Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q5Q6 Questions 2 pts What is the value of cell E? (Round to 4 decimal places and do not include the percentage sien. For example.

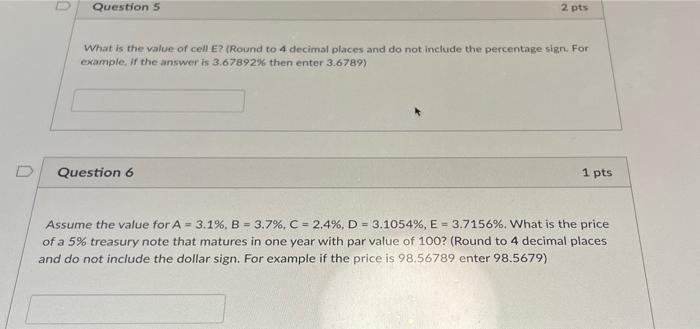

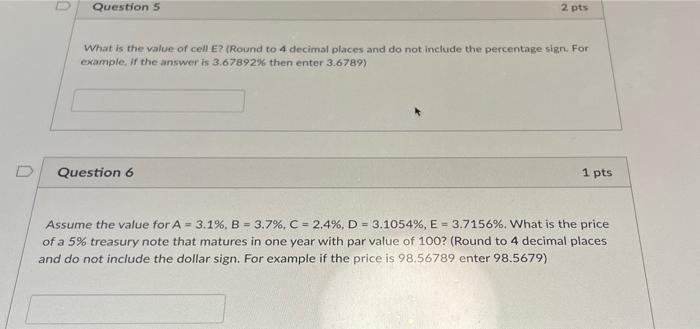

Q5Q6

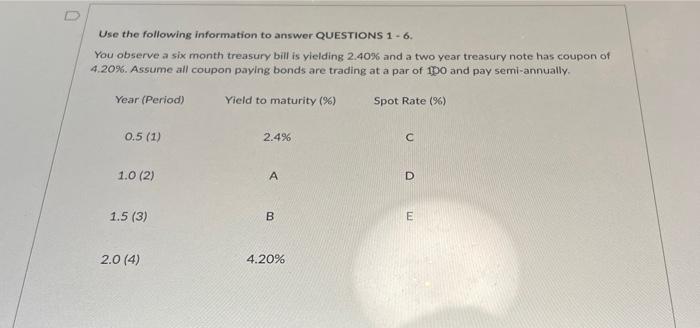

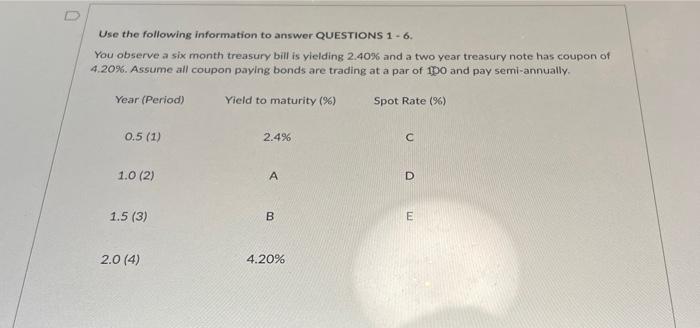

Questions 2 pts What is the value of cell E? (Round to 4 decimal places and do not include the percentage sien. For example. If the answer is 3.67892% then enter 3.6789) Question 6 1 pts Assume the value for A = 3.1%, B = 3.7%, C = 2.4%, D = 3.1054%, E = 3.7156%. What is the price of a 5% treasury note that matures in one year with par value of 100? (Round to 4 decimal places and do not include the dollar sign. For example if the price is 98.56789 enter 98.5679) U Use the following information to answer QUESTIONS 1 - 6. You observe a six month treasury bill is yielding 2.40% and a two year treasury note has coupon of 4.20%. Assume all coupon paying bonds are trading at a par of 100 and pay semi-annually. Year (Period) Yield to maturity (%) Spot Rate (96) 0.5 (1) 2.4% 1.0 (2) D 1.5 (3) B E 2.0 (4) 4.20% Questions 2 pts What is the value of cell E? (Round to 4 decimal places and do not include the percentage sien. For example. If the answer is 3.67892% then enter 3.6789) Question 6 1 pts Assume the value for A = 3.1%, B = 3.7%, C = 2.4%, D = 3.1054%, E = 3.7156%. What is the price of a 5% treasury note that matures in one year with par value of 100? (Round to 4 decimal places and do not include the dollar sign. For example if the price is 98.56789 enter 98.5679) U Use the following information to answer QUESTIONS 1 - 6. You observe a six month treasury bill is yielding 2.40% and a two year treasury note has coupon of 4.20%. Assume all coupon paying bonds are trading at a par of 100 and pay semi-annually. Year (Period) Yield to maturity (%) Spot Rate (96) 0.5 (1) 2.4% 1.0 (2) D 1.5 (3) B E 2.0 (4) 4.20%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started