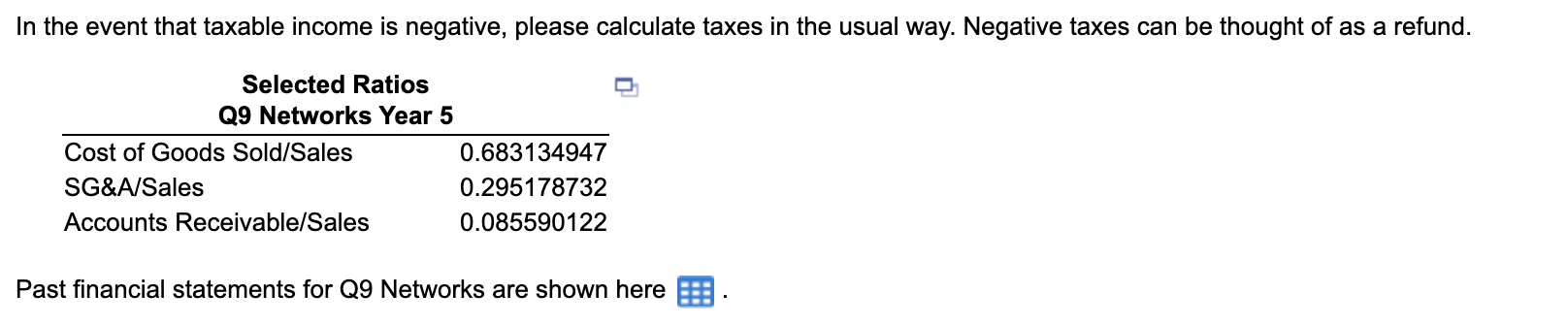

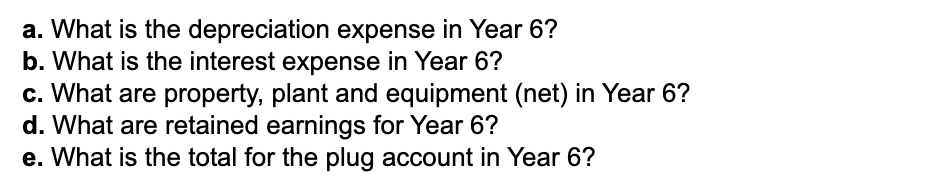

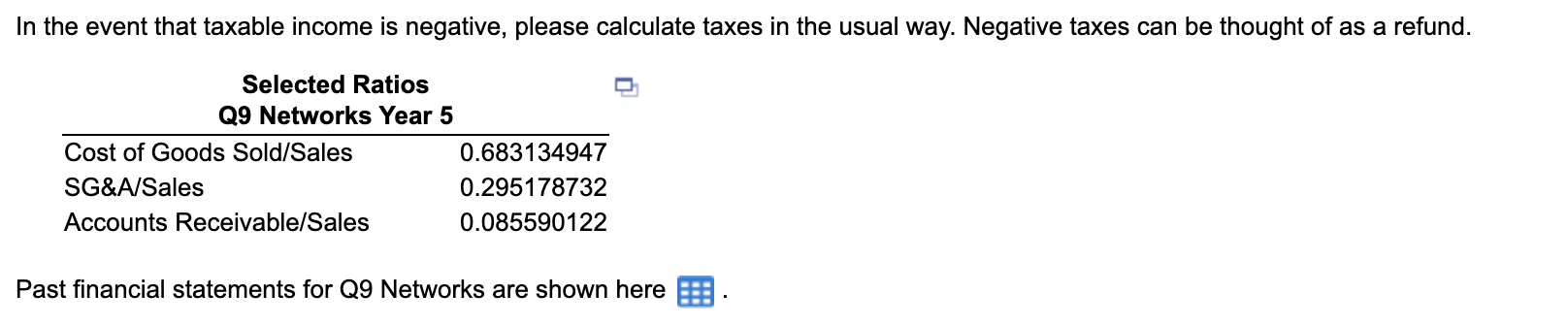

Q9 Networks is a leading provider of outsourced data center infrastructure such as web-servers and data storage. Forecast the financial statements for Q9 Networks for Year 6, based on the Dec 31, Year 5 historic financial statements. Use the percentage-of-sales method and make the following assumptions: 1. Sales growth of 20.2%. 2. The cost of (short and long-term) debt is 3.61%. 3. The Tax rate is 30%. 4. The depreciation rate is 5%. 5. CAPEX is $4,400,000. 6. Cash is the PLUG account. 7. The following accounts are held constant: prepaid expenses, short-term debt, long-term debt and common Stock. 8. No dividends. In the event that taxable income is negative, please calculate taxes in the usual way. Negative taxes can be thought of as a refund. In the event that taxable income is negative, please calculate taxes in the usual way. Negative taxes can be thought of as a refund. Selected Ratios Q9 Networks Year 5 Cost of Goods Sold/Sales 0.683134947 SG&A/Sales 0.295178732 Accounts Receivable/Sales 0.085590122 Past financial statements for Q9 Networks are shown here B a. What is the depreciation expense in Year 6? b. What is the interest expense in Year 6? c. What are property, plant and equipment (net) in Year 6? d. What are retained earnings for Year 6? e. What is the total for the plug account in Year 6? Q9 Networks is a leading provider of outsourced data center infrastructure such as web-servers and data storage. Forecast the financial statements for Q9 Networks for Year 6, based on the Dec 31, Year 5 historic financial statements. Use the percentage-of-sales method and make the following assumptions: 1. Sales growth of 20.2%. 2. The cost of (short and long-term) debt is 3.61%. 3. The Tax rate is 30%. 4. The depreciation rate is 5%. 5. CAPEX is $4,400,000. 6. Cash is the PLUG account. 7. The following accounts are held constant: prepaid expenses, short-term debt, long-term debt and common Stock. 8. No dividends. In the event that taxable income is negative, please calculate taxes in the usual way. Negative taxes can be thought of as a refund. In the event that taxable income is negative, please calculate taxes in the usual way. Negative taxes can be thought of as a refund. Selected Ratios Q9 Networks Year 5 Cost of Goods Sold/Sales 0.683134947 SG&A/Sales 0.295178732 Accounts Receivable/Sales 0.085590122 Past financial statements for Q9 Networks are shown here B a. What is the depreciation expense in Year 6? b. What is the interest expense in Year 6? c. What are property, plant and equipment (net) in Year 6? d. What are retained earnings for Year 6? e. What is the total for the plug account in Year 6