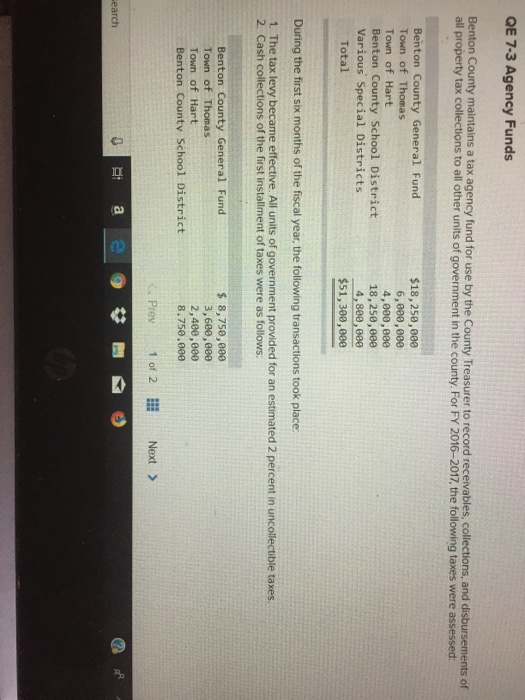

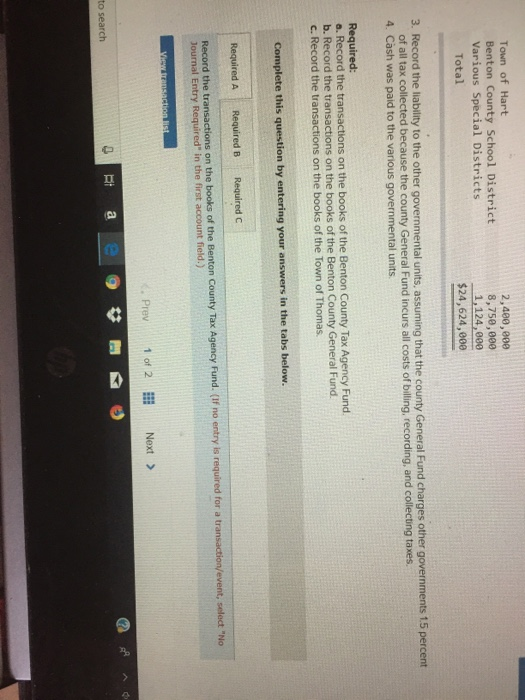

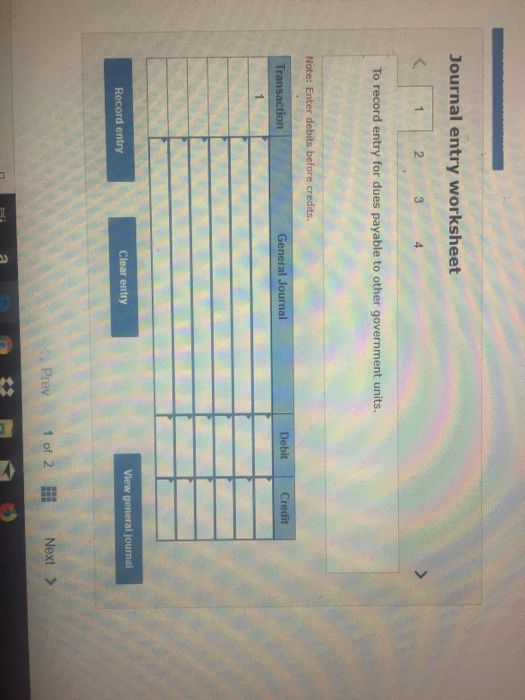

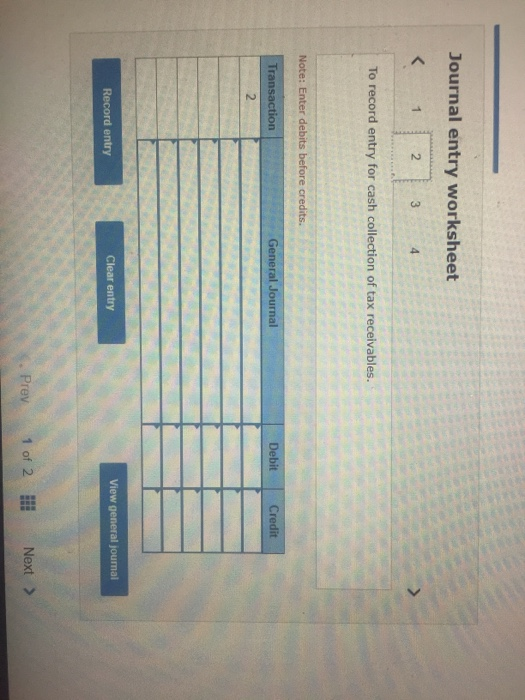

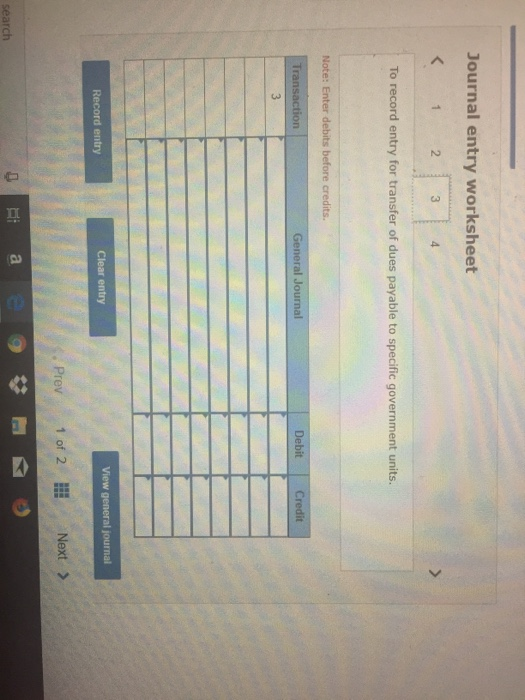

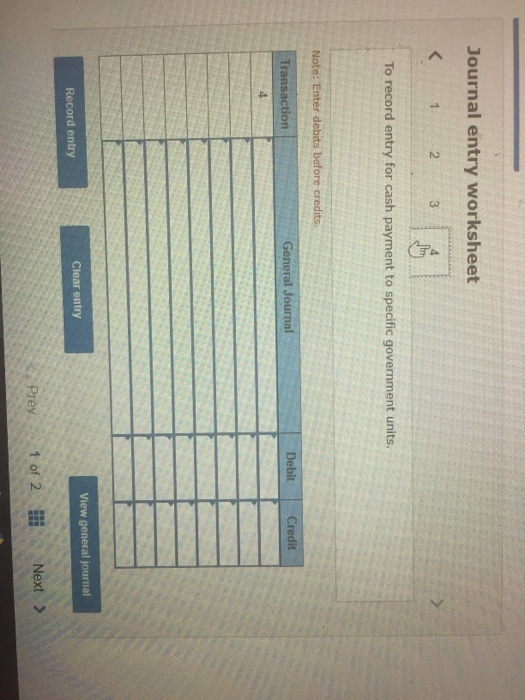

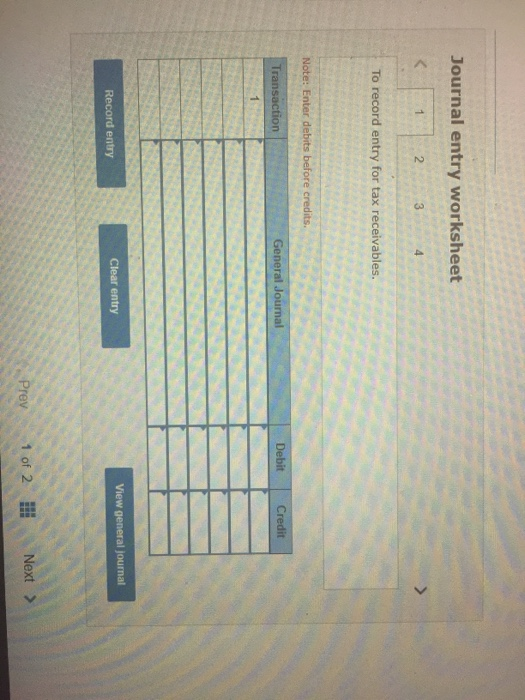

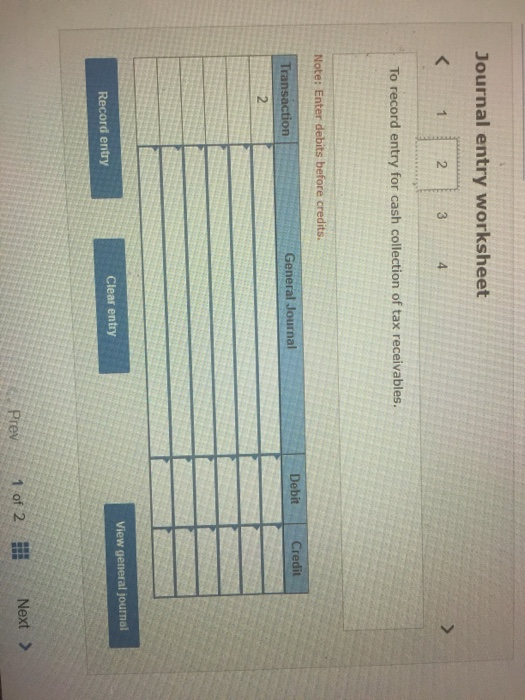

QE 7-3 Agency Funds Benton County maintains a tax agency fund for use by the County Treasurer to record receivables, collections, and disbursements of all property tax collections to all other units of government in the county. For FY 2016-2017, the following taxes were assessed: Benton County General Fund Town of Thomas Town of Hart Benton County School District Various' Special Districts Total $18,250,000 6,000,000 4,000,000 18,250,000 4,800,000 $51,380,000 During the first six months of the fiscal year, the following transactions took place: 1 The tax levy became effective. All units of government provided for an estimated 2 percent in uncollectible taxes. 