Question

Q8 Reporting a Sales-Type LeaseLessor On January 1 of Year 1, Ashe Company entered into a five-year equipment lease (with no renewal options) requiring payments

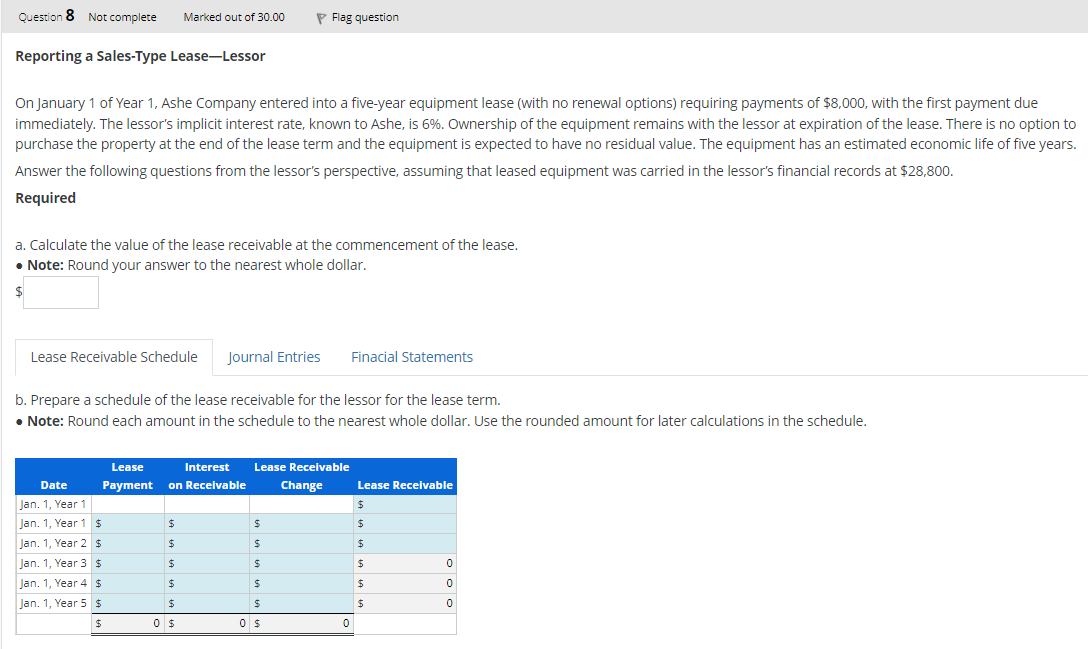

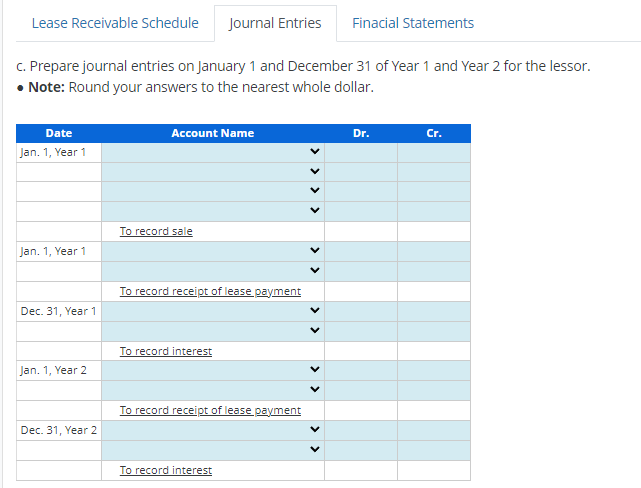

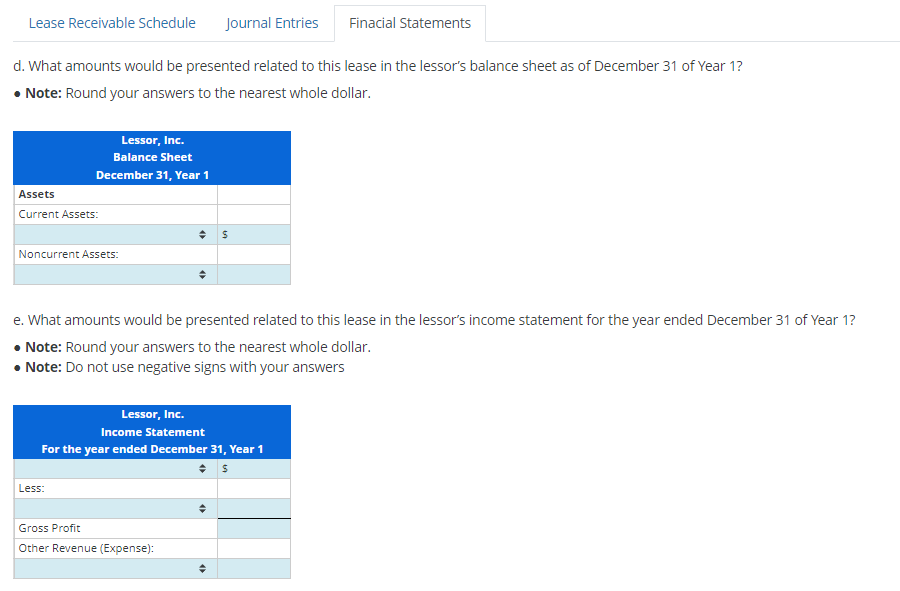

Q8 Reporting a Sales-Type LeaseLessor On January 1 of Year 1, Ashe Company entered into a five-year equipment lease (with no renewal options) requiring payments of $8,000, with the first payment due immediately. The lessors implicit interest rate, known to Ashe, is 6%. Ownership of the equipment remains with the lessor at expiration of the lease. There is no option to purchase the property at the end of the lease term and the equipment is expected to have no residual value. The equipment has an estimated economic life of five years. Answer the following questions from the lessors perspective, assuming that leased equipment was carried in the lessors financial records at $28,800. Required a. Calculate the value of the lease receivable at the commencement of the lease. b. Prepare a schedule of the lease receivable for the lessor for the lease term. c. Prepare journal entries on January 1 and December 31 of Year 1 and Year 2 for the lessor. d. What amounts would be presented related to this lease in the lessors balance sheet as of December 31 of Year 1? e. What amounts would be presented related to this lease in the lessors income statement for the year ended December 31 of Year 1?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started