Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q7. Varun, CEO of Arohan Corporation, has asked his CFO, Tarun, to prepare a valuation of Arohan for the purpose of selling the company

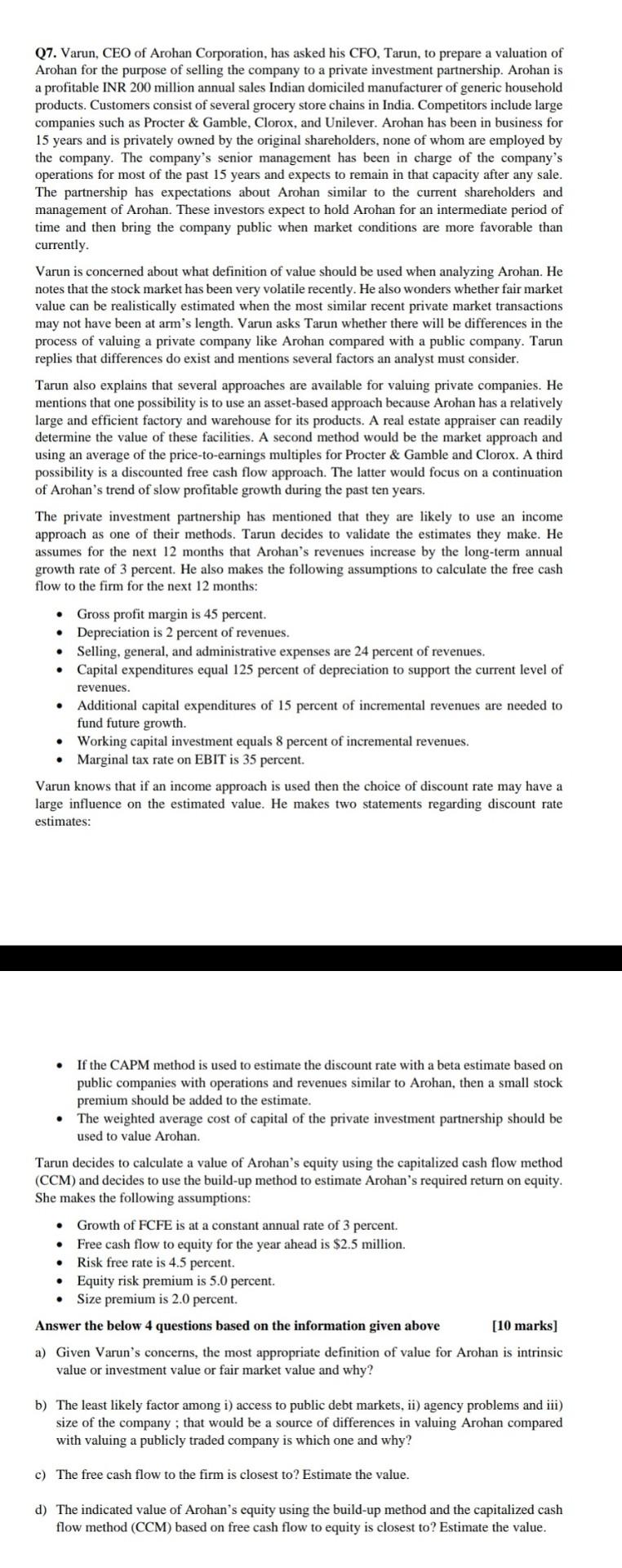

Q7. Varun, CEO of Arohan Corporation, has asked his CFO, Tarun, to prepare a valuation of Arohan for the purpose of selling the company to a private investment partnership. Arohan is a profitable INR 200 million annual sales Indian domiciled manufacturer of generic household products. Customers consist of several grocery store chains in India. Competitors include large companies such as Procter & Gamble, Clorox, and Unilever. Arohan has been in business for 15 years and is privately owned by the original shareholders, none of whom are employed by the company. The company's senior management has been in charge of the company's operations for most of the past 15 years and expects to remain in that capacity after any sale. The partnership has expectations about Arohan similar to the current shareholders and management of Arohan. These investors expect to hold Arohan for an intermediate period of time and then bring the company public when market conditions are more favorable than currently. Varun is concerned about what definition of value should be used when analyzing Arohan. He notes that the stock market has been very volatile recently. He also wonders whether fair market value can be realistically estimated when the most similar recent private market transactions may not have been at arm's length. Varun asks Tarun whether there will be differences in the process of valuing a private company like Arohan compared with a public company. Tarun replies that differences do exist and mentions several factors an analyst must consider. Tarun also explains that several approaches are available for valuing private companies. He mentions that one possibility is to use an asset-based approach because Arohan has a relatively large and efficient factory and warehouse for its products. A real estate appraiser can readily determine the value of these facilities. A second method would be the market approach and using an average of the price-to-earnings multiples for Procter & Gamble and Clorox. A third possibility is a discounted free cash flow approach. The latter would focus on a continuation of Arohan's trend of slow profitable growth during the past ten years. The private investment partnership has mentioned that they are likely to use an income approach as one of their methods. Tarun decides to validate the estimates they make. He assumes for the next 12 months that Arohan's revenues increase by the long-term annual growth rate of 3 percent. He also makes the following assumptions to calculate the free cash flow to the firm for the next 12 months: Gross profit margin is 45 percent. Depreciation is 2 percent of revenues. Selling, general, and administrative expenses are 24 percent of revenues. Capital expenditures equal 125 percent of depreciation to support the current level of revenues. Additional capital expenditures of 15 percent of incremental revenues are needed to fund future growth. Working capital investment equals 8 percent of incremental revenues. Marginal tax rate on EBIT is 35 percent. Varun knows that if an income approach is used then the choice of discount rate may have a large influence on the estimated value. He makes two statements regarding discount rate estimates: If the CAPM method is used to estimate the discount rate with a beta estimate based on public companies with operations and revenues similar to Arohan, then a small stock premium should be added to the estimate. The weighted average cost of capital of the private investment partnership should be used to value Arohan. Tarun decides to calculate a value of Arohan's equity using the capitalized cash flow method (CCM) and decides to use the build-up method to estimate Arohan's required return on equity. She makes the following assumptions: Growth of FCFE is at a constant annual rate of 3 percent. Free cash flow to equity for the year ahead is $2.5 million. Risk free rate is 4.5 percent. Equity risk premium is 5.0 percent. Size premium is 2.0 percent. Answer the below 4 questions based on the information given above [10 marks] a) Given Varun's concerns, the most appropriate definition of value for Arohan is intrinsic value or investment value or fair market value and why? b) The least likely factor among i) access to public debt markets, ii) agency problems and iii) size of the company; that would be a source of differences in valuing Arohan compared with valuing a publicly traded company is which one and why? c) The free cash flow to the firm is closest to? Estimate the value. d) The indicated value of Arohan's equity using the build-up method and the capitalized cash flow method (CCM) based on free cash flow to equity is closest to? Estimate the value.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started