Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q.8 (10 points, 5 points for each part) Cathay Pacific expects that it needs to pay 500,000 for its operation in the UK six months

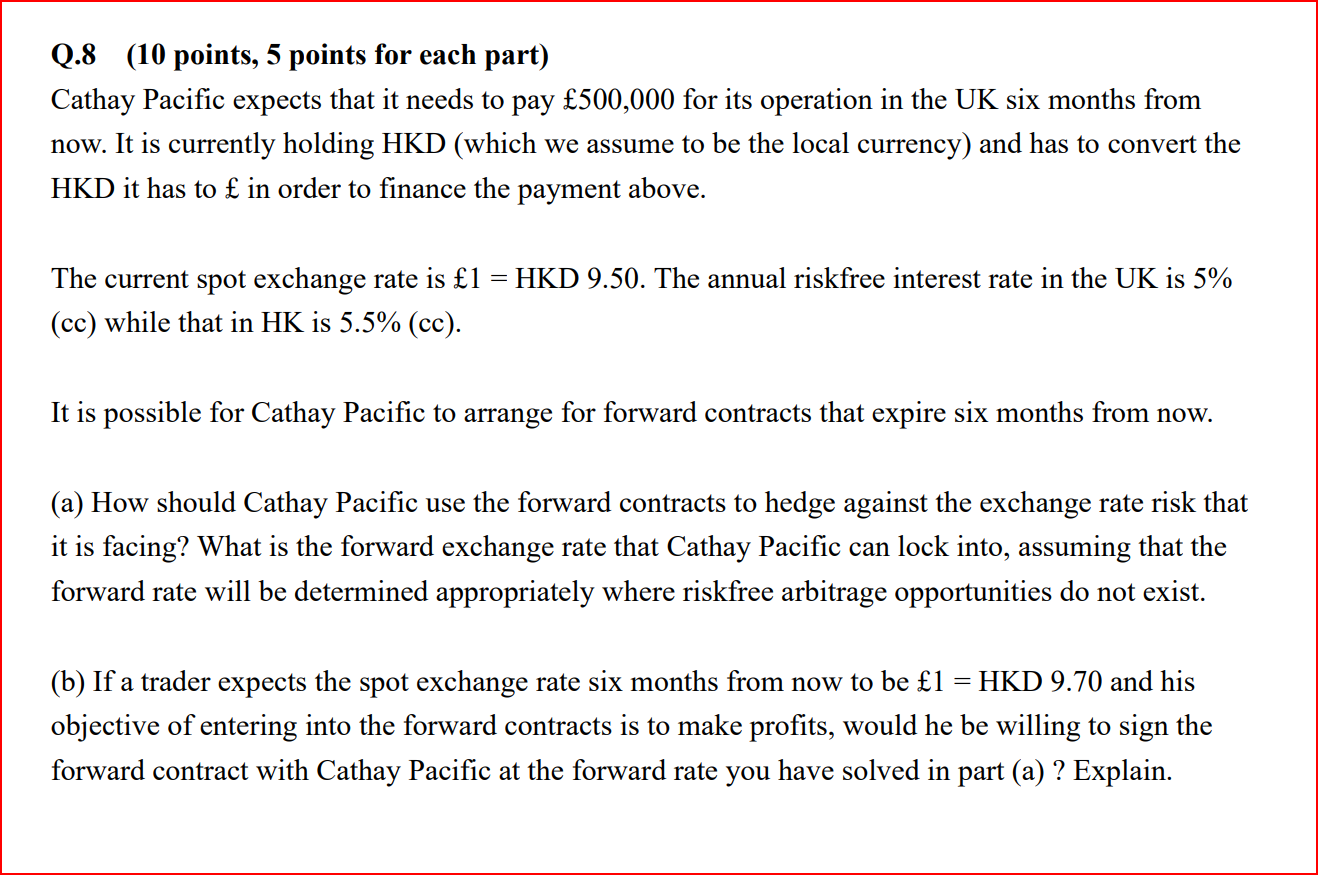

Q.8 (10 points, 5 points for each part) Cathay Pacific expects that it needs to pay 500,000 for its operation in the UK six months from now. It is currently holding HKD (which we assume to be the local currency) and has to convert the HKD it has to in order to finance the payment above. The current spot exchange rate is 1= HKD 9.50. The annual riskfree interest rate in the UK is 5% (cc) while that in HK is 5.5% (cc). It is possible for Cathay Pacific to arrange for forward contracts that expire six months from now. (a) How should Cathay Pacific use the forward contracts to hedge against the exchange rate risk that it is facing? What is the forward exchange rate that Cathay Pacific can lock into, assuming that the forward rate will be determined appropriately where riskfree arbitrage opportunities do not exist. (b) If a trader expects the spot exchange rate six months from now to be 1= HKD 9.70 and his objective of entering into the forward contracts is to make profits, would he be willing to sign the forward contract with Cathay Pacific at the forward rate you have solved in part (a) ? Explain

Q.8 (10 points, 5 points for each part) Cathay Pacific expects that it needs to pay 500,000 for its operation in the UK six months from now. It is currently holding HKD (which we assume to be the local currency) and has to convert the HKD it has to in order to finance the payment above. The current spot exchange rate is 1= HKD 9.50. The annual riskfree interest rate in the UK is 5% (cc) while that in HK is 5.5% (cc). It is possible for Cathay Pacific to arrange for forward contracts that expire six months from now. (a) How should Cathay Pacific use the forward contracts to hedge against the exchange rate risk that it is facing? What is the forward exchange rate that Cathay Pacific can lock into, assuming that the forward rate will be determined appropriately where riskfree arbitrage opportunities do not exist. (b) If a trader expects the spot exchange rate six months from now to be 1= HKD 9.70 and his objective of entering into the forward contracts is to make profits, would he be willing to sign the forward contract with Cathay Pacific at the forward rate you have solved in part (a) ? Explain Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started