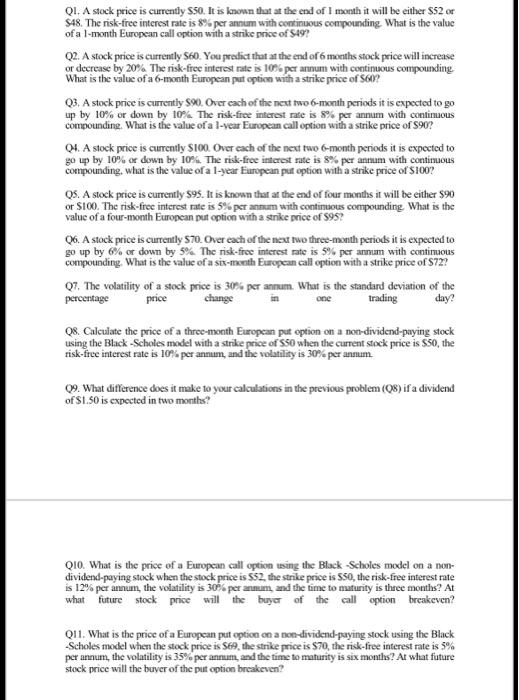

QI. A stock price is currently 550. It is known that at the end of 1 month it will be either $52 or S48. The risk-free interest rate is 8% per annum with continuous compounding. What is the value of a 1-month European call option with a strike price of 549? Q2. A stock price is currently 560. You predict that at the end of 6 months stock price will increase or decrease by 20% The risk-free interest rate is 10% per annum with continuous compounding What is the value of a 6-month European put option with a strike price of 56? 03. A stock price is currently S90. Over each of the next two 6-month periods it is expected to go up by 10% or down by 10% The risk-free interest rate is 8% per annum with continuous compounding. What is the value of a 1-year European call option with a strike price of S90? 04. A stock price is currently S100. Over each of the next two 6-month periods it is expected to go up by 10% or down by 10%. The risk-free interest rate is 8% per annum with continuous compounding, what is the value of a 1-year European put options with a strike price of $100? 05. A stock price is currently $95. It is known that at the end of four months it will be either $90 or S100. The risk-free interest rate is 5% per annum with continuous compounding What is the value of a four-month European put option with a strike price of $95? 06. A stock price is currently S70Over each of the next two three-month periods it is expected to go up by 6% or down by 5% The risk-free interest rate is 5% per annum with continuous compounding. What is the value of a six-month European call option with a strike price of S72? 07. The volatility of a stock price is 30% per annum. What is the standard deviation of the percentage price change one trading day? 08. Calculate the price of a three-month European put option on a non-dividend-paying stock using the Black Scholes model with a strike price of S50 when the current stock price is $50, the risk-free interest rate is 10% per annum, and the volatility is 30% per annum 09. What difference does it make to your calculations in the previous problem (08) ifa dividend of S1.50 is expected in two months? Q10. What is the price of a European call option using the Black Scholes model on a non- dividend paying stock when the stock price is 552, the strike price is 550, the risk-free interest rate is 12% per annum, the volatility is 30% per annum and the time to mafurity is three months? At what future stock price will the buyer of the call option breakeven? Q11. What is the price of a European put option on a non-dividend paying stock using the Black Scholes model when the stock price is Seo, the strike price is $70, the risk-free interest rate is 5% per annum, the volatility is 35% per annum, and the time to maturity is six months? At what future stock price will the buver of the put option breakeven