Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q7:7 Given A B C D E F G H I J The Valley Plant of Patton Supply manufactures a single product. The standard cost

Q7:7

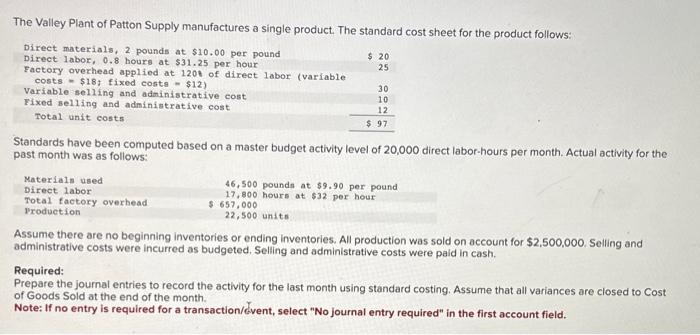

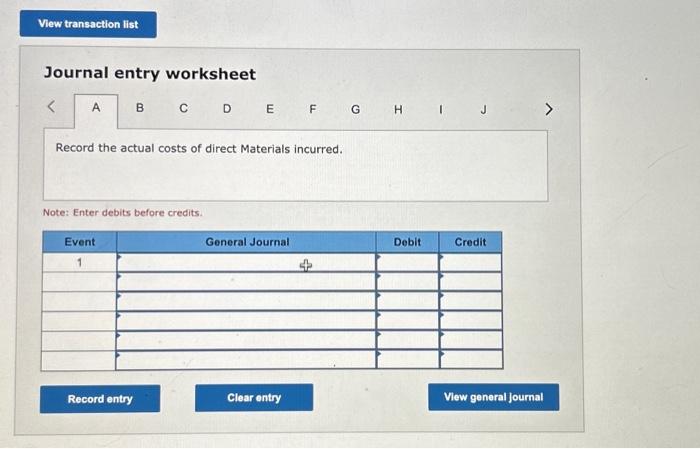

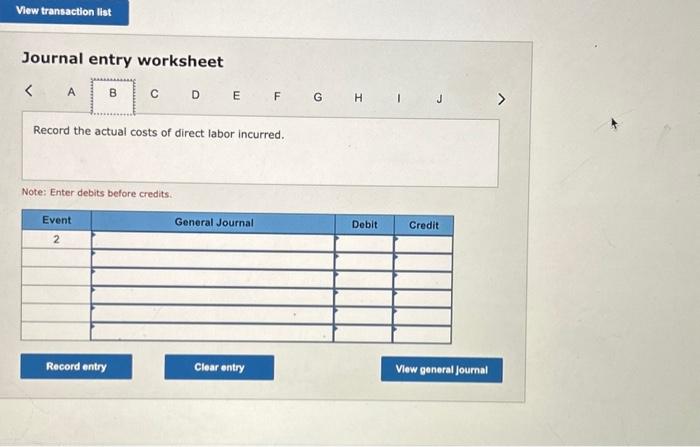

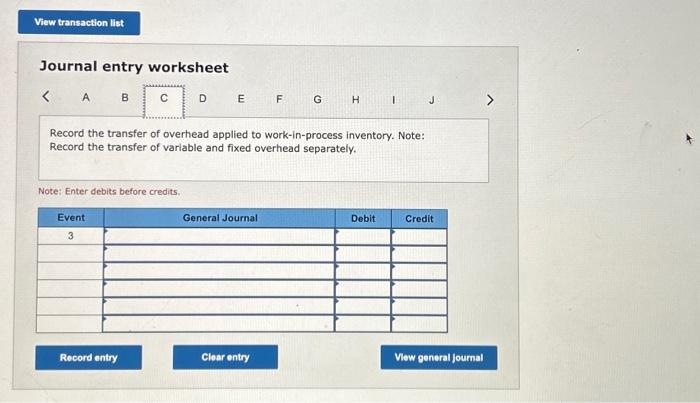

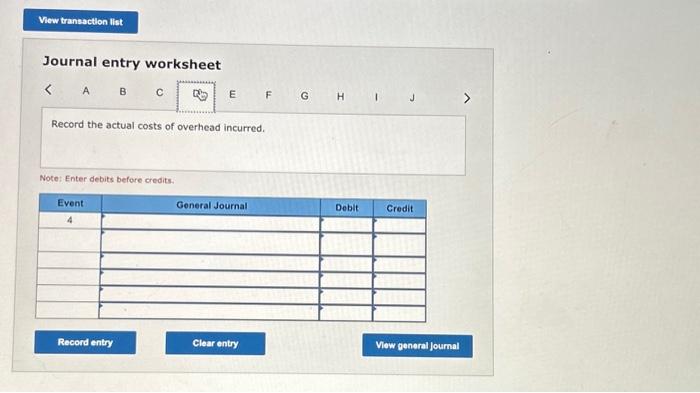

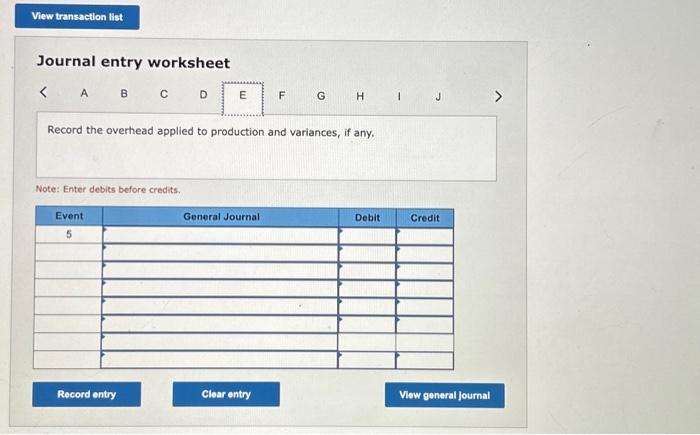

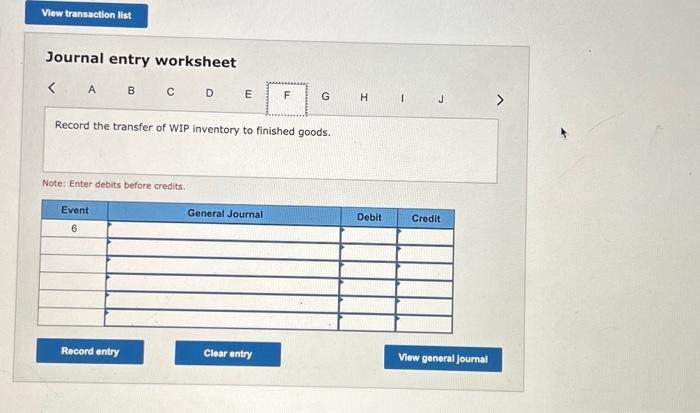

