Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q7-8-9 Purple Corp. purchased White Corp, in 2022. At the time of the purchase. White Corp. had the following assets: Irventory =75.000 Building = 525,000

Q7-8-9

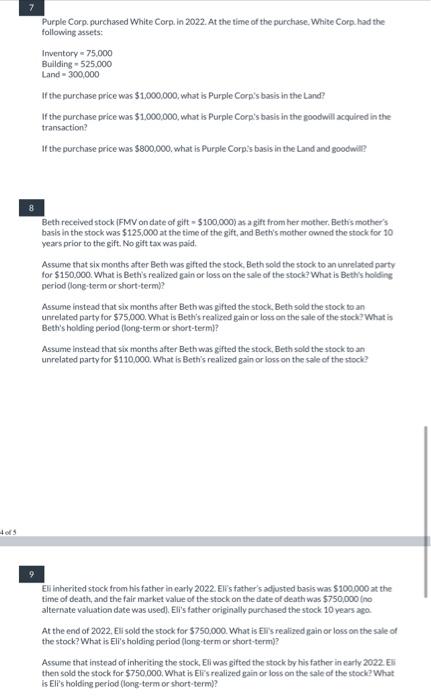

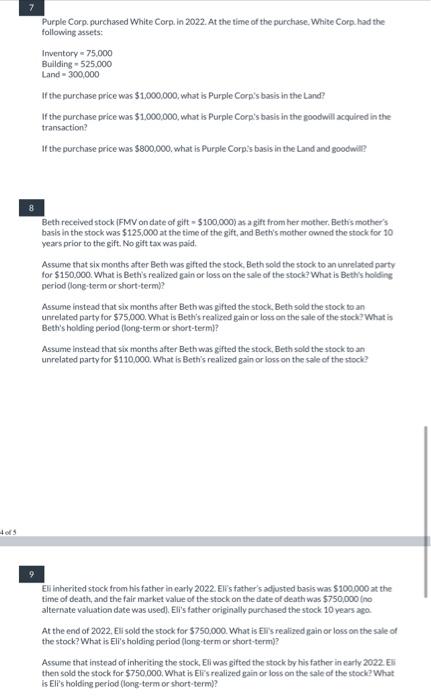

Purple Corp. purchased White Corp, in 2022. At the time of the purchase. White Corp. had the following assets: Irventory =75.000 Building = 525,000 Land =300,000 If the purchase price was $1,000,000, what is Purple Corp's basis in the Land? If the purchase price was $1.000.000, what is Purple Corp's basis in the goodwill acquired in the transaction? If the purchase price was $800.000. what is Purple Corp:'s basis in the Land and goodwil? 8 Beth received stock (FMV on date of gift = $100,000) as a gift from her mother, Bethis mother's basis in the stock was $125,000 at the time of the gift, and Beth's mother owned the stock for 10 years prior to the gift. No gift tax was paid. Assume that six months after Beth was gifted the stock, Beth sold the stock to an unrelated party for $150.000. What is Beth's realized gain or loss on the sale of the stock? What is Beth's holding period (long.term or short-term)? Assume instead that six months atter Beth was gifted the stock, Beth soid the stock to an unrelated party for $75,000. What is Beth's realized gain or loss on the sale of the stock? What is Beth's holding period (long-term or short-term)? Assume instead that six months after Bethwas gifted the stock, Beth sold the stock to an unrelated party for $110,000. What is Beth's realized gain or loss on the sale of the stock? 9 El inherited stock from his father in early 2022. Eli's father's adjusted basis was 5100.000 at the time of death, and the fair market value of the stock on the date of death was $750,000 (no alternate valuation date was used). Eli's father originally purchased the stock 10 years aga. At the end of 2022, Eli sold the stock for $750,000. What is Eli's realized gain or loss on the sale of the stock? What is Eli's holding period (long term or short-term)? Assume that instead of inheriting the stock. Ell was gitted the stock by his father in earty 2022 . Eli then sold the stock for $750,000. What is Eli's realized gain or loss on the sale of the stock? What is Eli's hoiding period (long-term or short-term)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started