Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q7 - PLEASE HELP 7. Jasmine and Laura form the JL limited partnership. Jasmine contributes $20,000 cash for a 20% interest and is the general

Q7 - PLEASE HELP

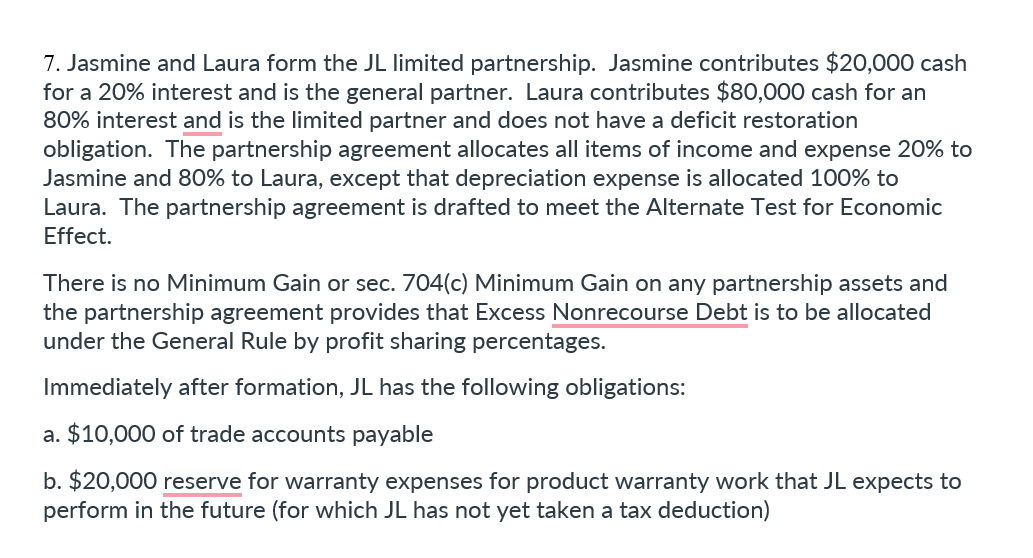

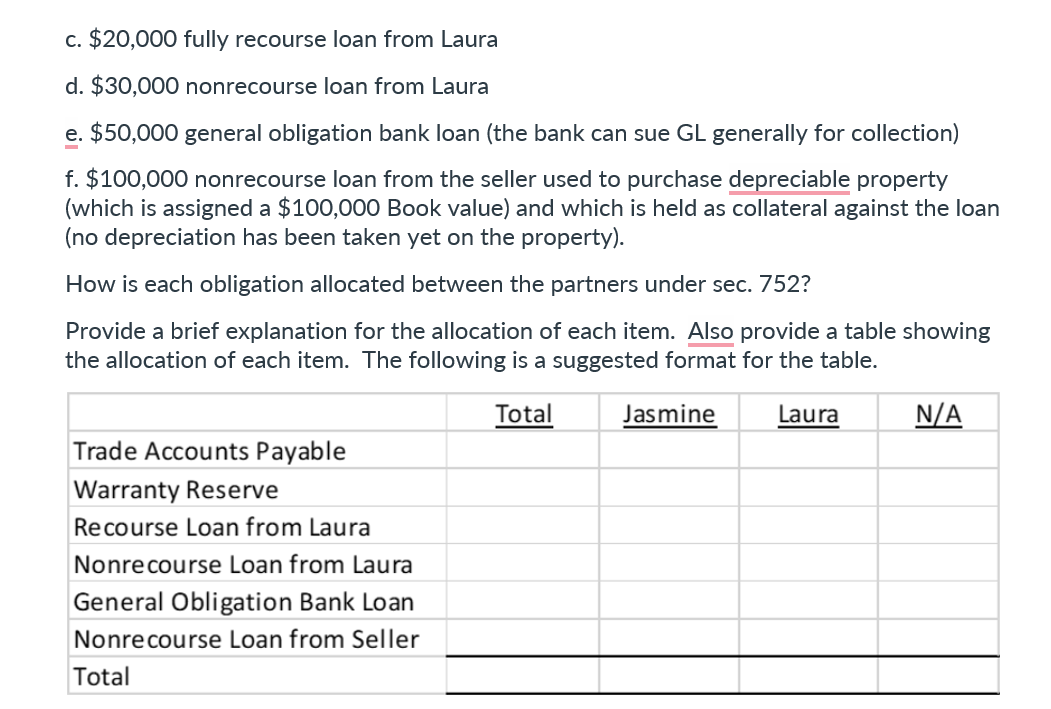

7. Jasmine and Laura form the JL limited partnership. Jasmine contributes $20,000 cash for a 20% interest and is the general partner. Laura contributes $80,000 cash for an 80% interest and is the limited partner and does not have a deficit restoration obligation. The partnership agreement allocates all items of income and expense 20% to Jasmine and 80% to Laura, except that depreciation expense is allocated 100% to Laura. The partnership agreement is drafted to meet the Alternate Test for Economic Effect. There is no Minimum Gain or sec. 704(c) Minimum Gain on any partnership assets and the partnership agreement provides that Excess Nonrecourse Debt is to be allocated under the General Rule by profit sharing percentages. Immediately after formation, JL has the following obligations: a. $10,000 of trade accounts payable b. $20,000 reserve for warranty expenses for product warranty work that JL expects to perform in the future (for which JL has not yet taken a tax deduction) c. $20,000 fully recourse loan from Laura d. $30,000 nonrecourse loan from Laura e. $50,000 general obligation bank loan (the bank can sue GL generally for collection) f. $100,000 nonrecourse loan from the seller used to purchase depreciable property (which is assigned a $100,000 Book value) and which is held as collateral against the loan (no depreciation has been taken yet on the property). How is each obligation allocated between the partners under sec. 752 ? Provide a brief explanation for the allocation of each item. Also provide a table showing the allocation of each item. The following is a suggested format for the tableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started