Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Qantas Airlines Ltd signs a contract with Airbus Corporation Ltd for Airbus to build a new aeroplane. The contract has 545 terms. Term 56 says

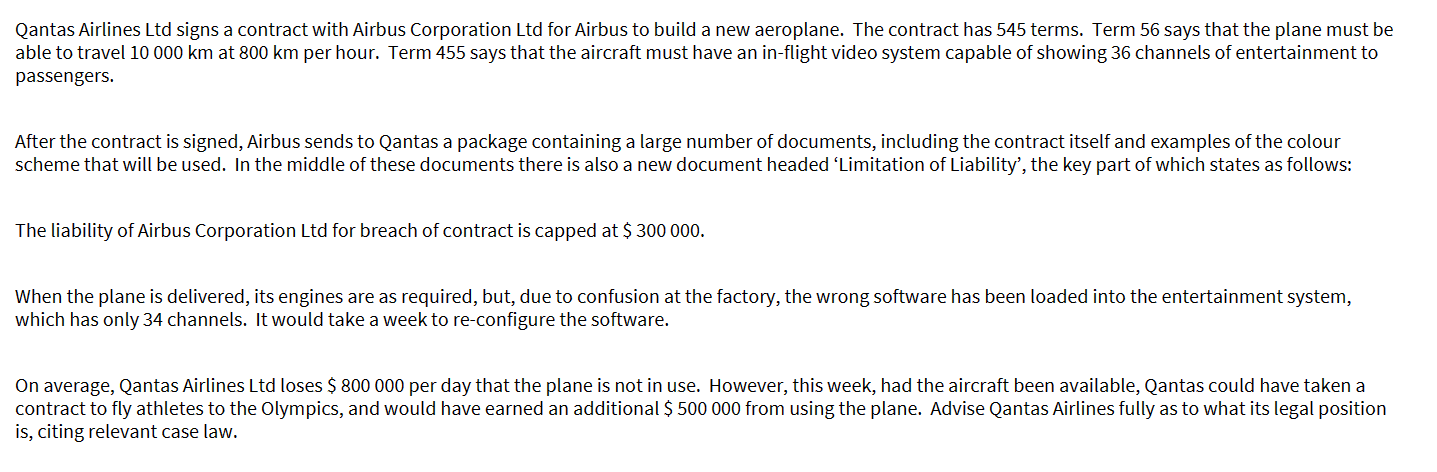

Qantas Airlines Ltd signs a contract with Airbus Corporation Ltd for Airbus to build a new aeroplane. The contract has 545 terms. Term 56 says that the plane must be able to travel 10000km at 800km per hour. Term 455 says that the aircraft must have an in-flight video system capable of showing 36 channels of entertainment to passengers. After the contract is signed, Airbus sends to Qantas a package containing a large number of documents, including the contract itself and examples of the colour scheme that will be used. In the middle of these documents there is also a new document headed 'Limitation of Liability', the key part of which states as follows: The liability of Airbus Corporation Ltd for breach of contract is capped at $300000. When the plane is delivered, its engines are as required, but, due to confusion at the factory, the wrong software has been loaded into the entertainment system, which has only 34 channels. It would take a week to re-configure the software. On average, Qantas Airlines Ltd loses $800000 per day that the plane is not in use. However, this week, had the aircraft been available, Qantas could have taken a contract to fly athletes to the Olympics, and would have earned an additional $500000 from using the plane. Advise Qantas Airlines fully as to what its legal position is, citing relevant case law

Qantas Airlines Ltd signs a contract with Airbus Corporation Ltd for Airbus to build a new aeroplane. The contract has 545 terms. Term 56 says that the plane must be able to travel 10000km at 800km per hour. Term 455 says that the aircraft must have an in-flight video system capable of showing 36 channels of entertainment to passengers. After the contract is signed, Airbus sends to Qantas a package containing a large number of documents, including the contract itself and examples of the colour scheme that will be used. In the middle of these documents there is also a new document headed 'Limitation of Liability', the key part of which states as follows: The liability of Airbus Corporation Ltd for breach of contract is capped at $300000. When the plane is delivered, its engines are as required, but, due to confusion at the factory, the wrong software has been loaded into the entertainment system, which has only 34 channels. It would take a week to re-configure the software. On average, Qantas Airlines Ltd loses $800000 per day that the plane is not in use. However, this week, had the aircraft been available, Qantas could have taken a contract to fly athletes to the Olympics, and would have earned an additional $500000 from using the plane. Advise Qantas Airlines fully as to what its legal position is, citing relevant case law Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started