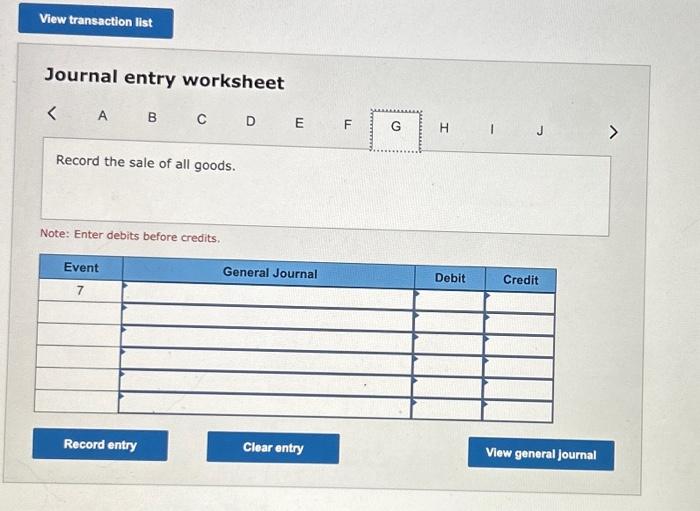

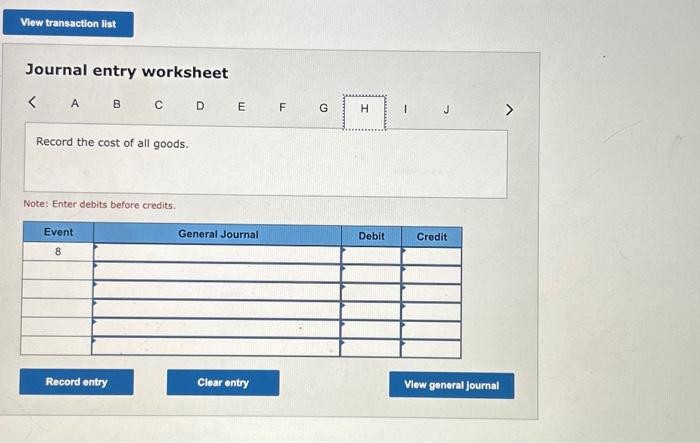

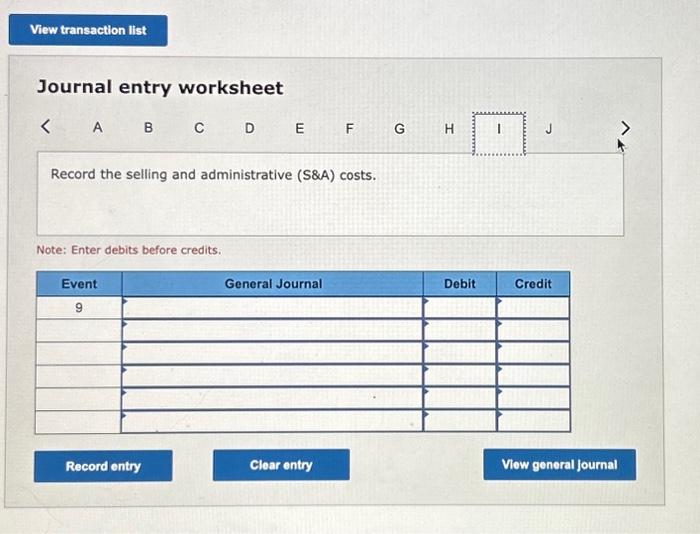

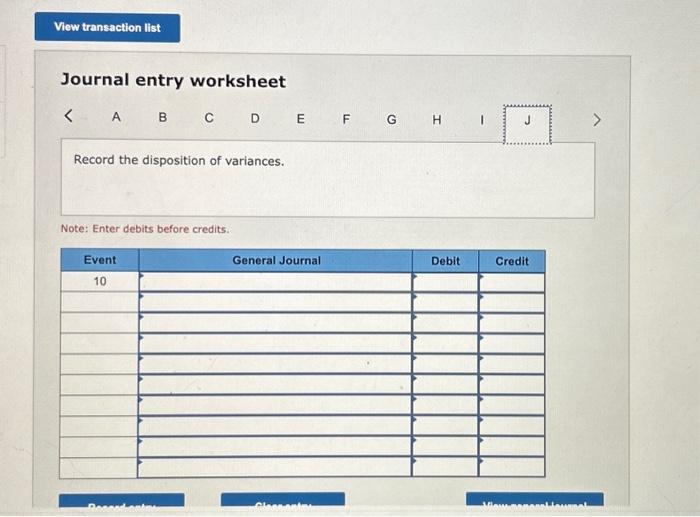

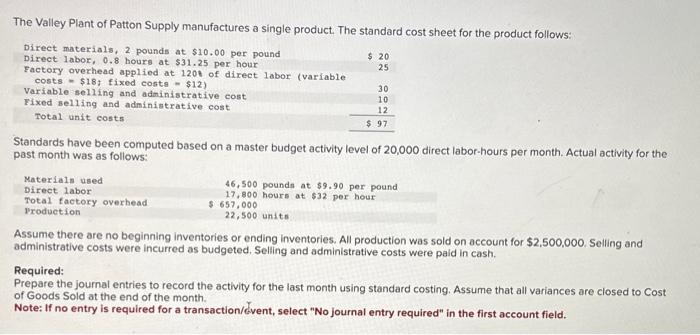

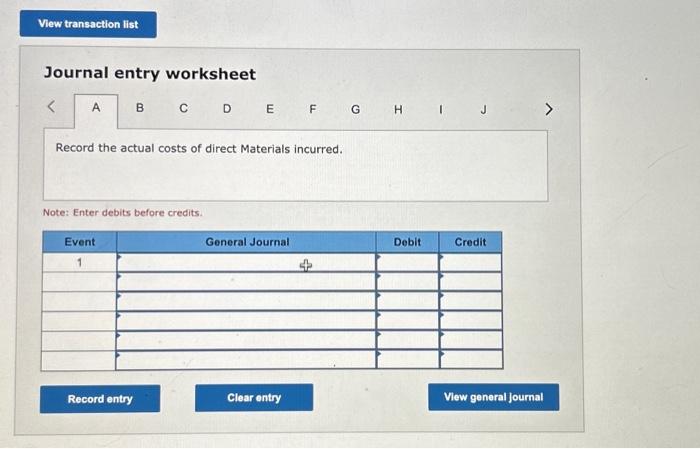

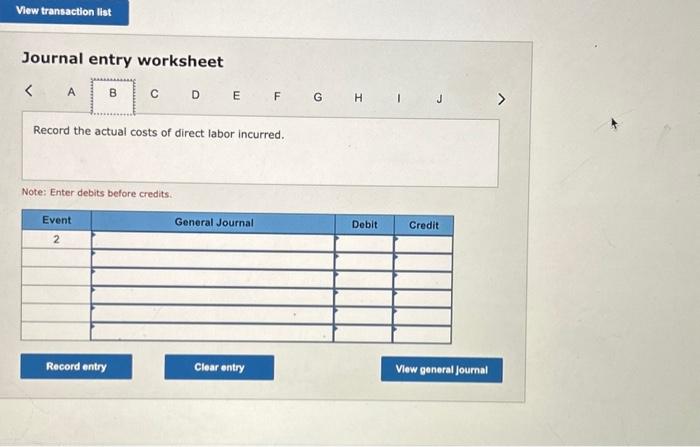

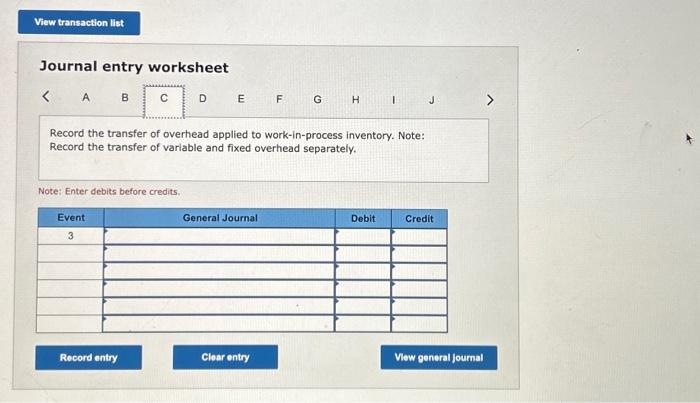

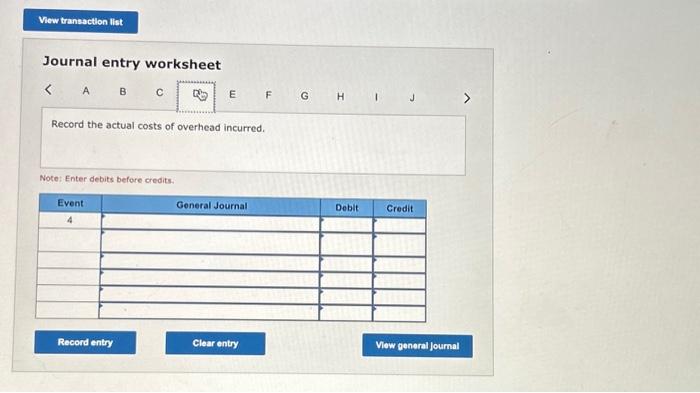

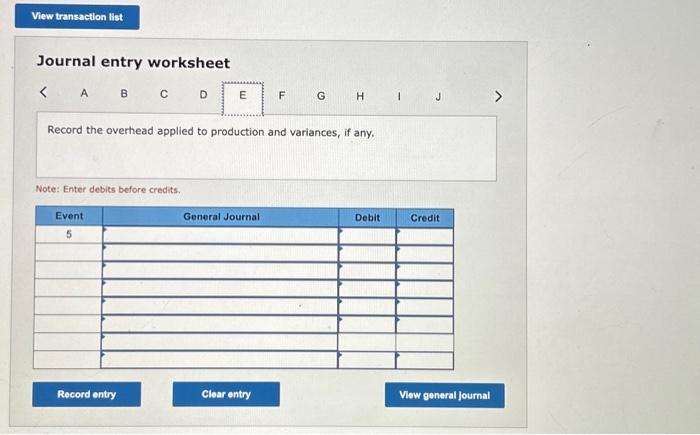

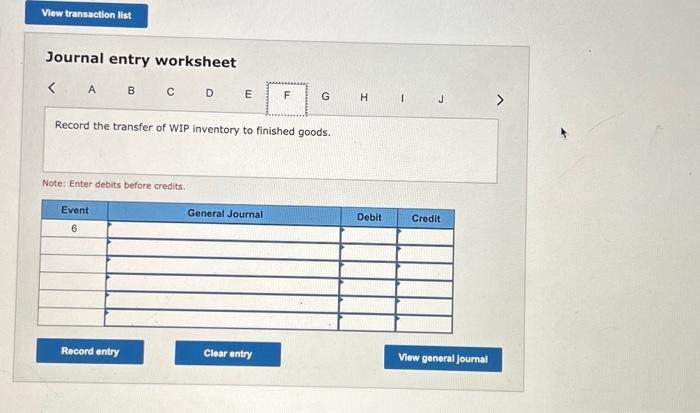