2. Cash collections of the first installment of taxes were as follows: Benton County General Fund Town of Thomas Town of Hart Benton County School District $ 8,750,000 3,600,000 2,400,000 8.750.000 Prev 1 of 2 Next > -earch Town of Hart Benton County School District Various Special Districts Total 2,400,000 8,750,000 1,124,000 $24,624,000 3. Record the liability to the other governmental units, assuming that the county General Fund charges other governments 15 percent of all tax collected because the county General Fund incurs all costs of billing, recording, and collecting taxes. 4. Cash was paid to the various governmental units. Required: a. Record the transactions on the books of the Benton County Tax Agency Fund. b. Record the transactions on the books of the Benton County General Fund. c. Record the transactions on the books of the Town of Thomas Complete this question by entering your answers in the tabs below. Required A Required B Required C Record the transactions on the books of the Benton County Tax Agency Fund. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Prev 1 of 2 !! Next > to search Journal entry worksheet To record entry for cash collection of tax receivables. Note: Enter debits before credits Transaction General Journal Debit Credit View general joumal Clear entry Record entry Prev 1 of 2 Next > Journal entry worksheet To record entry for transfer of dues payable to specific government units. Note: Enter debits before credits. Transaction General Journal Debit Credit View general journal Record entry Clear entry Prev 1 of 2 !!! Next > search Journal entry worksheet Journal entry worksheet To record entry for tax receivables. Note: Enter debits before credits. Transaction General Journal Debit Credit View general journal Record entry Clear entry D Prev ev 1 of 2 Next Journal entry worksheet To record entry for cash collection of tax receivables. Note: Enter debits before credits. General Journal Debit Transaction Credit View general journal Record entry Clear entry Prev 1 of 2 Next > Journal entry worksheet To record entry for dues from tax agency fund. Note: Enter debits before credits. Transaction General Journal Debit Credit View general journal Clear entry Record entry Prev 1 of 2 ! Next Journal entry worksheet To record entry for cash collection from tax agency fund. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal Prev 1 of 2 Next >