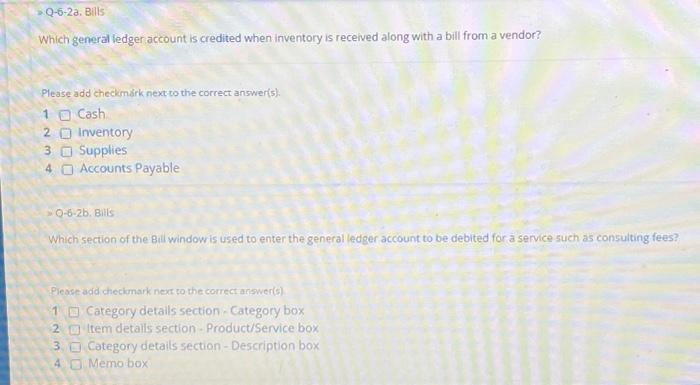

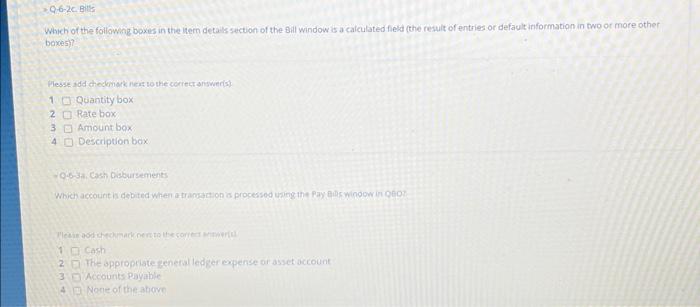

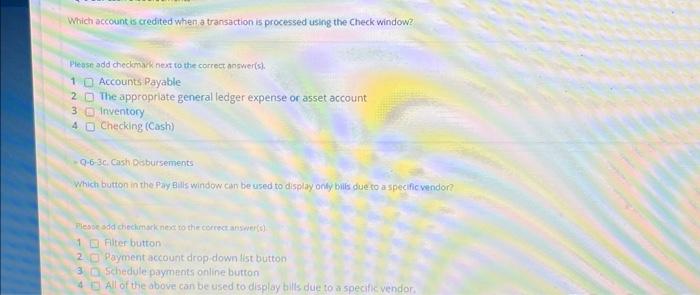

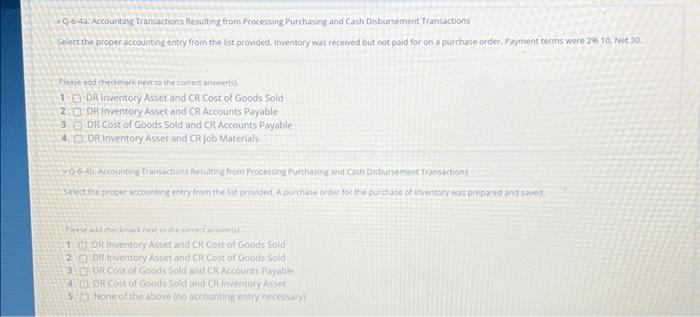

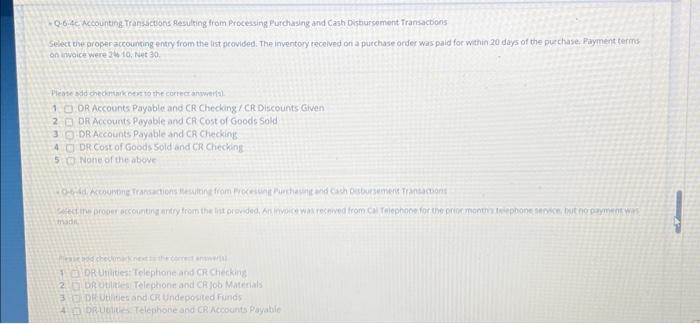

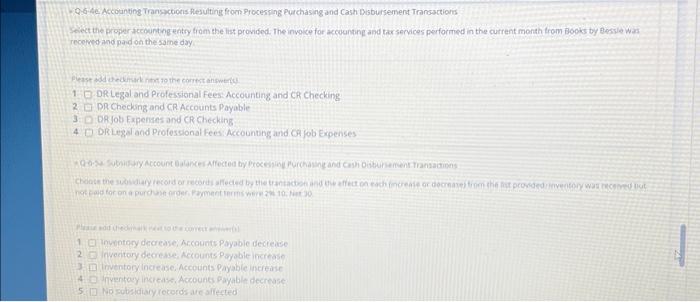

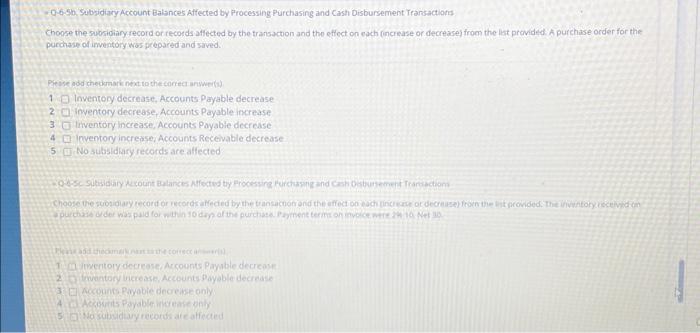

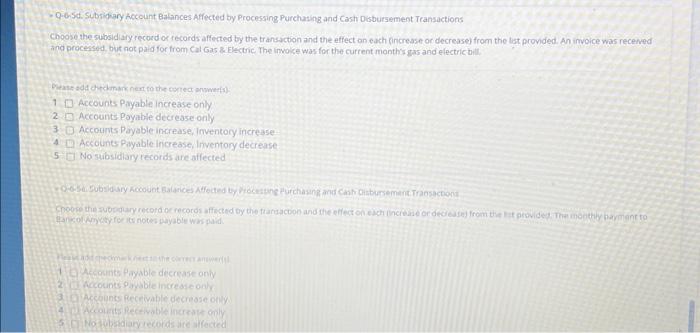

Q-6-2a. Bills Which general ledger account is credited when inventory is received along with a bill from a vendor? Please add checkmark next to the correct answer(s). \begin{tabular}{l|l} 1 & Cash \\ \hline 2 & Inventory \\ 3 & Supplies \\ \hline 4 & Accounts Payable \end{tabular} Q-6-2b, Bils Which section of the Bill window is used to enter the general ledger account to be debited for a service such as consulting fees? Piease add checkmark next to the correct answer(s) 1 Category details section - Category box 2 Item details section - Product/Service box 3 Category details section - Description box 4 Memobox Which of the followngt boxes in the itern detais section of the sill window is a calculated field cthe result of entries or default information in two or more other boxes)? Hesse add thedmak neis to the correct answeris). 1 Quantity box 2 Rate box 3 Amount box: 4 Descripuon box 1 Cash 2. The spproptate seneral ledger expense or asset account 3. Accounts Payabie 4. Norle of the ationn Which account is credited when a transaction is processed using the Check window? Please add checkmaik next to the correct noswer(s). 1 Accounts Payable 2 The approprlate general ledger expense or asset account 3 inventory 4 Checking (Cash) - Q-6-3c. Cash Qsbursements Which button in the Pay fllls window can be used to display only bils due to a specific vendor? Thesse sid checlimarknest to the correct answer(s) 1 Piter button 2 Payment account drop down tist button 3. Schedule payments online button 4 All of the above can be used to display bils due to a specifk vendor. 2-6-4a Accounting Transactions Hesulting from Processang Purchasing and Cash Disbursement Transactions Select the proper accounting entry from the fist provided, Inventory was received but not paid for on a purchase order. Fayment terms were 2 \% 10 , Net 30. Qlease rdd chechmerk pect to the concet antweits?: 1 DRimentory Asset and CR Cost of Goods Sold 2. DR inventory Asset and CR Accounts Payable 3 DR Cost of Goods Sold and CR Accounts Payable 4. DR inventory Asser and CR job Matertals 1 DR. inventory Asset and CR Cost of Goods Sold 2. DR inventery Asset and CR Cost of Goods Sold 33 DR Cost of Geds 5old and CR Arcounts PAyahle 44 PR Costor Goodn 5oid arud CRInventory Asset - Q.6.4C Accounting Transactons Resulting from Processing Purchasing and Cash Ostiursement fransactons Sehkt vie proper accounting entry from the list pecovided: The imventory received on a purchase order was paid for within 20 days of the puzchase. Payment terms on involce were 240 10, Net 30 . 