Q7 Written answer within 2hours plz

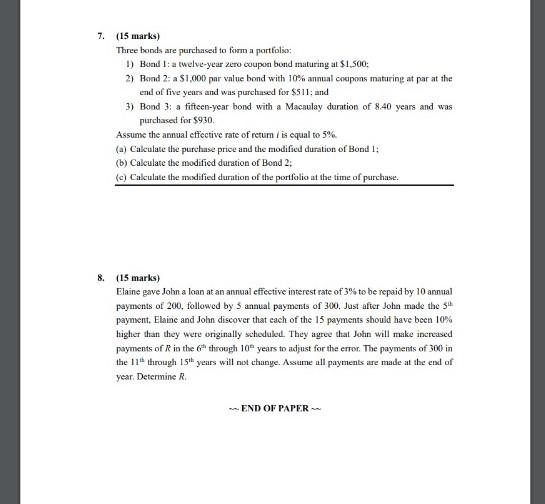

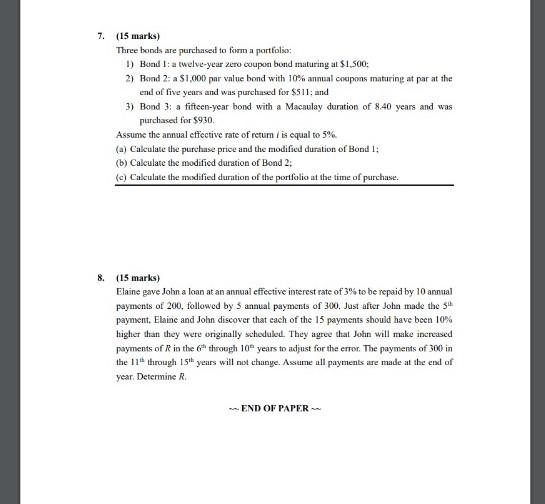

7. (15 marks) Three bonds are purchased to form a portfolio: 1) Bund 1: a twelve-year zero coupon bond maturing at $1.500: 2) Rond 2: a $1,000 par value bond with 10% annual coupons maturing at par at the end of five years and was purchased for $511; and 3) Bond 3: a fifteen-year bond with a Macaulay duration of 8.40 years and was purchased for $950 Assume the annual effective rate of retum is equal to 5% (a) Caleulate the purchase price and the modified duration of Bond 1: (b) Calculate the modified duration of Bond 2: (c) Calculate the manified duration of the portfolio at the time of purchase. 8. (15 marks) Elaine gave John a loan at an annual effective interest rate of 3% to be repaid by 10 annual payments of 200, followed by 5 annual payments of 300. Just after John made the 5 payment, Elaine and John discover that each of the 15 payments should have been 10% higher than they were originally scheduled. They agree that John will make increased payments of R in the through 10 years to adjust for the error. The payments of 300 in the 11 through 15 years will not chunye. Assume all payments are made at the end of year. Determine R END OF PAPER 7. (15 marks) Three bonds are purchased to form a portfolio: 1) Bund 1: a twelve-year zero coupon bond maturing at $1.500: 2) Rond 2: a $1,000 par value bond with 10% annual coupons maturing at par at the end of five years and was purchased for $511; and 3) Bond 3: a fifteen-year bond with a Macaulay duration of 8.40 years and was purchased for $950 Assume the annual effective rate of retum is equal to 5% (a) Caleulate the purchase price and the modified duration of Bond 1: (b) Calculate the modified duration of Bond 2: (c) Calculate the manified duration of the portfolio at the time of purchase. 8. (15 marks) Elaine gave John a loan at an annual effective interest rate of 3% to be repaid by 10 annual payments of 200, followed by 5 annual payments of 300. Just after John made the 5 payment, Elaine and John discover that each of the 15 payments should have been 10% higher than they were originally scheduled. They agree that John will make increased payments of R in the through 10 years to adjust for the error. The payments of 300 in the 11 through 15 years will not chunye. Assume all payments are made at the end of year. Determine R END OF PAPER