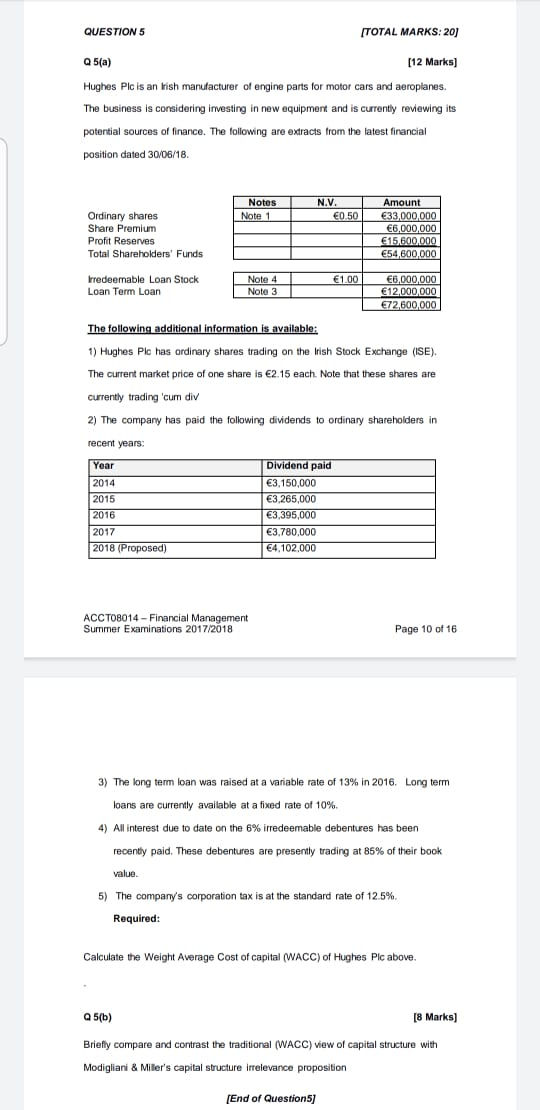

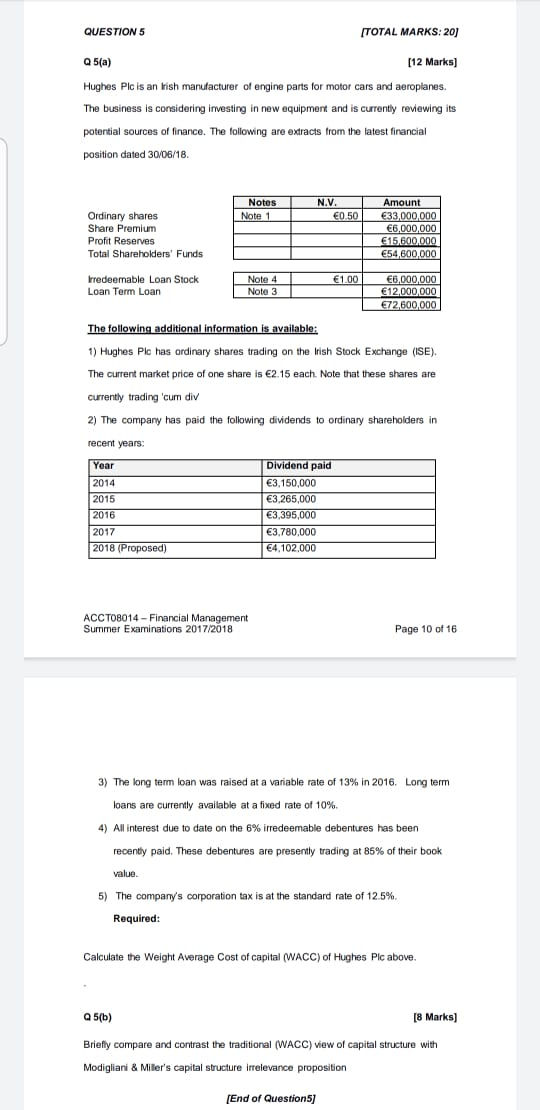

QUESTION 5 [TOTAL MARKS:20) Q5(a) [12 Marks) Hughes Plc is an Irish manufacturer of engine parts for motor cars and aeroplanes. The business is considering investing in new equipment and is currently reviewing its potential sources of finance. The following are extracts from the latest financial position dated 30/06/18. Notes Note 1 N.V. 0.50 Ordinary shares Share Premium Profit Reserves Total Shareholders' Funds Amount 33,000,000 6.000.000 15,600,000 54,600,000 1.00 Irredeemable Loan Stock Loan Term Loan Note 4 Note 3 6,000,000 12,000,000 72,600,000 The following additional information is available: 1) Hughes Plc has ordinary shares trading on the Irish Stock Exchange (ISE). The current market price of one share is 2.15 each. Note that these shares are currently trading 'cum div 2) The company has paid the following dividends to ordinary shareholders in recent years: Year 2014 2015 2016 2017 2018 (Proposed) Dividend paid 3,150,000 3,265,000 3,395,000 3.780,000 4.102,000 ACC TO8014 - Financial Management Summer Examinations 2017/2018 Page 10 of 16 3) The long term loan was raised at a variable rate of 13% in 2016. Long term loans are currently available at a fixed rate of 10% 4) All interest due to date on the 6% irredeemable debentures has been recently paid. These debentures are presently trading at 85% of their book value 5) The company's corporation tax is at the standard rate of 12.5%. Required: Calculate the Weight Average Cost of capital (WACC) of Hughes Plc above. Q5(b) [8 Marks) Briefly compare and contrast the traditional (WACC) view of capital structure with Modigliani & Miller's capital structure irrelevance proposition [End of Questions] QUESTION 5 [TOTAL MARKS:20) Q5(a) [12 Marks) Hughes Plc is an Irish manufacturer of engine parts for motor cars and aeroplanes. The business is considering investing in new equipment and is currently reviewing its potential sources of finance. The following are extracts from the latest financial position dated 30/06/18. Notes Note 1 N.V. 0.50 Ordinary shares Share Premium Profit Reserves Total Shareholders' Funds Amount 33,000,000 6.000.000 15,600,000 54,600,000 1.00 Irredeemable Loan Stock Loan Term Loan Note 4 Note 3 6,000,000 12,000,000 72,600,000 The following additional information is available: 1) Hughes Plc has ordinary shares trading on the Irish Stock Exchange (ISE). The current market price of one share is 2.15 each. Note that these shares are currently trading 'cum div 2) The company has paid the following dividends to ordinary shareholders in recent years: Year 2014 2015 2016 2017 2018 (Proposed) Dividend paid 3,150,000 3,265,000 3,395,000 3.780,000 4.102,000 ACC TO8014 - Financial Management Summer Examinations 2017/2018 Page 10 of 16 3) The long term loan was raised at a variable rate of 13% in 2016. Long term loans are currently available at a fixed rate of 10% 4) All interest due to date on the 6% irredeemable debentures has been recently paid. These debentures are presently trading at 85% of their book value 5) The company's corporation tax is at the standard rate of 12.5%. Required: Calculate the Weight Average Cost of capital (WACC) of Hughes Plc above. Q5(b) [8 Marks) Briefly compare and contrast the traditional (WACC) view of capital structure with Modigliani & Miller's capital structure irrelevance proposition [End of Questions]

Q5(b)

Q5(b)