1. OR Accounts Payoble and CR Checking/CR Discounts Given 2 DR Accounts Payable and CR Cost of Goods Sold 3. DR Accounts Payable and CR Checking. 4 DRCost of Goods Sold and CR Checking 5. Nane of the abeve 1. DR Undiest Telephone and CR checkines 2. brehtimes Teleptione and CR yob Materials 3. Dis Utilies and or Undeposited Funds Select the proper accountngentry trom the list provided. The invoice for accounting and tax services performed in the current month trom Bocks by Bessle was receoved and pad on the same day Pleast add atedimark hat to the correst anpwerty. 1 DR Legal and Professional Fees: Accounting and CR Checking 2. PR Checking and CR Accounts Payable 3. DR job Fxpenses and CR Checking 4. DRLegal and Professional Fees: Accounting and CA fob Expenses 1 Inupotory decrease; Arcounts Payabie decreise 2 - fiventary decreme, Accounts Payable increas? 13. Irventocyincrease. Accounts Payable increse 4 inyentary increass. Accounts Payable decrease 5. No subsidiary records ave affected - Q-6.5b, Subsidiary Account Balances Affected by Processing Purchasing and Cash Disbursement Transactions Chonse the subsiolary record or records affected by the transactoon and the effect on each increase or decrease) from the lat provided A purchase order for the purchase of imentory was prepared and saved. Pesise add chedimark next to the correct anwer(d) 1 Inventory decrease, Accounts Payable decrease 2. inventory decrease, Accounts Payable increase 3 Irventory increase, Accounts Poyabie decrease 4. Inventory increase, Accounts Recelvable decrease 5 No subsidary records are affected 1 imentorydecrese. Arcounts Paysble decreas 22 montory increase, Accepunts Paypble decrease 3. Accountr. Rayabie decreise only - Q-6.5ct. Subsidary Account Balances Affected by Processing Purchasing and Cash Disbursement Transactions Choose the subsidiary record or fecords affected by the transaction and the effect an each (increase or decrease) from the list provided. An invoice was received ing processed, but not paid for from Cal Gas \& Electric. The invoisewas for the current monthr gas and electric bill. 1 Accounts Payable increase only 2 Accounts Poyable decrease only 3. Accounts Payable increase, Inventory increase 4. Acsounts Paysble increase, Inventory decrease 5- No subsidiary iecords are affected Accosints Prable decrease only Accounts 9 ybble incresteonly