Answered step by step

Verified Expert Solution

Question

1 Approved Answer

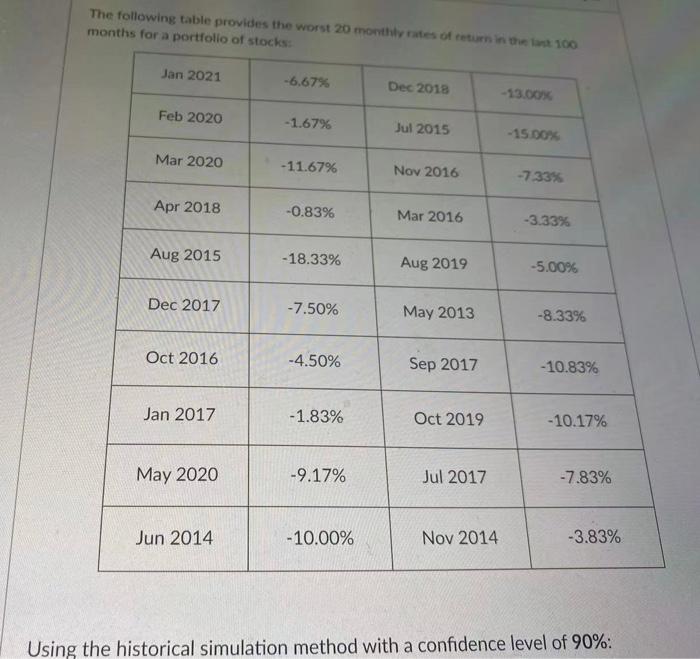

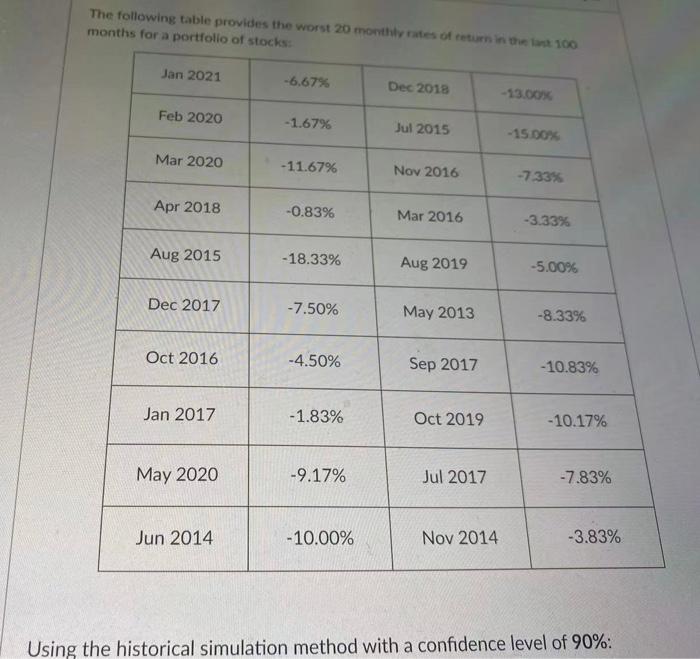

Q9 The following table provides the worst 20 monthly tes of return the 100 months for a portfolio of stocks Jan 2021 -6.67% Dec 2018

Q9

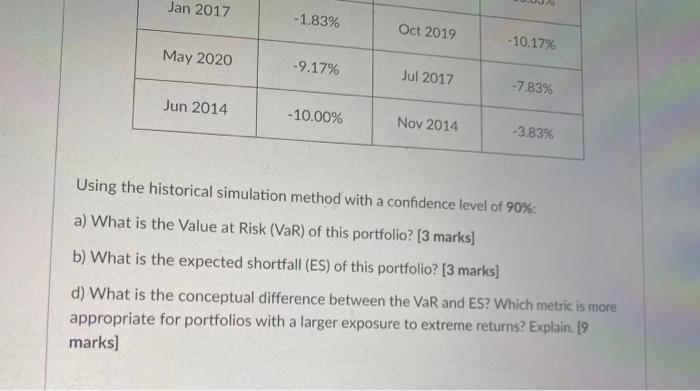

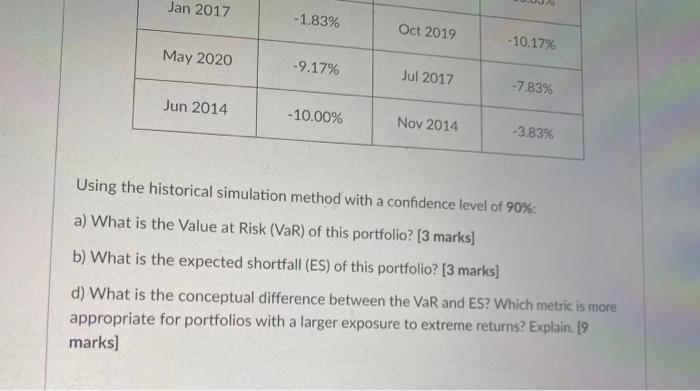

The following table provides the worst 20 monthly tes of return the 100 months for a portfolio of stocks Jan 2021 -6.67% Dec 2018 -13.00 Feb 2020 -1.67% Jul 2015 - 15.00 Mar 2020 - 11.67% Nov 2016 -733% Apr 2018 -0.83% Mar 2016 -3.33% Aug 2015 - 18.33% Aug 2019 -5.00% Dec 2017 -7.50% May 2013 -8.33% Oct 2016 -4.50% Sep 2017 -10.83% Jan 2017 -1.83% Oct 2019 -10.17% May 2020 -9.17% Jul 2017 -7.83% Jun 2014 - 10.00% Nov 2014 -3.83% Using the historical simulation method with a confidence level of 90%: Jan 2017 -1.83% Oct 2019 -10.17% May 2020 -9.17% Jul 2017 -7.83% Jun 2014 - 10.00% Nov 2014 -3.83% Using the historical simulation method with a confidence level of 90%: a) What is the Value at Risk (VaR) of this portfolio? [3 marks] b) What is the expected shortfall (ES) of this portfolio? [3 marks] d) What is the conceptual difference between the VaR and ES? Which metric is more appropriate for portfolios with a larger exposure to extreme returns? Explain. [9 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started