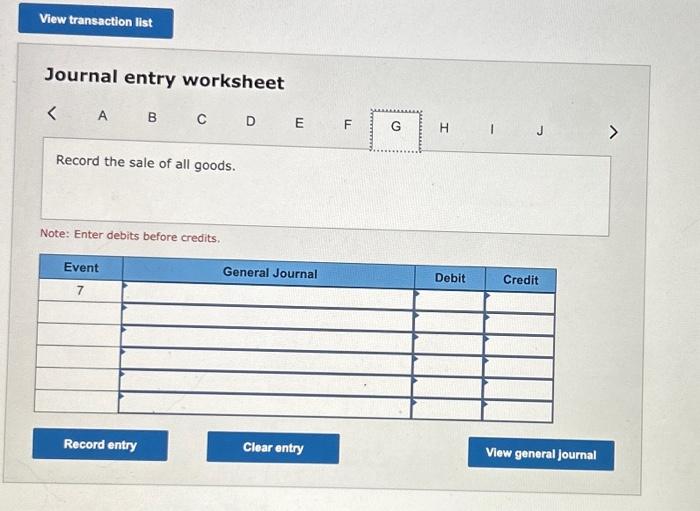

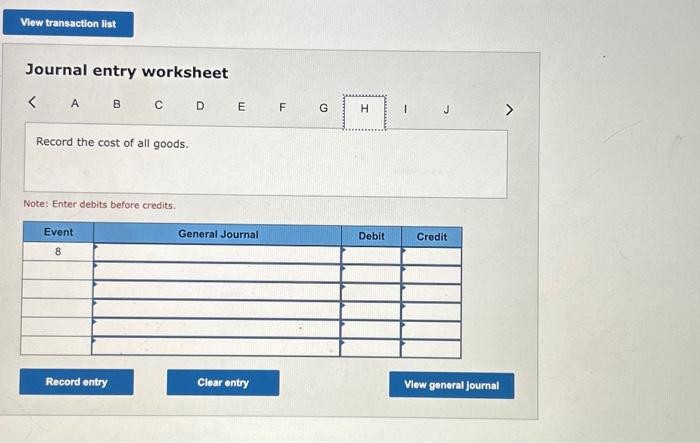

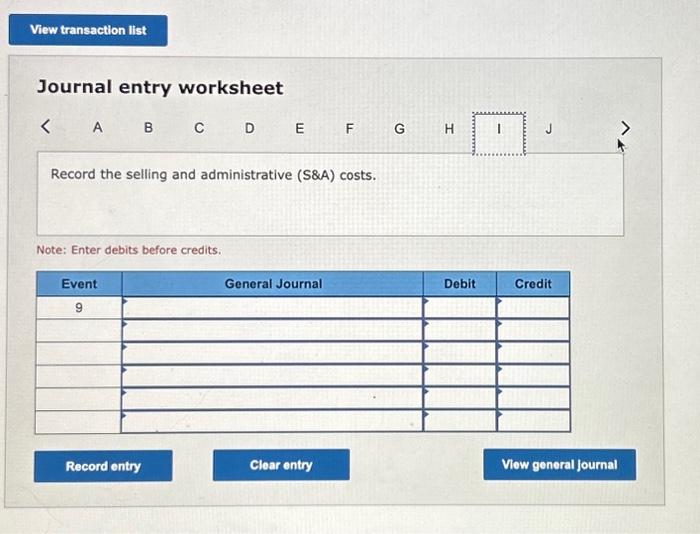

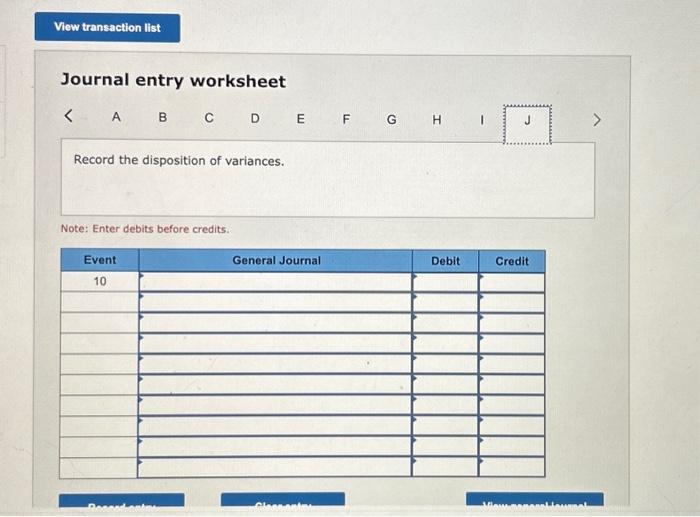

The Valley Plant of Patton Supply manufactures a single product. The standard cost sheet for the product follows: Standards have been computed based on a master budget activity level of 20,000 direct labor-hours per month. Actual activity for the past month was as follows: Assume there are no beginning inventories or ending inventories. All production was sold on account for $2,500,000. Selling and administrative costs were incurred as budgeted. Selling and administrative costs were paid in cash. Required: Prepare the journal entries to record the activity for the last month using standard costing. Assume that all variances are closed to Cost of Goods Sold at the end of the month. Note: If no entry is required for a transaction/dvent, select "No journal entry required" in the first account field. Journal entry worksheet Record the actual costs of direct Materials incurred. Note: Enter debits before credits. Journal entry worksheet D E F Record the actual costs of direct labor incurred. Note: Enter debits before credits. Journal entry worksheet E G G I Record the transfer of overhead applied to work-in-process inventory. Note: Record the transfer of variable and fixed overhead separately. Note: Enter debits before credits. Journal entry worksheet Record the actual costs of overhead incurred. Note: Enter debits before credits Journal entry worksheet FGG Record the overhead applied to production and variances, if any. Note: Enter debits before credits. Journal entry worksheet E Record the transfer of WIP inventory to finished goods. Note: Enter debits before credits. Journal entry worksheet Given

A

B

C

D

E

F

G

H

I

J

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started