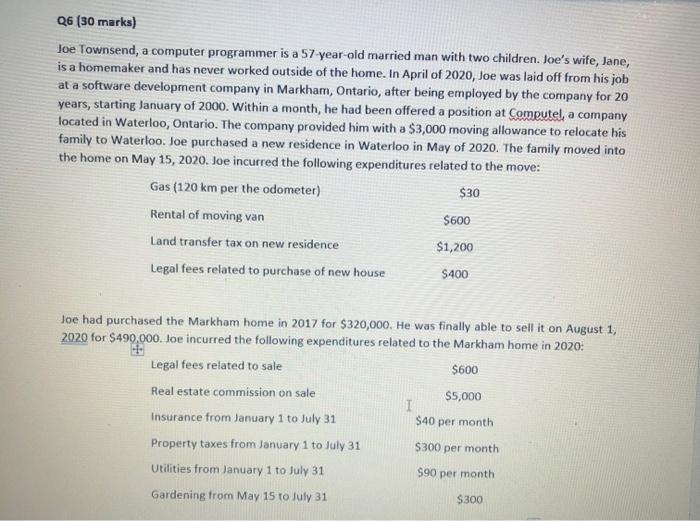

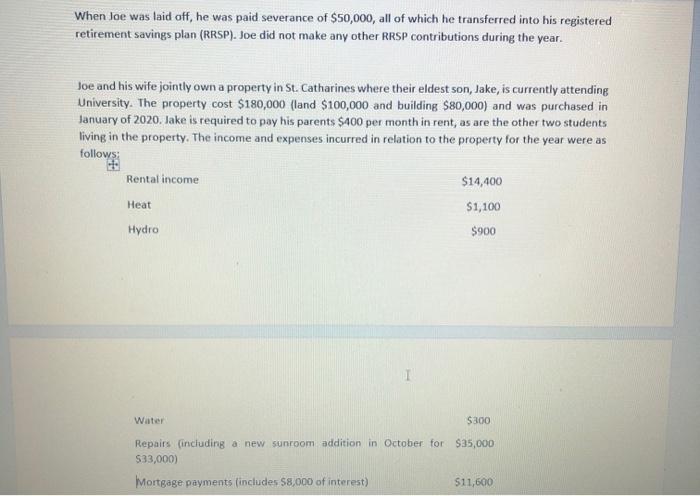

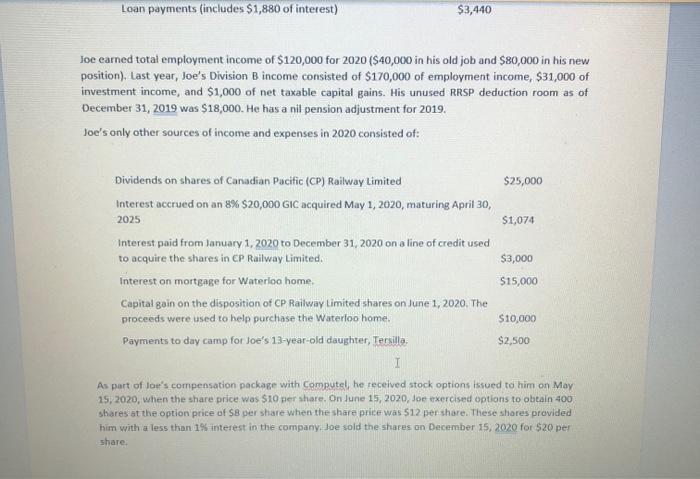

Q6 (30 marks) Joe Townsend, a computer programmer is a 57 year-old married man with two children. Joe's wife, Jane, is a homemaker and has never worked outside of the home. In April of 2020, Joe was laid off from his job at a software development company in Markham, Ontario, after being employed by the company for 20 years, starting January of 2000. Within a month, he had been offered a position at Computel, a company located in Waterloo, Ontario. The company provided him with a $3,000 moving allowance to relocate his family to Waterloo. Joe purchased a new residence in Waterloo in May of 2020. The family moved into the home on May 15, 2020. Joe incurred the following expenditures related to the move: Gas (120 km per the odometer) $30 Rental of moving van $600 Land transfer tax on new residence $1,200 Legal fees related to purchase of new house $400 Joe had purchased the Markham home in 2017 for $320,000. He was finally able to sell it on August 1, 2020 for $490,000. Joe incurred the following expenditures related to the Markham home in 2020: Legal fees related to sale $600 Real estate commission on sale $5,000 I Insurance from January 1 to July 31 $40 per month Property taxes from January 1 to July 31 $300 per month Utilities from January 1 to July 31 S90 per month Gardening from May 15 to July 31 $300 When Joe was laid off, he was paid severance of $50,000, all of which he transferred into his registered retirement savings plan (RRSP). Joe did not make any other RRSP contributions during the year. Joe and his wife jointly own a property in St. Catharines where their eldest son, Jake, is currently attending University. The property cost $180,000 (land $100,000 and building $80,000) and was purchased in January of 2020. Jake is required to pay his parents $400 per month in rent, as are the other two students living in the property. The income and expenses incurred in relation to the property for the year were as follows: Rental income $14,400 Heat $1,100 $900 Hydro I Water S300 Repairs (including a new sunroom addition in October for $35,000 $33,000) Mortgage payments (includes $8,000 of interest) $11,600 Loan payments (includes $1,880 of interest) $3,440 Joe earned total employment income of $120,000 for 2020 ($40,000 in his old job and $80,000 in his new position). Last year, Joe's Division B income consisted of $170,000 of employment income, $31,000 of investment income, and $1,000 of net taxable capital gains. His unused RRSP deduction room as of December 31, 2019 was $18,000. He has a nil pension adjustment for 2019. Joe's only other sources of income and expenses in 2020 consisted of: Dividends on shares of Canadian Pacific (CP) Railway Limited $25,000 Interest accrued on an 8% $20,000 GIC acquired May 1, 2020, maturing April 30, 2025 $1,074 Interest paid from January 1, 2020 to December 31, 2020 on a line of credit used to acquire the shares in CP Railway Limited. $3,000 Interest on mortgage for Waterloo home. $15,000 Capital gain on the disposition of CP Railway Limited shares on June 1, 2020. The proceeds were used to help purchase the Waterloo home $10,000 Payments to day camp for Joe's 13-year-old daughter, Tecsilla, $2,500 I As part of Joe's compensation package with Computel, he received stock options issued to him on May 15, 2020, when the share price was $10 per sharer. On June 15, 2020, Joe exercised options to obtain 400 shares at the option price of $B per share when the share price was 512 per share. These shares provided him with a less than 1% interest in the company, Joe sold the shares on December 15, 2020 for $20 per share Q6 (30 marks) Joe Townsend, a computer programmer is a 57 year-old married man with two children. Joe's wife, Jane, is a homemaker and has never worked outside of the home. In April of 2020, Joe was laid off from his job at a software development company in Markham, Ontario, after being employed by the company for 20 years, starting January of 2000. Within a month, he had been offered a position at Computel, a company located in Waterloo, Ontario. The company provided him with a $3,000 moving allowance to relocate his family to Waterloo. Joe purchased a new residence in Waterloo in May of 2020. The family moved into the home on May 15, 2020. Joe incurred the following expenditures related to the move: Gas (120 km per the odometer) $30 Rental of moving van $600 Land transfer tax on new residence $1,200 Legal fees related to purchase of new house $400 Joe had purchased the Markham home in 2017 for $320,000. He was finally able to sell it on August 1, 2020 for $490,000. Joe incurred the following expenditures related to the Markham home in 2020: Legal fees related to sale $600 Real estate commission on sale $5,000 I Insurance from January 1 to July 31 $40 per month Property taxes from January 1 to July 31 $300 per month Utilities from January 1 to July 31 S90 per month Gardening from May 15 to July 31 $300 When Joe was laid off, he was paid severance of $50,000, all of which he transferred into his registered retirement savings plan (RRSP). Joe did not make any other RRSP contributions during the year. Joe and his wife jointly own a property in St. Catharines where their eldest son, Jake, is currently attending University. The property cost $180,000 (land $100,000 and building $80,000) and was purchased in January of 2020. Jake is required to pay his parents $400 per month in rent, as are the other two students living in the property. The income and expenses incurred in relation to the property for the year were as follows: Rental income $14,400 Heat $1,100 $900 Hydro I Water S300 Repairs (including a new sunroom addition in October for $35,000 $33,000) Mortgage payments (includes $8,000 of interest) $11,600 Loan payments (includes $1,880 of interest) $3,440 Joe earned total employment income of $120,000 for 2020 ($40,000 in his old job and $80,000 in his new position). Last year, Joe's Division B income consisted of $170,000 of employment income, $31,000 of investment income, and $1,000 of net taxable capital gains. His unused RRSP deduction room as of December 31, 2019 was $18,000. He has a nil pension adjustment for 2019. Joe's only other sources of income and expenses in 2020 consisted of: Dividends on shares of Canadian Pacific (CP) Railway Limited $25,000 Interest accrued on an 8% $20,000 GIC acquired May 1, 2020, maturing April 30, 2025 $1,074 Interest paid from January 1, 2020 to December 31, 2020 on a line of credit used to acquire the shares in CP Railway Limited. $3,000 Interest on mortgage for Waterloo home. $15,000 Capital gain on the disposition of CP Railway Limited shares on June 1, 2020. The proceeds were used to help purchase the Waterloo home $10,000 Payments to day camp for Joe's 13-year-old daughter, Tecsilla, $2,500 I As part of Joe's compensation package with Computel, he received stock options issued to him on May 15, 2020, when the share price was $10 per sharer. On June 15, 2020, Joe exercised options to obtain 400 shares at the option price of $B per share when the share price was 512 per share. These shares provided him with a less than 1% interest in the company, Joe sold the shares on December 15, 2020 for $20 per share